-

Central Federal (CFBK) has restructured a planned capital raise and reached a deal with the Treasury Department that would help it exit the Troubled Asset Relief Program.

June 7 -

Centennial Bank in Denver is adding a new branch in Boulder as part of a broad strategy to establish a presence in some of the state's key banking markets.

February 13 -

Often finding the start-up route clogged, former bank executives looking to restart their careers are finding ready re-entry platforms via small-bank acquisitions.

May 21

For smaller banks, acquisitions and capital-raising are tough endeavors. Combining the two often raises the degree of difficulty.

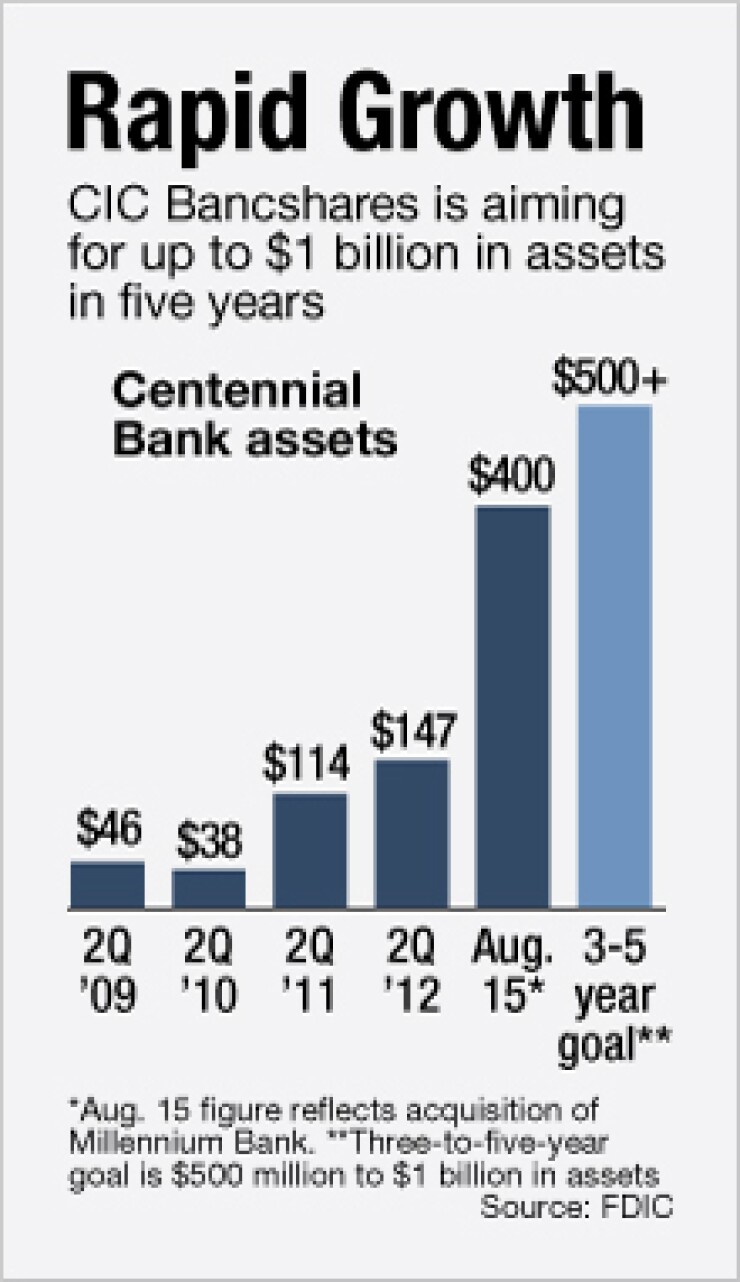

CIC Bancshares in Denver completed its purchase of Millennium Bancorp earlier this week. CIC, which had $140 million in assets, gained a company that was nearly twice its size. Millennium, while well capitalized, was dealing with elevated credit issues.

The all-stock deal,

"We bought Centennial as a platform and thought we would raise capital as needed to do add-on acquisitions but it has been challenging," says Kevin Ahem, CIC's president and chief executive. "There's a lot of uncertainty out there with the economy and bank regulations. There is cash out there, but a lot of hesitation to put it to work."

The deal shows the difficulty of making small but ambitious acquisitions. Industry experts have spent recent years preaching that banks need $1 billion in assets to make their businesses work, but it is difficult to get the capital needed to expand.

James Basey, the CEO of Centennial Bank and a CIC director, says he was shocked by how difficult the raise was compared to the 2010 deal. The initial capital, he says, was raised by selling a plan. This time, CIC had a track record after growing a $25 million-asset bank organically to $140 million in assets. CIC was ahead of schedule; it hadn't planned on buying a bank until 2013 at the earliest.

"We had attracted great people, we had grown the bank and we had accelerated the acquisition strategy," Basey says. "We just thought it would have been easier than when we were selling people on an idea."

Landing capital to grow small banks

"Your typical bank investors are hesitant to jump whole heartedly into small deals," says Adam Fiedor, a vice president at St. Charles Capital, a Denver investment bank that advised Millennium. "They are scared of the macro environment and are cautious because what has happened to their own portfolios."

Fiedor says Ahem worked tirelessly in find capital. CIC needed the equity to buffer against Millennium's nonperforming assets, which totaled 4.14% of total assets at June 30. CIC also needed funds to redeem the $7.5 million Millennium had issued the Treasury Department under the Troubled Asset Relief Program. Fiedor says the Treasury agreed to a "large" discount, which fits into the agency's goal of working with troubled banks to address capital woes.

With the deal completed, CIC will look to grow to $500 million to $1 billion in assets over the next few years. Basey says the next deal will likely involve a stock transaction for a clean bank, so CIC won't have to raise new capital.

"There are a lot of opportunities out there for us for banks with $100 million to $150 million in assets," he says. "Maybe we can pick up a couple. But hopefully we won't have to raise capital on the next one."