Consumer banking

Consumer banking

-

Customers reported failed subscription payments and support issues, though a backup system kept some basic functionality online.

January 14 -

Virtual reality and agetech devices were among the consumer electronics devices that caught the attention of U.S. Bank Chief Innovation Officer Don Relyea and Head of Research and Development, Innovation Todder Moning.

January 13 -

Coastal Financial in Washington State has acquired GreenFi, one of its fintech partners. The move is designed to buy time in order to figure out the best long-term strategy for the struggling neobank.

January 12 -

The 6-2 vote represents a win for the megabank, which has been fighting a nationwide push to organize its workers. Some 28 branches have voted in favor of unionization, while three have rejected unionization.

January 12 -

Despite attracting $2 billion in deposits, the cloud-native unit proved too expensive to maintain, prompting a strategic retreat by parent company SMBC.

January 12 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

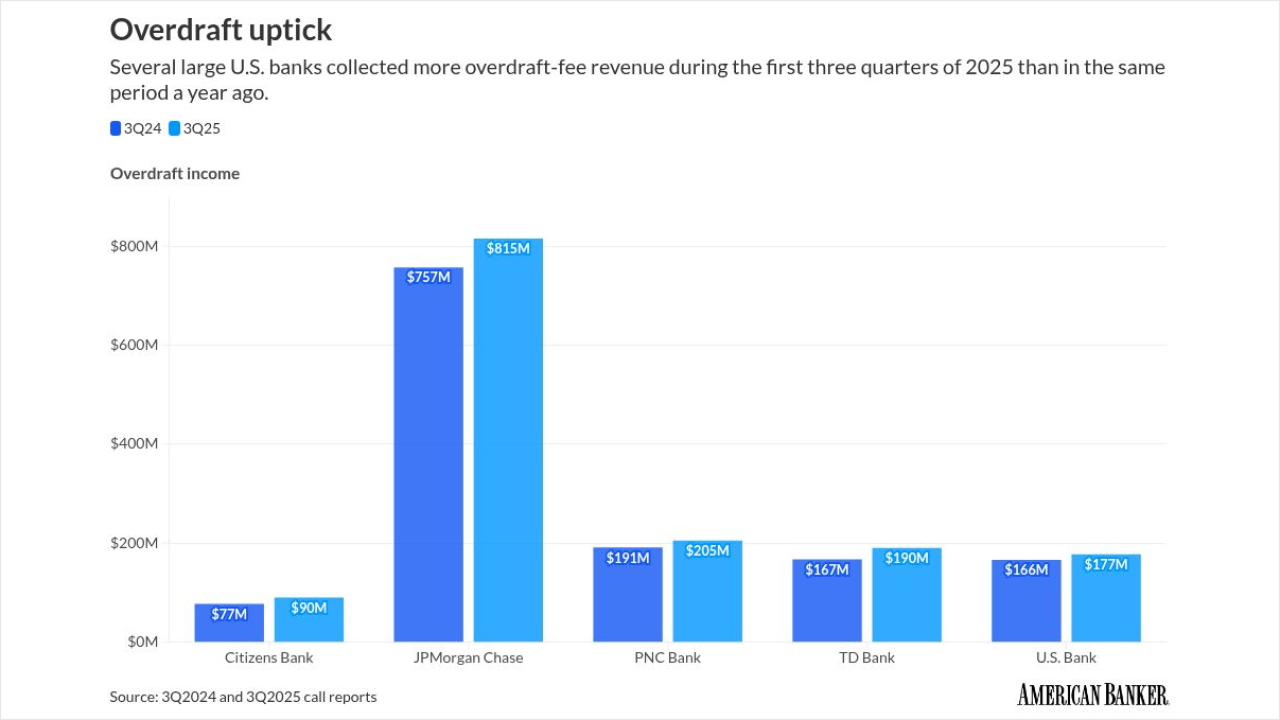

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

House Financial Services Committee Chairman French Hill's community-banking package includes reciprocal deposits, tailoring and many other items on community bankers' wish lists.

January 7 -

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined several priorities affecting community banks, including potential changes to asset thresholds for smaller institutions.

January 7 -

The 81-year-old Metamora State Bank renamed itself Bank419 to better align its brand with its business after years of regional expansion.

January 7 -

PicPay is making a second attempt at entering the U.S. market as a profitable digital bank and a competitor to fellow Brazilian fintech Nubank.

January 6 -

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

Just a handful of de novo banks opened in 2025. But there are signs of renewed activity, with eight banks currently actively in formation and more than 10 charter applications on file with the FDIC.

January 5 -

Mike Dargan, former chief operations and technology officer for UBS, stepped down at the end of 2025 and will become the CEO of neobank N26 this spring.

January 2 -

Bank First in Manitowoc, Wisconsin, has completed its acquisition of Centre 1 Bancorp in Beloit; Citi plans to shed its remaining Russian operations; Heritage Financial in Olympia, Washington, has received regulatory approvals to acquire Olympic Bancorp; and more in this week's banking news roundup.

January 2 -

As artificial intelligence is integrated into more and more core banking operations, bank boards of directors need to make sure business continuity plans account for the possibility of AI system failures.

January 2 -

Community banks are always looking for ways to expand local engagement. But for some banks, sponsoring disc golf courses, clubs and events offers a relatively inexpensive way to boost their profile among a very loyal customer base.

January 1 -

Conditional approval of a national bank charter used to be a virtual guarantee that an institution would open its doors. But the OCC's recent treatment of Erebor Bank suggests that banks with conditional approvals still have work to do.

December 31