Over the years, acquisitions of fee-based business have played a key role in Citizens Financial Group’s growth strategy. The Providence, Rhode Island, company’s agreement to purchase much of HSBC’s U.S. retail business breaks with that pattern.

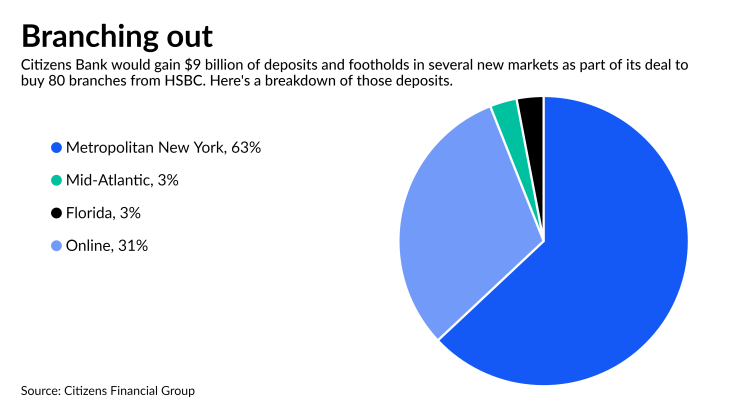

The deal, which includes $9 billion of deposits, $2.2 billion of loans and 80 East Coast branches, was largely opportunistic, Citizens Chairman and CEO Bruce Van Saun said in an interview Thursday. Specifically, it would lower the $187 billion-asset firm’s loan-to-deposit ratio, immediately put Citizens into some geographies it’s been eyeing, and add to its digital franchise, Citizens Access. About 31% of the deposits are in HSBC’s direct bank, which Citizens is also acquiring.

“It ticks all the boxes: It’s great for our balance sheet, it’s great for our physical footprint and it helps accelerate what we’re doing with the digital bank,” Van Saun said. “We didn’t go seeking out a branch-based divestiture, because there’s not too many of them, but when it falls in your lap and it’s in geographies you care about and you can get it at a good price then you jump on it.”

Citizens and HSBC announced the

The companies did not disclose a total deal size, although Citizens said it will pay a 2% premium on deposits when the transaction closes. That translates to roughly $180 million based on current deposit levels, or less than 1% of Citizens’ market capitalization, according to Piper Sandler analyst Scott Siefers.

“We view this as a low-cost, low-risk transaction that will expand [Citizens] into some attractive new markets” and add about 800,000 new customers, Siefers wrote in a note to clients.

The deal would give the bank 66 branches in the New York City metropolitan area, nine in the mid-Atlantic and Washington, D.C., area and five in southeast Florida. Citizens will also bring on roughly 600 HSBC employees, mostly in retail banking, Van Saun said. The bank expects the transaction to close in the first quarter of 2022, pending regulatory approval.

Since it spun off from Royal Bank of Scotland in 2015, Citizens has acquired nonbank, fee-based businesses at a steady clip. Early in 2020 it

In 2018 it bought

When asked about M&A by analysts, Van Saun has generally been consistent in his response: Citizens won’t rule out whole-bank deals, but it’s more interested in nonbank deals. Van Saun said in October that “there’s more we’d like to do in terms of increasing our scale, filling in holes in our geographical footprint,” but he said it’s been a challenge to find “a good fit” available “at a reasonable valuation.”

It found those criteria in HSBC. Pointing to PNC Financial Services Group’s deal for BBVA’s U.S. banking business, Van Saun said Citizens executives had “had an inkling” that some foreign-owned U.S. bank subsidiaries might be looking to sell off certain businesses.

More traditional bank acquisitions may be possible from Citizens, but those deals would likely focus on boosting its Florida or the mid-Atlantic footprint rather than a larger “transformational” merger, said Peter Winter, an analyst at Wedbush Securities.

Winter called the acquisition a “great deal” that strengthens Citizens’ deposit franchise. Setting the closing of the deal in early 2022 is critical, he said, because it will give Citizens more flexibility to fund loans as the economy gets back to normal.

Right now, the banking industry is “awash in deposits” and is struggling to increase loan balances, Winter said. But that picture is likely to change by the time the deal is slated to close.

“This supports loan growth when it should start to pick up, and it backfills deposits because we do think … deposits will be leaving to some degree” across the banking industry, Winter said.

The makeup of HSBC’s deposits may be an additional benefit since they appear to be stickier, Winter said. The vast majority of the deposits are in checking and savings accounts, and only 2% are in certificates of deposit. HSBC’s deposits are also cheaper, with an average cost of deposits of 9 basis points in the first quarter, compared with 14 basis points at Citizens, Winter noted.

The acquisition will speed growth at Citizens’ national online-only bank, Citizens Access. Since launching in July 2018, Citizens Access has accumulated $5.5 billion of deposits in roughly 72,000 accounts in all 50 states and the District of Columbia.

Geography was also big draw for Citizens, Van Saun said. The company already had mortgage origination, commercial lending and commercial real estate lending in the New York metro market, so the HSBC deal would immediately give it a retail presence there, too. Van Saun added that he’s not concerned about short-term difficulty New York City may be facing in the wake of COVID-19 and that the city’s economy is still vibrant.

“To be able to enter that market on day one and have that be profitable and accretive is very attractive,” he said. “If we’re gonna be a really strong bank principally on the East Coast, then you’ve gotta fill in that gap, from New England into the mid-Atlantic franchise.”

HSBC’s Florida branches were also appealing to Citizens, given that the Rhode Island-based company has a number of “snowbird” customers who spend winters in Florida, Van Saun said.

“It’s a nice add to the footprint franchise at a very reasonable price,” said Ken Usdin, a Jefferies analyst.

Citizens’ stock was up 1.61%, to $49.88 a share, Thursday afternoon.