A form of

The scheme was portrayed as a glitch rather than

"Let's go to the ATM, let's go to the ATM, let's go to the ATM," one person said to his friend in a TikTok video reacting to the trend.

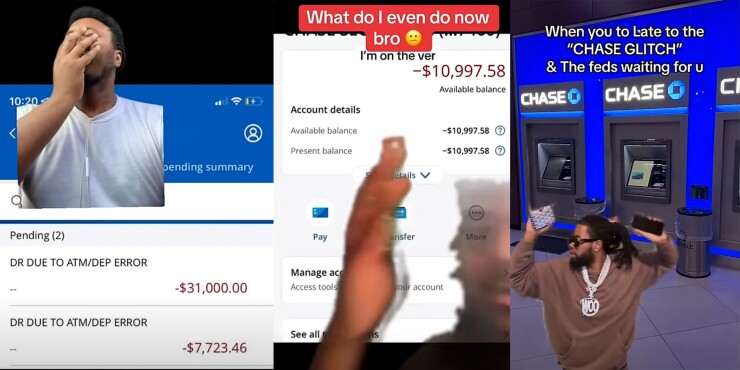

Within hours of the videos going up, some of these customers posted videos reacting to negative balances on their accounts, sometimes for tens of thousands of dollars. While many of the original videos have been taken down by either the posters or the platform,

"They really told me to tap in, next day it was supposed to clear," said one TikTok user who showed a screenshot of his Chase accounts, depicting over $38,000 in negative adjustments. "Look at my account, yo."

A spokesperson for Chase said the bank is "aware of this incident, and it has been addressed." The spokesperson did not elaborate on why some customers were able to withdraw or transfer funds from large checks.

When a customer deposits a check, the first $225 must generally be available to them the day after they make the deposit,

"Regardless of what you see online, depositing a fraudulent check and withdrawing the funds from your account is fraud, plain and simple," the Chase spokesperson said.

The episode served as a teachable moment for some influencers whose content revolves around financial advice. Jim Wang, who is a personal finance blogger and @bestwallethacks on TikTok, told viewers that errors that appear to be in their favor almost never are.

"Just because money appears in your account doesn't mean it's literally yours," he said. "It's known as unjust enrichment."

Others emphasized the long-term damage that the fraud scheme can have on people who attempt it.

"The debt is going to follow you, especially the people with upwards of $10,000 of debt," he said. "There's basically no way you're going to escape this; you're going to have to figure a way to make that money back."