Community banks wrestled with lighter demand, high interest rates and their own caution around

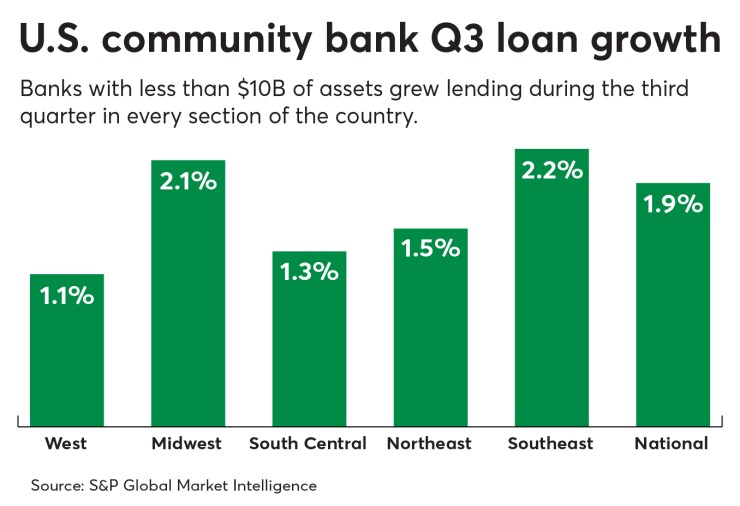

U.S. banks with less than $10 billion of total assets posted sequential third-quarter loan growth of 1.9%, according to S&P Global Market Intelligence data. While that marked a decrease from 2.5% growth during the second quarter — and from 3.5% in the third quarter of 2022 — it nevertheless

By region, community banks in the heavily populated and fast-growing Southeast recorded the strongest third-quarter loan growth: 2.2% from the prior quarter.

Christopher McGratty, head of U.S. bank research at Keefe, Bruyette & Woods, said that while lending "clearly decelerated," banks have plenty of motivation to remain active. With rates at the

"You could argue that this is the time to grow," he said.

Many community bankers throughout the earnings season late in October and early this month said they had grown more selective with the new loans they made during the past quarter, and many reported lighter overall demand in the face of higher interest rates that have made borrowing

Yet, the economy remained on solid footing and consumers continued to use credit cards and personal loans to finance their spending. The U.S. added jobs every month this year and the economy grew at a 4.9% seasonally adjusted annual rate in the third quarter, according to the Commerce Department. That was more than double the 2.1% rate of the prior quarter.

What's more, real estate developers continued to invest in apartments to meet strong demand for rentals as more people delayed homebuying amid high rates. Mortgage rates in the third quarter reached 8%, tripling year-earlier levels.

Consumer loans grew 1.3% during the third quarter. Multifamily apartment loans, coupled with commercial real estate data, offset declines in other subcategories and drove 1% growth in CRE. One- to four-family home loans, powered by demand for multiunit buildings, increased by 2%.

Total loans and leases for banks under $10 billion of assets topped $2.35 trillion at the close of the third quarter, according to S&P Global.

Despite the momentum and resiliency of the consumer-driven U.S. economy, analysts noted that community banks' bread-and-butter is CRE. Worries remain about interest rates adversely impacting floating-rate CRE borrowers and elevated levels of office property vacancies due to remote-work trends. As a result, small banks could struggle late this year and early next to drive stronger overall loan growth.

The S&P Global data showed that the third-quarter loan delinquency rate across the banking industry increased 21 basis points from the prior quarter to 1.03%. That marked the largest sequential increase in five years and nudged the delinquency rate above its early pandemic peak of 1.02% in the fourth quarter of 2020.

DBRS Morningstar said the U.S. CRE office sector, in particular, is expected to continue grappling with high vacancy rates and falling property values.

"In the near term, we expect more challenges as the demand for office space continues to dwindle while refinancing will be harder for investors because of increasing interest rates and banks requiring additional equity or collateral to renew loans given falling appraisal values," said Morningstar analyst Mindula Suriyabandara.

That helps to explain why community banks are cautious. But there are signs that concerns are beginning to ease.

The Federal Reserve's latest senior loan officer survey, released earlier this month, found that while 51% of banks reported more restrictive business lending standards in the second quarter, only 35% said they further tightened standards in the third quarter.

"Standards continue to tighten across the board," Piper Sandler analyst Scott Siefers said. "The silver lining is that the degree of degradation may not be as bad as in the last couple surveys."