-

With Beth Mooney in charge, KeyCorp has emerged as one of the industry's top regional banking companies while becoming a model for workplace diversity.

September 22 -

While executives are eager to put excess capital to work, the sell-off of KeyCorp stock following the announcement of the First Niagara deal shows investors will react swiftly and severely when it appears a buyer has overpaid.

October 30

Competition for commercial clients is fierce, so banks are on the hunt for ways to keep their customers happy.

KeyCorp surveyed its business customers and a trend emerged: they wanted better payment capabilities.

"We asked [client-facing staff] to get feedback from customers on their pain points, and digitizing payments and reducing paper was a big one," said Clark Khayat, group head of enterprise commercial payments for Key. There are "a lot of pain points in B-to-B payments, and it's really ripe for disruption."

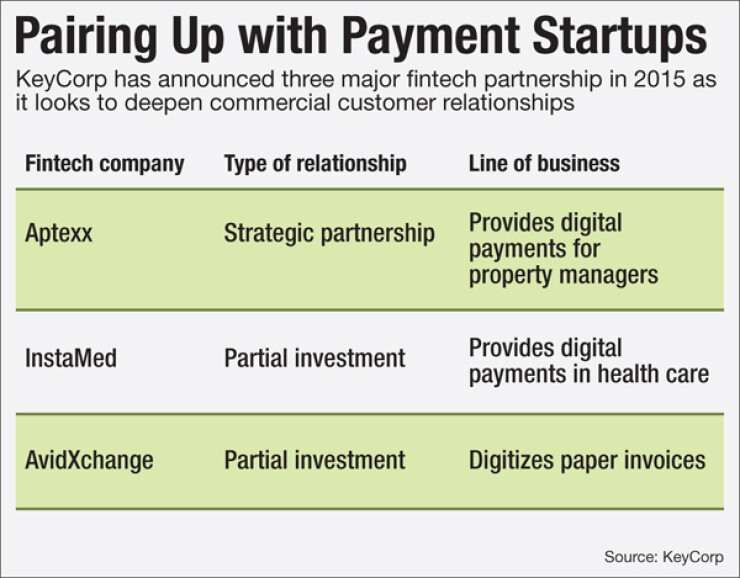

The $94 billion-asset company spent the last year deepening its commercial payments offerings. On Dec. 1 the bank announced a partnership with Aptexx, which provides software enabling property management companies to accept mobile and digital payments. And earlier this year, it invested in Philadelphia-based InstaMed, a health care payments provider, and Charlotte-based AvidXchange, which makes software that digitizes paper invoices.

Payments innovation has been one of the hottest areas in fintech for several years, but it's largely been confined to the retail side. Consumer-facing payments products like Apple and Android Pay, and peer-to-peer payments services such as Venmo, receive much of the attention.

That could soon change. According to a recent BNY Mellon report, wholesale and business-to-business payments are gaining traction.

"Indeed, it must not be forgotten that in the midst of [payments] advancements impacting the retail space, the wholesale and corporate banking industry itself has been evolving," says a portion of the report, titled "Innovation in Payments: The Future is Fintech."

The demand for commercial payments is part of a larger trend in digital banking. Commercial clients are increasingly expecting the digital tools available to them to be as good as the ones they use in their personal lives.

Further, the company's decision to partner rather than build the technology is a sign of the times. Recent years have seen somewhat of a "banks vs. fintech" mentality in the industry, but that is beginning to change, said Sam Maule, emerging payments practice lead for Carlisle & Gallagher Consulting Group.

"I think we've moved into a new age of fintech, where the banks and the disruptors are seeing the value of partnership more than ever before," he added.

Key made the strategic decision to work with fintech companies in the commercial payments space, Khayat said.

"Banks aren't always the best technology builders, and even in cases where we can do it, it can be a long slog, and it can be easier to find companies in the market to partner with," he added.

For banks outside the "big four," developing technology in-house may not be practical, Maule said. So pursuing partnerships can be crucial in a bank's innovation strategy.

Key's search for partners was an exhaustive one, Khayat said. Of the three partnerships it ended up making, the bank had talks with as many as 100 fintech companies.

"We've set the bar reasonably high," he added, regarding the bank's selectivity in choosing partners. "We were looking for companies that not only had an innovative solution, but also wanted to be a true partner. And those don't always travel in pairs."

Even with all the research the bank has already done, it has only "scratched the surface" in terms of the number of potential partner companies out there, said Ken Gavrity, head of product and innovation for Key's enterprise commercial payments unit. It is continuing to search for potential partners, but wants to be careful in picking things that its clients will find useful.

"Sometimes it's easy to be inwardly looking in this industry, and just think about getting the next product out, without thinking about the disruption or the innovative value of the product you just put into the marketplace," he said.

Aptexx typically sells its solution directly to property managers, who then integrate it with their own payments and financial systems, said William Evick, the company's chief executive. The opportunity to work directly with a bank was appealing, because it can utilize Key's payments capabilities and collaborate with the bank on delivering additional ancillary services to Key's property manager clients, including digital maintenance requests and delivering resident communications, he said.

Key "realizes they are a bank and not a software company, and so they went out into the market and partnered," Evick said.