WASHINGTON - Aiming for a more streamlined, and what some say is a more tolerant, regulatory structure, Countrywide Financial Corp. plans to turn in its national bank charter and move $88.9 billion of assets to a federal thrift charter.

The switch is a win for the Office of Thrift Supervision, and a loss for the Federal Reserve Board, Countrywide's holding company regulator, and the Office of the Comptroller of the Currency, which oversees Countrywide Bank.

Countrywide Financial, a $195 billion-asset holding company in Calabasas, Calif., confirmed the planned charter flip Thursday.

"The company has determined that Countrywide is better positioned for future growth as a savings institution with a single primary regulator as opposed to the current dual-regulator structure," it said in a statement. "The company believes that the OTS's focus on the housing market and its unitary supervisory approach aligns more closely with Countrywide's existing business activities and future diversification efforts."

This rationale boils down to savings of time and money, but outsiders offered two other reasons: scrutiny of alternative mortgage products and federal preemption of state laws.

On Sept. 29 the four banking and thrift agencies issued guidelines setting disclosure and underwriting standards for alternative mortgages. The OTS, with the most experience among the agencies in regulating mortgage lending, is widely expected to apply the guidelines with more restraint than the other agencies.

"The OTS understands the business better, and also, as a class of institutions, thrifts do this business better," said Robert Davis, the lead lobbyist at America's Community Bankers.

"The OTS is a little more relaxed," said one thrift executive. "The other agencies don't understand these products as well, so they are less comfortable leaving some of the management issues to the judgment of the examiner in the field.

"There is no question there is anxiety among the national banks about how the OCC is going to do this on the ground," he added.

The OTS also trumps the OCC in its legal standing to preempt state laws. The OCC is going before the Supreme Court on Nov. 29 to defend its authority to let operating subsidiaries of national banks ignore state laws. The agency has repeatedly won in the Supreme Court, but even its supporters concede defeat is a possibility.

"If the Supreme Court rules against the OCC, the thrift charter will get a boon," said Ronald R. Glancz, a partner in the Venable law firm here.

The OCC and the OTS declined to comment Thursday.

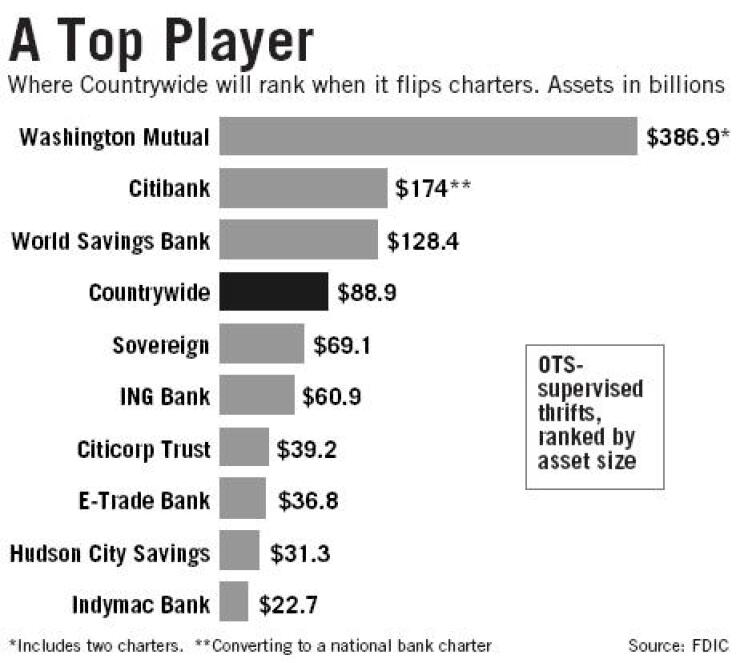

It has been an up-and-down year for OTS. Before Countrywide's move, it lost two of its biggest thrifts. First, Citigroup Inc. decided to move $174 billion of assets from two thrift charters into its national bank. (Citi kept one thrift charter, the $60 billion-asset Citicorp Trust Bank in Wilmington, Del.)

And in May Capital One Financial Corp. in McLean, Va., said it would shift the bulk of its retail banking assets into a nationally chartered bank.

Also on the plus side, Wachovia Corp. has made no move to fold World Savings Bank, the OTS' third-largest thrift, with $128 billion of assets, into its national bank. Wachovia closed its deal on Oct. 1 for World Savings' parent, Golden West Financial Corp.

Once these moves are complete, the top four thrifts would be Washington Mutual Inc., which dominates the list at $350 billion of assets; World Savings; Sovereign Bank in Philadelphia; and Countrywide.

Countrywide acquired a national bank charter in May 2001 with the purchase of Treasury Bank in the District of Columbia area, and it changed the name to Countrywide Bank in September 2005.