The storm surge of foreclosed properties on bank books shows little indication of ebbing, and institutions

Among the entities with the 25 highest percentages of repossessed assets (or “other real estate owned,” in industry parlance) to tangible equity at Sept. 30, about a third failed in October and November (see table).

Their fate was presaged by outlandish ratios. At RiverBank in Wyoming, Minn., for instance, a nearly fourfold increase in foreclosed properties since the third quarter of 2008 — mostly collateral backing construction and development loans that went bad — combined with losses that drained tangible equity by about 99% over the same time to produce a ratio of OREO to tangible equity of about 7,000% at Sept. 30.

Regulators closed RiverBank on Oct. 7 at an

The table excludes companies with negative OREO ratios that result from negative tangible equity, such as at Capitol Bancorp Ltd., which has been

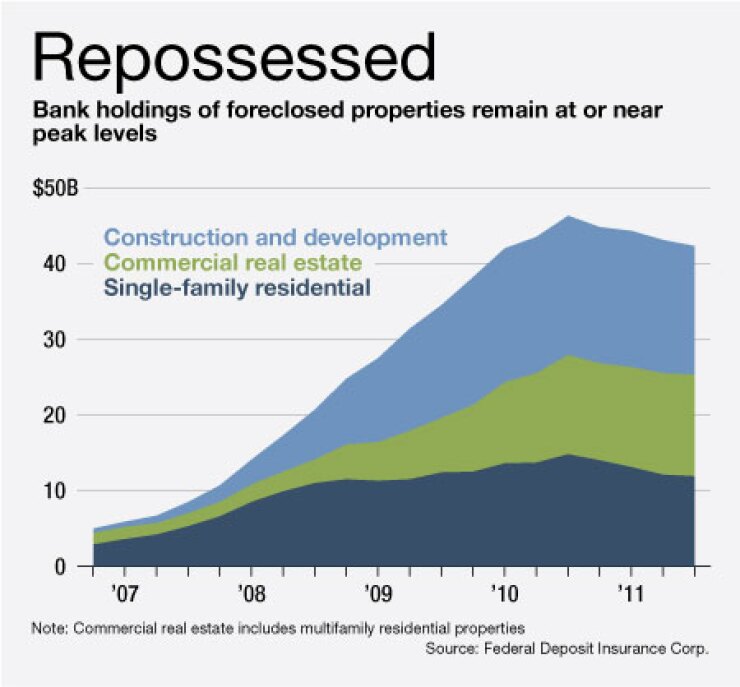

Simultaneous craters in equity and jumps in foreclosed properties are typical of entities with the highest ratios, as are high levels of soured construction and development assets. In fact, construction and development is the largest category of seized properties in the banking industry, totaling about $17 billion at Sept. 30, according to data from the Federal Deposit Insurance Corp. Commercial real estate, including multifamily residential buildings, is second at $13 billion, and single-family homes are third at $12 billion (see chart).

Repossessed single-family properties on bank balance sheets are down about 20% from a high in the third quarter last year, but the improvement could reflect widespread delays in the foreclosure process because of

Some institutions have recovered from extraordinarily high levels of foreclosed properties. Cascade Bancorp in Bend, Ore., for instance, raised about $180 million of capital in January from investors including private-equity funds affiliated with Lightyear Capital LLC and WL Ross & Co. LLC. Cascade, which had been badly damaged by loans to home builders, also sold off about $100 million of distressed assets, including some seized collateral, in September. Its ratio of OREO to tangible equity fell from about 1,300% the year prior to 20% at Sept. 30.