-

Citigroup boosted profit more than analysts estimated after a cost-cutting push helped it weather a slump in trading.

April 16 -

Citigroup Chief Executive Michael Corbat will still have a job tomorrow (and probably several days after that). The bank's capital distribution plan was approved by the Federal Reserve on Wednesday, undoubtedly to the delight of shareholders who were surprised by last year's rejection.

March 11 -

Lucrative sale of a subprime lending unit. Big credit card deal. Clear business plan. It's looking like a good year for Citi provided it passes the CCAR stress test this week and fills a key executive post.

March 10 -

Costco has picked Visa as its new payment card network and Citigroup as the new issuer of its cobranded credit cards.

March 2

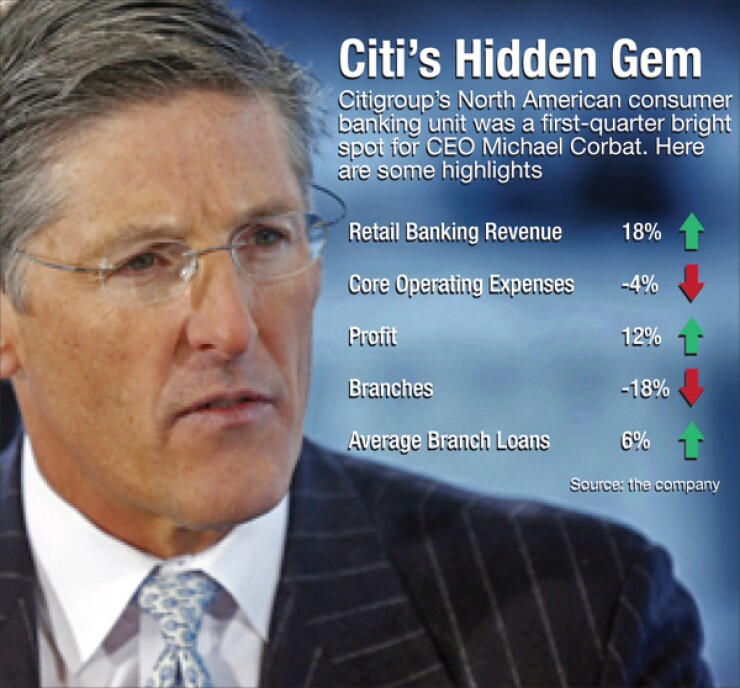

Citigroup may have a ways to go before it completes its turnaround, but its U.S retail business is already pointing in the right direction.

The most international of the megabanks got a surprising boost from its domestic banking operations in the first quarter. Its $4.8 billion profit, which far exceeded analysts' expectations, included $1.1 billion from its North American consumer banking unit.

In many ways, Citi's quarterly performance mirrored that of its megabank peers. Revenue from traditional banking has been tight across the industry, and earnings growth has come from a combination of trading gains and cost savings, especially lower legal charges.

Unlike its peers, however, Citi's traditional banking in the U.S. was a strength, not a weakness. North American retail banking revenue (which excludes cards and some other services) grew 18%, to $1.3 billion, through a combination of loan growth, mortgage originations, asset sales and cost savings.

Chief Executive Richard Corbat described it as a "good performance" from the U.S. group, while sounding a cautionary note on the economy.

"The environment both macroeconomically and legally remains very challenging," he said. "Interest rates remain low, economic growth is uneven and market sentiment lacks conviction."

The 12% profit growth of Citi's North American consumer bank compared with a 5% decrease for Citi's international consumer bank. Revenue was flat in Latin America and declined 1% in Asia, while expenses rose in both regions.

Citi's plan to get leaner and shed ancillary businesses is farther along in the U.S. than internationally, which has helped the retail franchise. Citi has sold or shuttered 174 branches in the past year, or 18% of the total, increasing the average deposits and loans per branch. Citi also earned $110 million on the sale of its Texas branches in the first quarter, compared with $70 million on a branch transaction in the same period a year ago.

Now, 90% of Citi's branches are in just seven cities, Chief Financial Officer John Gerspach said. The bank may further prune or add branches, but "whatever we do will be consistent with that strategy of concentrating our efforts on those seven urban areas," he said.

Having worked through bad assets and closed unwanted branches, Citi's U.S retail bank can finally start going on the offensive, said Gerard Cassidy of RBC Capital Markets.

"They can now pursue retail business in the U.S. that they hadn't been able to because of all their problems," he said.

All together, investors liked Citi's quarter, and the company's stock rose 1.5% Thursday.

The earnings surprise came despite a revenue miss. Overall revenue declined by 2%, to $19.7 billion, as net interest revenue fell by the same amount, to $11.6 billion. Citi's net interest margin actually widened by 2 basis points, to 2.92%, but its loan portfolio shrunk 6%, to $621 billion.

Citi's trading revenue was also off in the first quarter a disappointment to some, after the huge trading quarters put up by JPMorgan and Goldman Sachs, but not really a surprise given Citi's trading focus. JPM and Goldman concentrate on currency and rate-based trading, which has been strong overall this year, while Citi is more dependent on corporate spread-based trading, which has been weaker.

Citi took another hit when the Swiss franc decoupled from the Euro in January. Overall, the company's trading and securities revenue fell 6%, to $4.8 billion.

Dramatically lower expenses can make up for a lot, however. Legal costs and restructuring charges fell 65%, to $403 million, and other operating costs fell 5%, to $10.5 billion.

Citi's legal problems are far from over, with investigations ongoing into possible money laundering, rate rigging and foreign-exchange manipulation.

But it appears that the bulk of the bank's legal costs are in the past. It set aside $3.5 billion in the fourth quarter to cover legal costs and restructuring charges, which should cover most of the coming regulatory bill.

"They've reserved or prepared for these legal and regulatory issues that are swirling around, so the legal expense, while elevated, will not be as extraordinary as we've seen in the past couple years," said Marty Mosby of Vining Sparks.

Citi's declining legal and restructuring expenses are more significant than its revenue problems, especially considering pressures on the industry overall, Cassidy said.

"At some point when the turnaround is completed, it's going to be a problem if the revenue shrink continues," he said. "But at this point in the recovery we don't view it as negatively as we would if they were farther along in their turnaround."

Citi executives provided few new details Thursday on their pending deals to sell its subprime unit OneMain Financial and to take over American Express' partnership with CostCo, but said more information would be coming this year.

Overall, Citi's efforts to shed bad assets have shown steady progress. Citi Holdings, its distressed-asset portfolio or "bad bank," shrunk by 5% in the past year, to $122 billion. It was more than $800 billion at its peak five years ago.