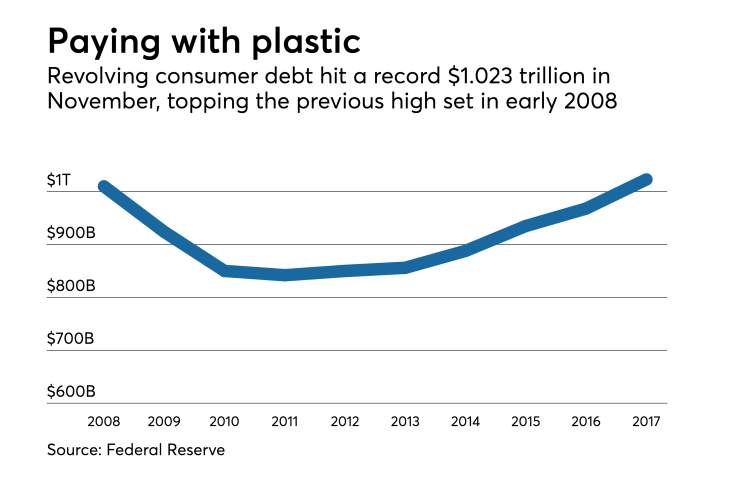

U.S. revolving consumer debt reached an all-time high of $1.023 trillion in November, according to Federal Reserve Board data released Monday.

The milestone marks the end of a seven-year-long recovery in the credit card market that followed the Great Recession.

The card market’s previous peak came in April 2008, when $1.021 trillion in revolving consumer debt was outstanding. Then unemployment spiked, consumers became warier about borrowing, banks started reducing their customers’ credit lines, and charged-off loans surged.

In 2009, Congress passed the Credit Card Accountability Responsibility and Disclosure Act, which put new clamps on the industry.

By April 2011, the volume of revolving consumer debt had fallen to $832 billion, or 19% below its former peak, according to the Fed.

Since then, the card market has been recovering at an accelerating pace. In 2012, loans outstanding grew by just 0.5%. Four years later, the growth rate was 6.7%. In November 2017, revolving consumer debt grew at a seasonally adjusted, annual rate of 13.3%.

The Fed has been tracking revolving consumer credit outstanding — a category that excludes loans secured by real estate, and is seen as a proxy for the credit card market — on a monthly basis since 1968. The monthly data is seasonally adjusted.

The Fed’s findings about the card market’s recovery were echoed in a separate report released last month by the Consumer Financial Protection Bureau.

“Most origination metrics we observe are near pre-recession levels. This is true across credit score tiers for both general purpose and private label cards. Approval rates have climbed for all credit score tiers since post-recession lows, even as application volumes have stabilized,” the CFPB stated.

The Fed’s latest report seems likely to spark debate about whether U.S. consumers are stretching themselves too thin. Late payment rates in the card industry have been rising, even though they remain low in comparison with their levels a decade ago.

One persistent worry is that as interest rates continue to rise, as is widely expected, many more consumers will be unable to stay current on their credit card bills.

“It’s been a wonderful run,” Robert Hammer, a credit card industry consultant, said Monday. “I can’t tell you when, but there will be a correction.”