As the coronavirus pandemic wreaks economic havoc in the U.S. —

To be sure, the practice of letting people borrow from their own next paycheck is controversial. Some critics say the fees charged are usurious, no better than a payday loan. Others argue that even when the fee is low or waived completely, it is still a bad idea for people living on the financial edge to borrow from future earnings.

“Early wage access programs are no panacea for the current crisis, and in fact the crisis illustrates the limits of those programs,” said Lauren Saunders, associate director of the National Consumer Law Center. “This crisis will not be over in one paycheck, yet taking money from next week's paycheck just creates another hole to fill and less ability to meet future challenges that will only get worse."

But desperate times arguably call for desperate measures.

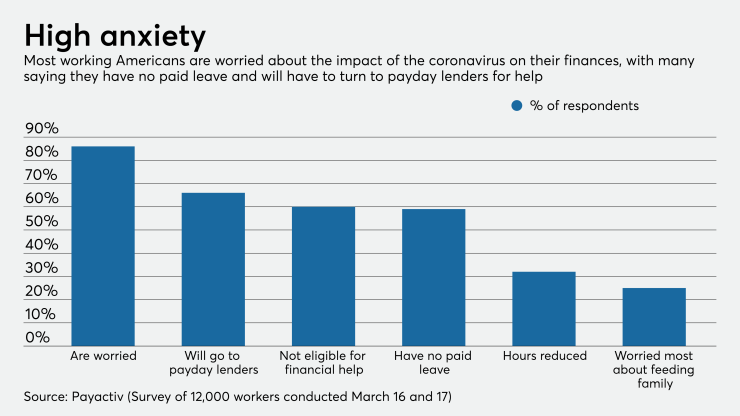

The economic toll of the coronavirus is bound to be tougher on that 74% of workers who,

As reports of companies laying off and furloughing employees due to the coronavirus pandemic roll in, lower-income households are being hit hardest. According to

Meanwhile, the regular rent, mortgage and utility bills roll in and families need to buy extra supplies for indefinite periods of working and schooling from home. All of this is driving people to early wage access companies, to fill those pressing needs that are hopefully short-term.

PayActiv

PayActiv is based in San Jose, Calif., where all residents have been ordered to “shelter in place.” It works with about 1,000 employers and 1 million end users. It integrates with major payroll providers like ADP, Paychex and Kronos. In 2019, it processed $2.5 billion in early wage payments.

Since the coronavirus outbreak, it has seen a 5% to 6% increase in use of its early wage access service, which is now free. Normally it charges a monthly fee of $1, $3 or $5.

“People are lining up to buy groceries,” CEO Safwan Shah said. “And for a broad cross-section of society in America, maybe 70-80 million people, they don't have the extra cash to buy in bulk. Suddenly employers are realizing this is a necessity, because there are so many people living paycheck to paycheck. Whatever they’ve earned today or yesterday, they might need it to buy groceries because the need is today and now. Two weeks is too long, or five days to payroll is too long.”

DailyPay

Across DailyPay’s client base of 2 million people, the use of early wage access began ticking up in tandem with media reports about the worsening health crisis, especially in Italy, and the need for social distancing, according to Jeanniey Mullen, chief innovation officer at the New York-based fintech.

"We started to see a significant and consistent increase in not only the usage of earned income, but also the percentage of our earned income going specifically towards preparing for the coronavirus: supporting a family through the coronavirus challenges and changes in work-life situation or even, unfortunately, battling the coronavirus,” Mullen said.

About 43% of early access is being attributed directly to coronavirus preparations or management, she said. This includes buying extra supplies now that the whole family is home all the time in many places and buying medicine.

“That has been consistently increasing over the past week, and we’re continuing to watch that,” Mullen said.

The increases in usage are being counterbalanced by people losing their jobs altogether, and therefore not having future wages from which they can borrow.

“Across our hospitality clients, we have seen a significant decrease in the number of employees,” she said. “Therefore, those people no longer have access to any earned wages. In some cases they’re filing for unemployment.”

Other employers, such as online retailers and grocery stores, are still hiring and increasing hours, Mullen said.

Overall usage of DailyPay has increased slightly in recent days, despite the layoffs and furloughs.

DailyPay usually has a per-transaction fee of $3 for instant access to the money, $2 for next-day access. It has waived the next-day access fee for all clients throughout this crisis period.

“We believe that people should have access to their full earned income, and we want them to be able to have access to that for no fee,” Mullen said. Some employers are waiving the immediate access fee or subsidizing it for their employees, she said.

To afford the fee waivers, DailyPay has cut expenses like employee trade show attendance. It has reallocated some money that was being invested in growth initiatives.

“Our board has been extremely supportive of funding changes that we would need in order to do this,” Mullen said.

Branch

At Branch, which offers digital banking including early wage access through employers, CEO Atif Siddiqi said it’s too early to know if early wage access usage is going up significantly.

He is seeing increased employer adoption and interest in the offering. Some employers that were going to go live with Branch at a later time are now asking to do it sooner. Many of Branch’s clients are quick service restaurants like Taco Bell and home health care providers like Visiting Angels.

“About 35% of our users right now are seeing their hours getting cut,” he said. “So employers are turning to additional benefits they can offer their employees, and they understand employees’ need to get their money faster is of the utmost importance right now.”

Last year, Branch says it added 1 million users to its base; it declined to give a figure for total customers. About 80% of users log in weekly just to check their balances and receive “healthy nudges,” for instance, that they are spending more than they normally do and might be short on rent.