The once-embattled Comerica has had a banner year after slashing costs in what analysts describe as a remarkable turnaround.

But while the company has proved its naysayers wrong and

Among them is succession planning. Chairman and CEO Ralph Babb, 68, is older than most of his peers. Analysts have recently begun asking if he is on the verge of retirement — and what that could mean about the direction of the company.

Perhaps a bigger source of concern, though, is Comerica’s heavy focus on commercial lending. As other regional banks

“Here we are today at a crossroad,” said Brett Rabatin, an analyst with Piper Jaffray. Comerica’s so-called Gear Up restructuring initiative “isn’t going to be around forever — so how are they going to outperform peers?”

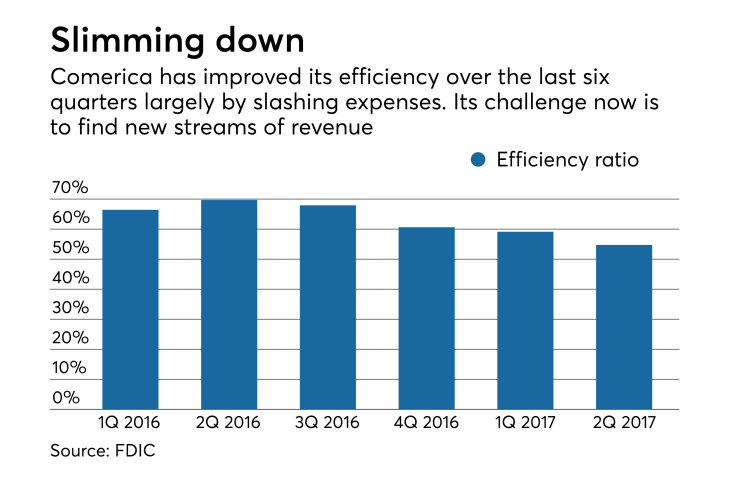

Comerica’s comeback over the past year has mostly been driven by drastic cost cutting. As of June 30 noninterest

Sustaining its profits in the years to come will likely require new sources of revenue, analysts said.

Commercial and industrial loans are the bulk of Comerica's loan book. Over the past year, however, businesses have been reluctant to borrow amid

“The challenge will be more diversification of the revenues,” said Peter Winter, an analyst with Wedbush Securities. He noted that many of Comerica’s competitors have diversified their loan books, mostly through online lending partnerships.

That analysts are even musing about Comerica’s long-term future is a sign of how quickly times have changed for the Dallas company.

Comerica was

But rather than putting itself on the block, Comerica set out to prove its worth as an independent company. Through its turnaround plan, announced in July 2016, the company has boosted profitability by scaling back on oil lending, and simply becoming more efficient.

Energy

Comerica has eliminated about 10% of its full-time employees since the end of 2015, with many of those cuts coming from midlevel management. Meanwhile, the company has eliminated 8% of its branches over the same period, according to a report from Wells Fargo Securities.

The impact of those changes has been immediate. Profits as of June 30 jumped 95% from a year earlier to $203 million.

“I think if you look at where we were a year and a half ago versus where we are today, clearly the rates have been a big help,” Chief Financial Officer David Duprey said at an investor conference last week. “But we’ve also done a lot to help ourselves and help our shareholders by the moves that we’ve made, including all the moves of Gear Up, and continue to make.”

Comerica’s turnaround plan extends through 2019. In addition to cost cuts, the plan calls for boosting revenue by $90 million, in part by improving technology and analytics used by the company’s sales force.

But once the plan is put to bed, Comerica will likely face a challenge distinguishing itself in the increasingly competitive market for middle-market lending.

“What’s the growth trajectory? That’s the $64,000 question,” Rabatin said, noting that the company has already done the “heavy lifting” on the cost cuts.

It’s a question that will define Babb’s remaining tenure as CEO.

After facing calls to step down last year, Babb engineered Comerica’s recovery with the help of an outside consultant. As the company delivers on its goals, questions have grown louder about how long Babb plans to remain at the helm.

Babb has served as CEO and chairman since 2002.

“We continually look at succession planning and discuss that at the board level,” Babb said during Comerica’s earnings call in July, when asked about his possible retirement. “When decisions are made, we make the appropriate announcements.”

Though analysts have begun to raise questions about retirement, Babb remains “incredibly energized” and involved at the company, Winter said.

Curtis Farmer, Comerica’s president, is widely viewed as Babb’s most likely successor. Farmer joined Comerica in 2008 and was given the title of president in April 2015. All major business lines, including retail and business banking, report to him.

If Farmer is someday chosen to be CEO, investors should expect few changes in the leadership style at the top of the company, analysts said.

“I think they are cut from the same cloth,” Rabatin said.