As companies around the world enacted continuity plans to keep running during the pandemic while employees were scattered remotely, corporate clients of Citi’s Treasury and Trade Solutions unit ramped up their use of its online banking platform.

That platform, CitiDirect BE, is used by large multinational institutions as well as small and midsize firms to make payments to suppliers, pay bills and taxes, collect money and ensure they have ample cash flow.

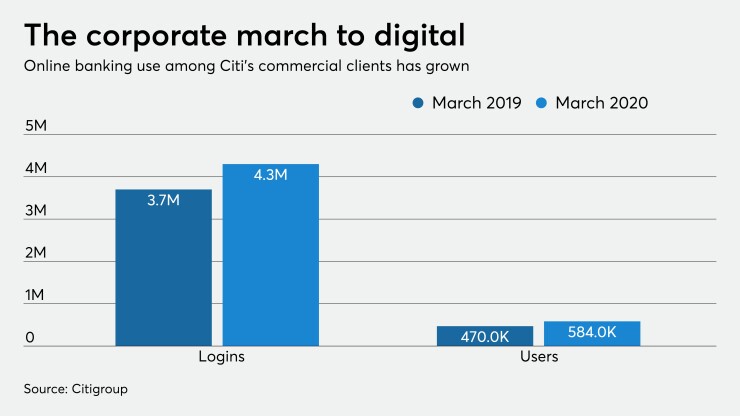

The platform’s online and app users grew from 470,000 in March 2019 to 584,000 in March 2020. The number of logins increased 18% from 3.7 million in March 2019 to 4.3 million in March 2020.

Interactions over mobile devices also have risen, with a tenfold increase in active CitiDirect BE app users, from 300 in March 2019 to 3,400 in March 2020. Users can access CitiDirect on desktops, tablets and smartphones.

Citi’s success at getting large commercial clients to handle their banking through a smartphone is worth a closer look because it’s rare. Very few banks even offer digital account opening for corporate clients. But the bank’s efforts to address security threats and investment in customer service features such as live chat have made the process easier and more convenient for customers during the pandemic and beyond.

As a result, the platform handled a 24% increase in online and app users in March compared with the previous year.

Sheer necessity is one factor that has sped up adoption among Citi’s clients.

Clients’ internal processes sometimes dictated that a letter with a wet signature was critical, rather than logging in to an electronic banking platform.

“Most of the resistance and issues were coming from clients because of internal policies,” said Tapodyuti Bose, global head of digital channels and data for Citi Treasury and Trade Solutions.

But another factor is that clients have been able to fast-track changes to these policies during the pandemic.

They've strongly gravitated toward digital onboarding. Clients opened more than 1,000 accounts online in March, up 300% from a year earlier, and the number was similar in April and May.

Digital onboarding is more complex on the corporate side than the consumer side.

“In retail banking, you take a selfie, scan your driver’s license and open an account,” Bose said. “But the corporate side requires more rigorous know-your-customer checks for compliance, including who owns the company and how much they own.”

But once it’s enabled, digital onboarding is also significantly faster than manual processes. The traditional paper-based method of opening accounts took two months on average, whereas Citi says its digital platform shortens the process to two days.

Digital logins for commercial clients are also more complicated and involve more steps than the user ID and password required in retail banking.

In the past, multifactor authentication required physical tokens to be mailed and used to log in securely. But 18 months before the pandemic began, Citi shifted to soft tokens, such as apps with single-use passwords, facial recognition software or a fingerprint.

This came in handy for clients whose hard-token cards were lying in their abandoned offices once the quarantine started, said Bose.

New account openings have come from a mix of new and existing clients, such as large companies with hundreds of different subsidiaries and legal entities that conduct business with other banks in other parts of the world and need a more digital-friendly solution. Features such as live chat and biometric authentication have also helped drive business to Citi, said Bose.

Citi offers digital onboarding to corporate customers in 42 countries, and expects to expand it to 50 countries by the end of 2020.

Customer service and security

Although digital account opening is par for the course in retail banking, the CitiDirect BE platform is fairly unusual among banks in digitizing the account-opening process for large businesses.

Jacob Jegher, president of Javelin Strategy & Research, says eight of the top 30 U.S. banks offer digital onboarding to small-business customers, but “as you move upmarket to corporate banking, it drops like a stone,” he said.

That’s because corporate banking is very relationship-driven and the security risks increase with larger dollar amounts.

Citi says it addresses security threats proactively. The company uses machine-learning algorithms to spot unusual logins, transactions and system navigations (such as different typing cadences) that deviate from a client’s typical activity.

A new client with no previous connection to Citi, either at a parent or subsidiary level, will first be contacted by a relationship manager before being able to continue the digital account-opening process.

Overall, the spike in activity has not caused any issues for Treasury and Trade Solutions, which already processes $4 trillion in payments daily.

“Our network, platforms and processes are built for volume and scale,” said Bose.