-

Parke Bancorp in New Jersey decided to sell its SBA lending business when it realized the group had national aspirations. Berkshire Hills Bancorp, a larger bank in Massachusetts, was pleased to buy the unit.

November 9 -

The Small Business Investment Company program may be less famous among banks than some of the SBA's other programs, but it enjoyed a record in fiscal 2015 that wrapped up this week. Stories like that of Opus Bank in California shed light on why.

October 1 -

As the Small Business Administration's flagship 7(a) loan program breaks records, its other loan program stagnates. Advocates for so-called 504 loans hope a drive to permit CRE refinancing will inject new life.

August 13

Maybe all the Small Business Administration needs to convince more credit unions to make 7(a) loans is a good middleman.

Until now, the SBA's effort to attract more credit unions to its flagship lending program could best be described as a work in progress.

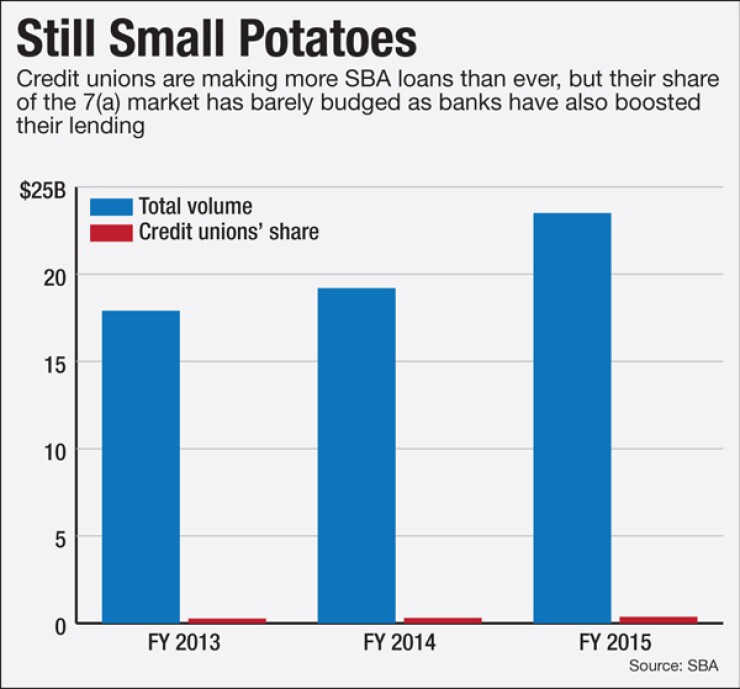

Though the volume of SBA loans originated by credit unions reached a record $369 million in the fiscal year that ended Sept. 30, credit unions' share of the overall 7(a) market remained stuck at 1.6%. Perhaps more worrisome for the SBA is that the number of credit unions making 7(a) loans actually declined from 195 in fiscal year 2014 to 185 in the most recent fiscal year.

Enter Leverage, a joint venture formed by the League of Southeastern Credit Unions and Capital Growth Solutions, a Tennessee-based loan servicer. The venture, which launched Monday, has a simple mission: to help small credit unions that lack expertise in SBA lending jump into the booming 7(a) market.

Lisa Burroughs, Leverage's chief operating officer, said that Leverage will underwrite loans to SBA standards and provide servicing and other backroom support. Institutions that try to enter the market on their own typically pay up to $600,000 to build the necessary infrastructure, she added.

"Doing 7(a) lending is more complex than conventional loans, and most credit unions don't have the expertise on their staffs," Burroughs said Tuesday. "It's not low-hanging fruit for a lot of credit unions."

The 7(a) program has experienced land-office growth in recent years, reaching a record $23.5 billion fiscal year 2015 — up from $15.1 billion just three years ago.

Six weeks into a new fiscal year, 7(a) lending appears to be maintaining its torrid pace. Through Friday, lending volume totaled $2.33 billion, up 1% from the same time last year. Activity should accelerate further in the second quarter, after borrowers complete year-end financial statements, industry experts predict.

Credit unions have played a historically small role in the program, as the industry's focus has leaned toward consumer and mortgage lending. In recent years, however, credit unions have shown growing interest in commercial lending, and the sharply rising SBA tide has lifted their 7(a) participation to unprecedented levels measured by dollar volume.

According to SBA, 7(a) lending by credit unions was up 23% in fiscal year 2015 from the previous year and 38% from two years earlier. The federal government's fiscal years run from Oct. 1 to Sept. 30.

When viewed as a part of that whole, however, credit unions' 7(a) activity has remained relatively flat. Despite the impressive-looking gains, the proportion of 7(a) loans originated by credit unions barely budged, inching up from 1.5% in FY 2013 to 1.6% in FY 2015.

Numbers like that might put a gleam in the eye of bankers, who are mounting a determined campaign to limit business lending by credit unions, but the industry's 7(a) activity — and along with it its market share — is almost certain to grow, according to some observers.

Keith Leggett, a retired American Bankers Association economist and author of the "Credit Union Watch" blog, noted government-guaranteed loans are exempt from the limitation on credit unions' business lending put in place by the Credit Union Membership Act of 1998.

The law limits the size of a credit union's business-loan portfolio to 12.25% of total assets.

Moreover, earlier this year, the SBA signed a memorandum of agreement with the National Credit Union Administration, the industry's federal regulator, promising guidance and support for credit unions interested in the 7(a) program.

"We're going to see more credit unions involved in SBA lending," Leggett said Monday. "While credit unions account for just a small fraction of overall 7(a) volume today, they'll grow more important over time."

According to Bob Coleman, author of the Coleman Report, a trade newsletter for SBA lenders, SBA "loves to have credit unions involved" in 7(a) because they tend to make smaller loans than banks and other lenders. Increasing the availability of small loans is a key priority of the agency, which quit assessing fees on loans under $150,000 in size in fiscal 2013.

Overall in fiscal 2015, the average size of a 7(a) loan was $373,000. The average size of 7(a) loans originated by credit unions was $219,000.

The Southeastern League had been planning a move to support 7(a) lending for more than a year, and the effort gained increased momentum after the NCUA and SBA agreed to the memorandum of understanding, Burroughs said.

While the Southeastern League serves credit unions in Florida and Alabama, Leverage will market its services to institutions around the country. Burroughs said it is already in serious discussions with one credit union and has had exploratory discussions with a number of others.

"We're seeing a really nice level of interest," she said.