Revenue growth exceeded expectations at Citigroup, with a hat tip to credit cards. Now the question becomes whether the Federal Reserve’s anticipated rate cut throws a wrench into things.

Citi, which kicked off second-quarter earnings season among banks, said Monday that total revenue grew 2% from a year earlier to $18.8 billion. That beat Sandler O’Neill’s estimate of 1%. Credit card revenue led the way, climbing 4% to $4.9 billion. International revenue also contributed, rising 4% to $3.3 billion. Those results helped compensate for

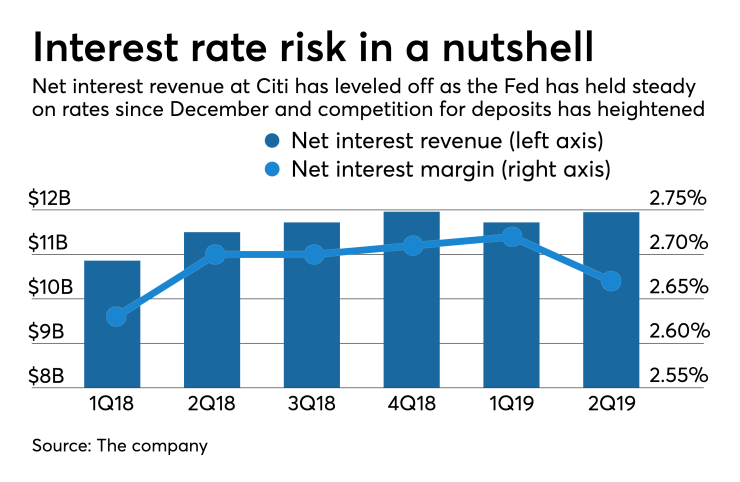

But the Fed’s likely rate cut threatens Citi’s net interest income, which is far bigger and growing faster than its fee-income businesses. It’s an issue that all banks will face this year — what steps should they take to protect profits and margins against falling interest rates, said Gerard Cassidy, an analyst at RBC Capital Markets.

The largest banks “have different levers they can pull, including lowering deposit rates when the Fed cuts,” Cassidy said.

Indeed, Ally Financial and Goldman Sachs in late June cut consumer deposit rates. And Citigroup hinted at that possibility — Chief Financial Officer Mark Mason told analysts on a conference call that “I would imagine that, over time, with clarity on the direction” of overall interest rate movement, Citi will lower deposit rates.

Net interest income growth has already begun flattening at Citi, as the Fed has not raised the federal funds rate since December and deposit competition has heated up, forcing Citi to pay higher rates to account holders. Citi’s net interest margin dropped 5 basis points to 2.67% from March 31 to June 30. As a result, net interest income was $11.9 billion in the second quarter, up only 2% from the previous quarter compared with 10% year over year.

If anything, having an excuse to tighten the reins on deposit costs is a silver lining to the shift in monetary policy, said Marty Mosby, an analyst at Vining Sparks. Most big banks delayed paying higher deposit rates after the Fed began its series of rate hikes, in order to build a wider profit-margin spread as loan rates rose. These banks

“Since big banks just raised rates, they have the ability to lower rates faster” than other banks, Mosby said.

Deposits have been growing rapidly at Citi. It added $2 billion of deposits in the quarter, largely due to a new strategy of persuading existing credit card customers to open savings or checking accounts through digital channels.

“A good portion of the deposit growth we achieved was outside of our six markets” where Citi operates retail branches, Mason said during the call.

Citi’s strategy also includes cutting noninterest expenses. Adding new customers through mobile and online channels has the additional benefit of being less expensive, CEO Michael Corbat said during the call.

“The faster we can continue to drive digital adoption and mobile usage, we know that it’s cheaper,” Corbat said.

Noninterest expense fell 2% to $10.5 billion, as technology investments helped improve efficiency. As a result of the tech-related improvements, Mason said Citi is likely to hit the high end of its $500 million-$600 million range of estimated cost savings this year.

Finally, Citi can improve its earnings per share by continuing to return capital to shareholders. Citi estimates it will return about $62.3 billion to shareholders over a three-year period ending this year through dividends and buybacks. Buybacks reduce outstanding common shares, which in turn improves earnings, Mosby said.

In fact, now that many

“That’s an innate momentum embedded in all of the large and regional banks,” Mosby said. “All banks have the ability to generate that benefit.”