Largely absent from recent discussions about financial policy has been the future of the Community Development Financial Institutions Fund.

It is unclear where the Trump administration stands on the fund, a Treasury Department program in which banks serving lower-income communities can apply for money. The uncertainty has some industry observers speculating on what to expect this year.

Some worry that the fund could be viewed as discretionary spending, making it a prime candidate for cuts. At the same time, President Donald Trump has talked about creating jobs and revitalizing inner cities that often benefit from CDFI activity.

“Obviously there’s a concern about the future support” for the fund, said Jeannine Jacokes, executive director of the Community Development Bankers Association. Jacokes said she hopes that Treasury Secretary-designate Steven Mnuchin will realize that he “already has some proven and highly effective tools right under his nose at the CDFI Fund.”

Working in the fund’s favor is its historical bipartisan support, said Matt Josephs, senior vice president for policy at Local Initiatives Support Corp. in New York. The fund “did quite well” during the Obama administration, with House Republicans supporting allocations that exceeded the Treasury’s requests, he said.

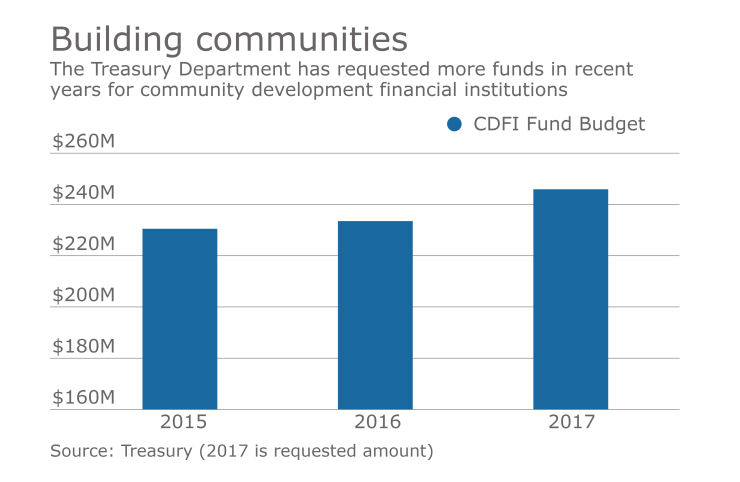

The 2017 House budget for the fund is about 2% higher than the $246 million requested by the Treasury under the Obama administration, according the Community Development Bankers Association. (The Treasury’s request represents a 5% increase from the 2016 budget.)

“That’s very rare,” said Josephs, who worked at the fund from 1999 to 2012. “You wouldn’t necessarily expect [to hear] House Republicans saying, ‘Yeah, we’re going to do more.’ ”

“There’s … bipartisan support that these are the very banks – and sometimes the only banks – that serve low-income communities, both rural and urban,” said Kat Taylor, co-founder and co-CEO of Beneficial State Bank in Oakland, Calif.

The Senate may be less supportive. Its proposed 2017 budget for the fund is about 5% below the Treasury’s request.

The Treasury did not immediately comment. A email to the White House, which is expected to release a proposed budget in May, was not immediately returned.

There are also concerns that the fund could get more scrutiny under the Trump administration’s budgeting process. The White House’s ideas “hew closely” to a proposal from the right-leaning Heritage Foundation that would cut $10.5 trillion from the federal budget over a decade, according to

“We in the advocacy world have to prepare for the worst,” Josephs said.

Antony Bugg-Levine, CEO of the Nonprofit Finance Fund, said he “has no idea” what’s going to happen to under Trump, though he said the industry will make a case that the Fund “is a great example of a bipartisan program.”

Money from the CDFI Fund helps the Nonprofit Finance Fund, which is a CDFI, invest in low-income communities, Bugg-Levine said. The CDFI Fund “has been a major contributor to the permanent capital on our balance sheet,” he said.

Optimists, like Aaron Klein, say they believe the administration will find value in the fund.

“CDFIs are effective tools to deploy capital in areas that have been underserved,” said Klein, a former Treasury employee who now serves as policy director for the Center on Markets and Regulation at the Brookings Institution. “I think this administration will find what prior administrations have found, which is that it’s a good idea and effective program.”

Other industry observers share that opinion, noting that the CDFI Fund supports many groups that largely voted for Trump.

“I’m surmising that the political leadership that has chronically supported the CDFI Fund and allocations see this as a very necessary and treasured resource,” said Taylor, who is a board member at the Community Development Bankers Association. “If you think about this administration’s base, at least according to what they say, are those very same communities.”