A former chairman and CEO of American Metro Bancorp has sued the Chicago company on claims of gender discrimination.

Yman Vien, who was replaced as CEO in August 2013 and fired about a year later, claims in a lawsuit filed in December in U.S. District Court for the Northern District of Illinois that her dismissal was tied to her gender. She also claims that the bank cut her salary before she was fired and has refused to pay her any severance.

The $63.4 million-asset bank said in its response that it removed Vien as CEO because her poor performance as a leader resulted in a 2009 cease-and-desist order from the Federal Deposit Insurance Corp. American Metro also pointed to the FDIC to explain why it didn’t pay severance, stating in a response that the agency would not sign off on the payment because it represents a “golden parachute.”

The lawsuit shows that, even a decade later, the financial crisis and its aftermath continue to dog certain financial institutions.

The minority-owned bank's decision to pull the FDIC into the litigation is a gutsy move, said Lisa Mead, an employment law expert and partner at Taylor Mead Management Consultants and Executive Recruiters in Atlanta.

“This dispute should have never gotten to this point,” Mead said, adding that she thinks the parties will eventually settle out of court. “The last thing a bank wants to do is pull the examiner into court as a defense witness.”

Otherwise, evidence and witnesses will be critical to each case, Mead said, adding that a big takeaway for banks is the importance of documenting every interaction with management and regulators.

Vien, who had been CEO since May 2000, noted in her lawsuit that her replacement as president and CEO, Patrick McShane, had no prior experience as a bank CEO. Vien claims she was removed because Raymond Lee, father of the bank’s majority shareholder, had “a clear preference that women should not be in leadership positions” and convinced the board to replace her.

Kristen Prinz, Vien’s lawyer, declined to comment beyond her client’s lawsuit. Though the FDIC did not immediately respond, the agency rarely discusses matters associated with banks operating under regulatory orders.

Lee, who isn’t named as a defendant, was “shocked and deeply saddened to see the allegations,” Michael Braun, American Metro’s lawyer, said in a statement.

Braun said the complaint is the first time that Vien had made any allegations about Lee. “The bank and Mr. Lee believe that the allegations directed against him will prove as baseless as the allegations made against the bank,” Braun said.

Vien's lawsuit claims McShane was paid more and that her salary was reduced in mid-2014 while she was still the bank’s chairman. It also alleges that Vien was fired in November 2014 after refusing to sign a separation agreement that would have relinquished her claims to severance.

The bank, in its Feb. 3 response, claimed it had “legitimate, non-discriminatory reasons for terminating Vien’s employment,” including her performance. The bank said it continues to operate under the cease-and-desist order and that it lost millions of dollars while Vien was CEO.

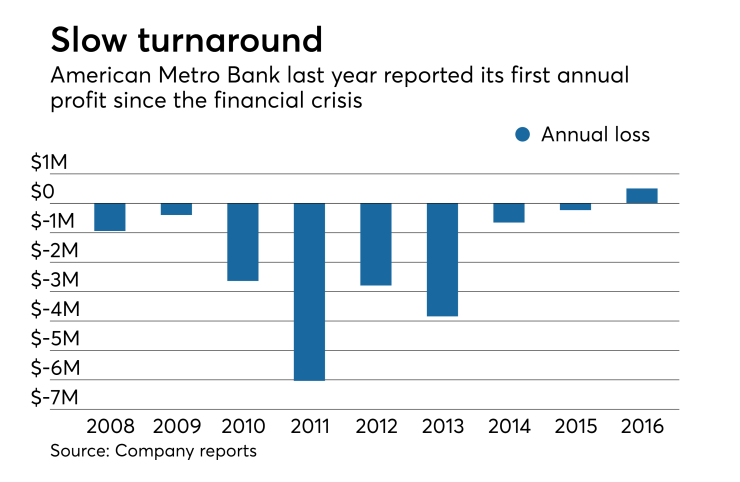

American Metro reported $15.4 million in losses from 2008 to mid-2013, according to its call reports. It lost $2.1 million from mid-2013 to 2015 before reporting a $506,000 profit last year.

The bank said Vien offered to resign in June 2014 but refused to sign the separation agreement, which prompted her termination. It also claimed that the regulatory order bars it from paying severance without the FDIC’s blessing.

“The FDIC has not given such approval,” the response said.

The bank also denied that Lee, who had been serving as an unpaid adviser, has any bias toward female executives.

As for McShane, American Metro noted that he had never been a CEO, though he has 30 years of banking experience and once was chief operating officer of “larger and successful banking operations.” His LinkedIn profile says he was chief operating officer of Lakeside Bank from 2001 to 2003, when it had assets of about $522 million, and a commercial lending executive at an Old Second Bancorp predecessor from 2003 to 2010.

American Metro denied McShane received more compensation than Vien while she was employed, adding that it had planned to lower her compensation, in part because of concerns raised by the FDIC.

Another area of debate is Vien’s performance.

Despite the bank’s losses, Vien noted in her lawsuit that an FDIC-mandated management study by an outside firm touted her “negotiation and loan workout strategy skills,” along with a “depth of banking knowledge.”

Vien claimed that the FDIC and other entities praised her ability to keep the bank from failing during the financial crisis. Vien, who claimed she had tried to raise capital, noted that McShane had recruited “minimal investors” to the bank.

American Metro admitted that the comment from the management study was legitimate, but it warned that Vien had isolated one sentence from a larger report. The bank said it was unaware of the any supportive statements from the FDIC. As for capital, American Metro said it had “determined to limit the investors to the bank.”

The bank’s biggest issue might be Lee’s alleged comments, especially if Vien has witnesses to back up her claims, Mead said. For Vien, the greatest legal hurdle is the amount of time passed between her dismissal and her decision to file the lawsuit.

American Metro, for its part, noted the lengthy gap in its legal response. McShane “was hired more than 360 days before Vien complained that she had been discriminated against, making this action time barred,” the bank said.