-

Regulators are taking a hard look at payday lending practices, and that could give banks an unprecedented edge over storefront operators.

June 28 -

The renewed focus on fair lending and UDAP issues, especially with the advent of the Consumer Financial Protection Bureau, is becoming a bigger factor in CRA ratings.

May 8 -

Federal regulators seem to be of two minds about the Community Reinvestment Act, a law with an explicit and limited congressional purpose of requiring each banking regulator "to use its authority when examining financial institutions, to encourage such institutions to help meet the credit needs of the local communities in which they are chartered consistent with the safe and sound operation of such institutions."

December 28

A group of community activists called on the Office of the Comptroller of the Currency Tuesday to give Wells Fargo (WFC) a failing grade on its upcoming Community Reinvestment Act examination, citing its lending practices in minority communities and a "usurious" payday-like loan product.

The group, which includes the California Reinvestment Coalition, NEDAP, Reinvestment Partners, and the Woodstock Institute, alleges that Wells Fargo has engaged in "abusive, fraudulent and discriminatory practices," citing

Sarah Ludwig, the founder and co-director of NEDAP, in New York, said community groups have sent 2,750 letters to the OCC urging the agency to take into account "discriminatory lending practices that have devastated entire communities through the concentration of foreclosures."

Community groups believe they "have a tremendous opportunity right now," to open a dialogue with Thomas Curry, who was

Mike Rizer, director of community relations and CRA risk management at Wells Fargo, called the lobbying effort by community groups a "healthy give-and-take," and "a normal, standard part of the exam process."

Wells,

Its upcoming CRA exam will begin early next year but the lengthy exam process means the San Francisco bank won't get a rating until late 2013, Rizer said.

"This will be our first exam since 2008 and we're feeling good about how we're going to do," he says. "There's nothing wrong with the community organizations communicating their positions. This is really not unusual and is part-and-parcel of the process that we go through every four years when we go through the exam."

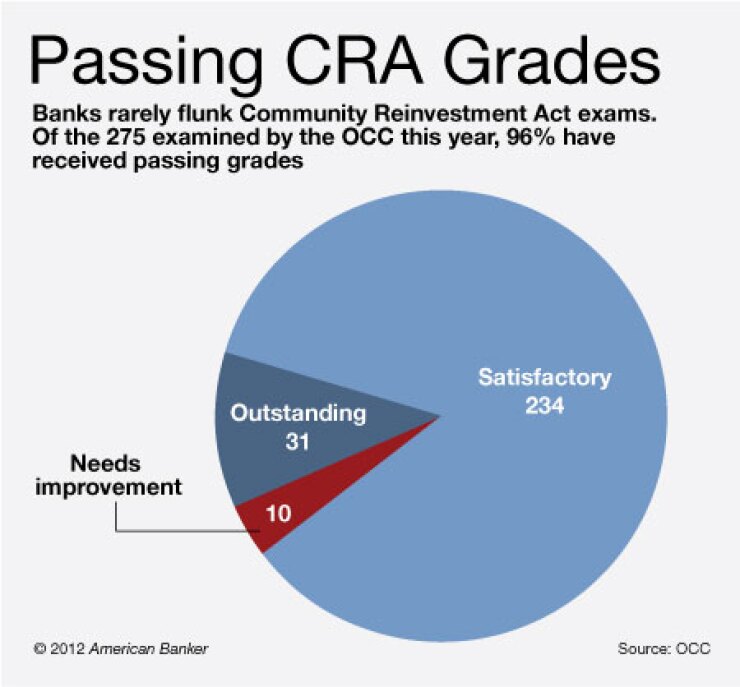

It is rare for banks to flunk CRA exams. Through the first 10 months of this year, the OCC handed down just 10 "needs to improve" ratings, versus 234 "satisfactory" ratings, according to the agency's web site.

Still, Ellen Seidman, the chair of the Center for Financial Services Innovation and the former director of the Office of Thrift Supervision, says community activists can absolutely influence the CRA exam process.

"Community groups can have a pretty significant impact in the course of the exam because regulators are required to talk with them," she says "There's certainly enough in the lawsuits that Wells has already settled to raise the community groups' ire."

In July, Wells

Wells has even acknowledged material errors on its own. Last month, it began

Kristina Bedrossian at the California Reinvestment Coalition, said the OCC should examine Wells payday loan-like product known as "direct deposit advance," which allows borrowers access to $300 to $500 but carries an annual interest rate of 180%.

"Wells uses its payday loans to lure customers into a debt trap that lasts more than six months, where customers pay more in fees than the amount initially borrowed," Bedrossian said.

Wells countered with "talking point" explanation of the product saying it provides short term credit quickly so customers can get through emergencies, and it is only available to Wells customers with checking accounts and direct deposit. Wells charges a $7.50 fee for each $100 borrowed compared with the industry average of $17 per $100 borrowed, the company said.