Just days after Facebook’s data scandal broke, Citibank

Doubling down on personal data sharing amid heightened attention to the practice — including Facebook CEO Mark Zuckerberg's two days of testimony on Capitol Hill starting Tuesday — might seem puzzling. But Citibank’s bet is that consumers still need and want financial wellness help and banks have earned people’s trust to supply it.

“At the end of day, people may not love banks, but they trust banks,” said Yolande Piazza, head of

Citibank’s offer is not novel, as there are dozens of digital personal financial management services available. Nor is it the first bank to hope a general app can find a wider audience and help convert more consumers into customers. Ally Bank has tested a

What Citi hopes will stand out is that the app offering comes from a brand that is more than 200 years old and in the business of guarding assets.

This kind of service could become a big opportunity for Citi and many other banks to position their apps as a safe means to improve financial outcomes at a time when

“They have the brand, the trust, the consumer — so why not do more?” said Theodora Lau, founder of Unconventional Ventures, a fintech consultancy.

Banks are quick to emphasize how important guarding someone’s data is, and they have long bickered over how to

Given Facebook’s woes, a bank brouhaha has already

Certainly, Citi is betting on an opportunity in financial wellness.

Its app, which will be available to iPhone users in the coming weeks, will initially rely on word-of-mouth marketing for a service designed to help anybody understand spending patterns, spot recurring bills and open an

“For us, it’s really the beginning of a very exciting journey,” Piazza said.

Letting people import their other financial data into a bank app is also not new. MX and Geezeo are among the vendors that have let banks pull in other bank data. However, Citi is going a step further in letting noncustomers draw in their transaction data through its aggregation partner, Yodlee. And unlike Mint, Citi users can open a bank account via the app to do more things, like automatically move money into a goal-based savings account.

Bob Hedges, a partner with management consulting firm A.T. Kearney, says engaging noncustomers with a general app is a good strategy for an industry that needs to move away from peddling products — and to meet people’s financial needs. “It’s the best way to succeed in the marketplace,” Hedges said.

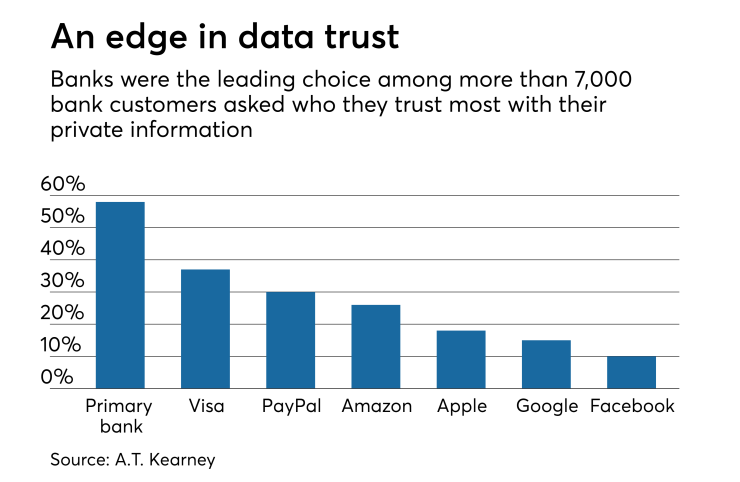

Even as consumers are becoming more sensitive about data sharing, banks remain trusted stewards of consumer data. According to an A.T. Kearney report, 58% of consumers are willing to hand over their data to their primary bank to improve their financial lives.

“The need and the value is there,” Hedges said. “Now is going to be a good time for banks to step forward with tools that help consumers intentionally and securely share their data.”

Only time will tell if Citi finds a big enough market for its app. To the privacy-minded, sharing more data with a big brand sounds like a perfect way to

Citi said it takes privacy and security very seriously. So if users want to stop sharing data with the bank app, they can. “You have to let customers choose what they want, when they want it,” Piazza said.

Ben Gaddis, president of the innovation consultancy T3, has some doubts about the app’s utility, including concerns about whether the bank will support an app regardless of how many sales it generates. “There has to be some sort of business in it for them,” he said. “If it doesn’t drive checking accounts, how long will it be supported? Probably not that long.”

Ron Shevlin, director of research at Cornerstone Advisors, is another naysayer. He says Citi’s effort is doomed. As Shevlin

Regardless of whether the app flames out, it offers a glimpse of a direction the industry many believe it must take — to champion people’s financial well-being at a time when the traditional bank model of holding money is under attack by services that promote savings, reduce debt and move money fast.

“There is a really old model here that worked for a long time,” Gaddis said. “But the way people think about money and finance has changed. … Money will be everywhere.”