Commercial clients represent billions of dollars in assets, but they often have a harder time opening a bank account than the average retail client.

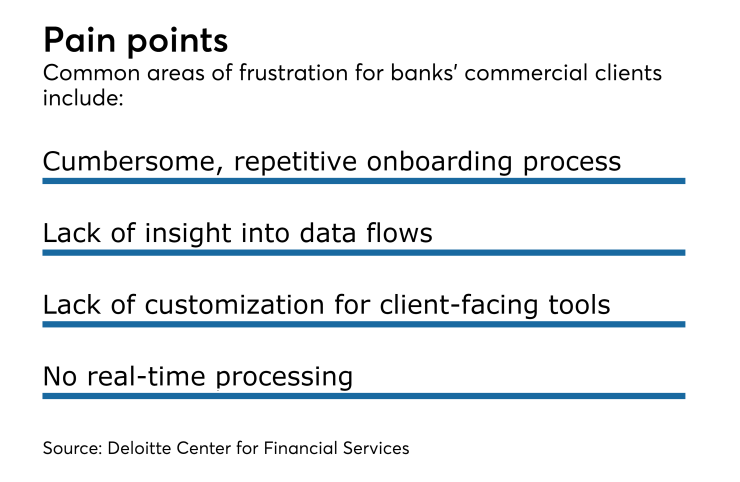

For example, commercial clients often have to send the same documentation and information to a bank a number of times just to be onboarded and then again for setting up different services.

The same innovation and technology making banking simpler, mobile and paperless is finally being applied to commercial banking clients, as institutions revamp or invest in new wholesale banking systems to solve the frustrations felt by firms.

The effort is spread between banks big and small. Peapack-Gladstone Bank in Bedminster, N.J., developed several new features for corporate clients, including a treasury management product; JPMorgan Chase is building a new client portal called Data Once.

“Whether it is larger banks or smaller banks, they need to identify a different way of interacting with clients,” said Chris Doroszczyk, a Deloitte Consulting principal. “The industry needs to modernize with a greater sense of urgency.”

JPMorgan Chase’s new portal, which will be offered to a limited client base this November and fully rolled out next year, is the result of the firm studying where commercial clients were getting frustrated, said Kevin Heins, managing director and global head of implementations.

“Banks see product implementation and client onboarding as two separate processes, but clients don’t see it as different; they see it as having to send the same information multiple times to multiple groups to accomplish one thing,” Heins said.

Further, the bank found the process of sending and receiving documents between the clients could be done in a more streamlined manner — there were too many long email chains, for example — and that clients also wanted greater visibility into the status of payments and cash flow.

The tool will offer clients a dashboard that shows all the documentation necessary to send the bank; that information now will only have to be sent once (hence the name of the product) and can be stored and reused for any future products or services where that data is needed if applicable, Heins said.

The dashboard also shows different tasks in a color-coded format that indicates whether a piece of data is still needed from the client, if it is being processed on JPMorgan Chase's end, or if the task is complete. The dashboard lets the bank and the client view the same thing and helps create better transparency.

“Clients were not looking at same things as our internal implementation team; clients were looking at emails and project workbooks that we previously sent,” Heins said.

The idea for Data Once was inspired by part by the

Further, clients can have greater insight into payment and other information flows, said Solimine.

“When information is coming in piecemeal, clients don’t get visibility into the end-to-end process,” he said. “When you use Uber, you look at your phone and see where the car is and when it’s picking you up; you don’t wait on the corner wondering when it will arrive. Clients can now have that greater insight into the status of onboarding requests, where they are in the process and exactly when they are complete.”

Not enough to automate

Giving commercial clients that visibility is crucial, and it’s not enough to just automate processes, Doroszczyk said. A rethink is needed on how work is done and empowering clients to gain more control of service delivery.

“Banks can’t be fast enough in answering every question or putting out specific reports all the time" to clients, Doroszczyk said. “They have to think about what they can do to externalize services to clients.”

He predicted change in the transaction banking environment picking up in the next three years, an apparent trend when examining recent tech investments in the industry.

Bank of America, for example, partnered with the fintech firm HighRadius in August to launch a new

But it’s not just large institutions like looking to innovate in this area. Some community banks too are investing in better tech for commercial clients to retain their business.

-

Bank innovation has tended to focus on retail customers, but expect more technology for commercial customers in the coming year as those clients deman products that are easy to use and help them run more efficient enterprises.

December 21 -

ING recently launched its InsideBusiness platform, which aims to allow corporate clients to do things like manage their global liquidity from anywhere in the world. The product, which will be expanded slowly, is part of the company's push to compete for commercial clients in the U.S.

July 2 -

Ditching paper and digitizing tasks help community banks operate more efficiently and write more profitable commercial loans.

October 19

Peapack-Gladstone, which counts among its clients residential builders, a variety of local small and midsize businesses and even the former New Jersey Gov. Christine Todd Whitman, this month implemented a new treasury management product from Jack Henry, one that it and a few other community bank customers of Jack Henry’s helped create.

“We worked with them and provided feedback about what type of functionality we would like,” said Kevin Runyon, executive vice president of information technology at the bank. “It’s flexible and we can customize the product for our own needs.”

Among its features, commercial clients can customize payment reports, and sets permissions on how payments are approved and who can approve them, Runyon said. Reporting filters also give users the flexibility to generate tailored reports that can be saved and even flagged as favorites. It also has a slick interface clients are generally used to in their consumer lives, he noted.

“It also has a completely different look and feel,” added Runyon. “There’s a dashboard that gives clients a complete view of cash positions. It’s designed to give a lot more flexibility to the businesses.”

The $4.2 billion-asset bank initially was looking to upgrade its commercial tech because it felt it had an edge in service, but perhaps did not have the technology capabilities larger banks can offer.

“Very often we’re competing against the larger institutions” for commercial clients, Runyon said. “We feel we have a better service model, and have been successful in bringing over clients from larger banks. But once we brought them over, the technology we had in place was not equivalent from where they came from. With this new platform we feel we can compete with the larger banks [on technology] and go big-game hunting for larger business clients.”