A new accounting standard for loan losses could be particularly harsh for consumer lenders.

The Current Expected Credit Loss standard, or CECL, will require banks to estimate the losses tied to a loan when it is originated. The change is widely expected to contribute to a spike in provision expenses in 2020; publicly traded banks are slated to convert to the standard in January.

Banks

Conversely, banks that focus on commercial lending could benefit from the new standard.

“A lot depends on portfolio mix,” Cannon said in an interview. Loans with shorter durations and a low loss history "are going to do well.”

Downward pressure could be pronounced at institutions with heavy exposure to consumer loans with historically elevated losses such as credit cards. At Discover Financial Services, KBW is forecasting a drop in tangible book value per share of 10% or more. The hit could be roughly 6% at Capital One.

While it can be tricky to determine the life of credit card balances, "the duration can be pretty long" when a lot of borrowers make minimum payments, Cannon said.

Representatives for Discover and Capital One declined to comment.

During a conference call last month, R. Scott Blackley, Capital One's chief financial officer, said the company had sufficient capital to cover what he termed the "phased-in impacts" of the planned Jan. 1 conversion.

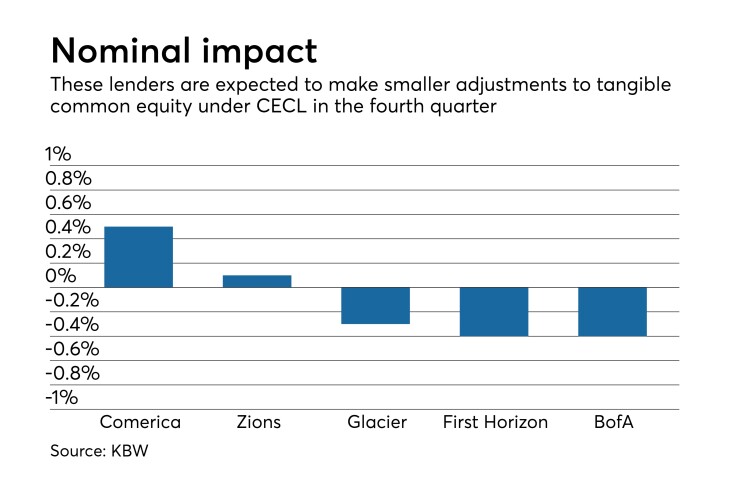

Two banks — Comerica in Dallas and Zions Bancorp. in Salt Lake City — could have an increase in tangible book value after converting to the new standard, KBW found. The portfolios at the $71 billion-asset Comerica and the $69 billion-asset Zions skew heavily toward commercial lending.

A Comerica spokesman declined to comment.

During a January conference call to discuss quarterly earnings, Chief Credit Officer Peter Guilfoyle said he expected CECL to have a modest impact on Comerica's balance sheet, “given the fact that our portfolio has a much shorter duration than most of our peers.”

At other major commercial lenders, CECL-linked declines in tangible book value should be less than 1%, Cannon said.

Overall, CECL’s impact will be modest for most banks, “as long as credit remains benign and the economy continues growing," Cannon said. Measured by tangible book value, the hit should be less than 5%. In all, KBW provided individual estimates of CECL's effect for 87 banks in its coverage universe.

Capital One and Discover are part of a group of regional banks that endorsed a plan to create a two-tiered allowance structure.

The group requested that losses projected to occur within 12 months flow through net income, while accounting for longer-term losses through accumulated other comprehensive income. The Financial Accounting Standards Board convened a roundtable to

Zions, which also endorsed the regional bank proposal, is withholding comment while FASB considers it, said James Abbott, the company's director of investor relations.

Most banks have shown far more concern about the possible hit to capital stemming from converting to CECL than about the likelihood it would increase in the future. Those concerns prompted federal banking regulators to approve a rule permitting institutions to phase in any adverse capital impacts tied to the new standard over three years.