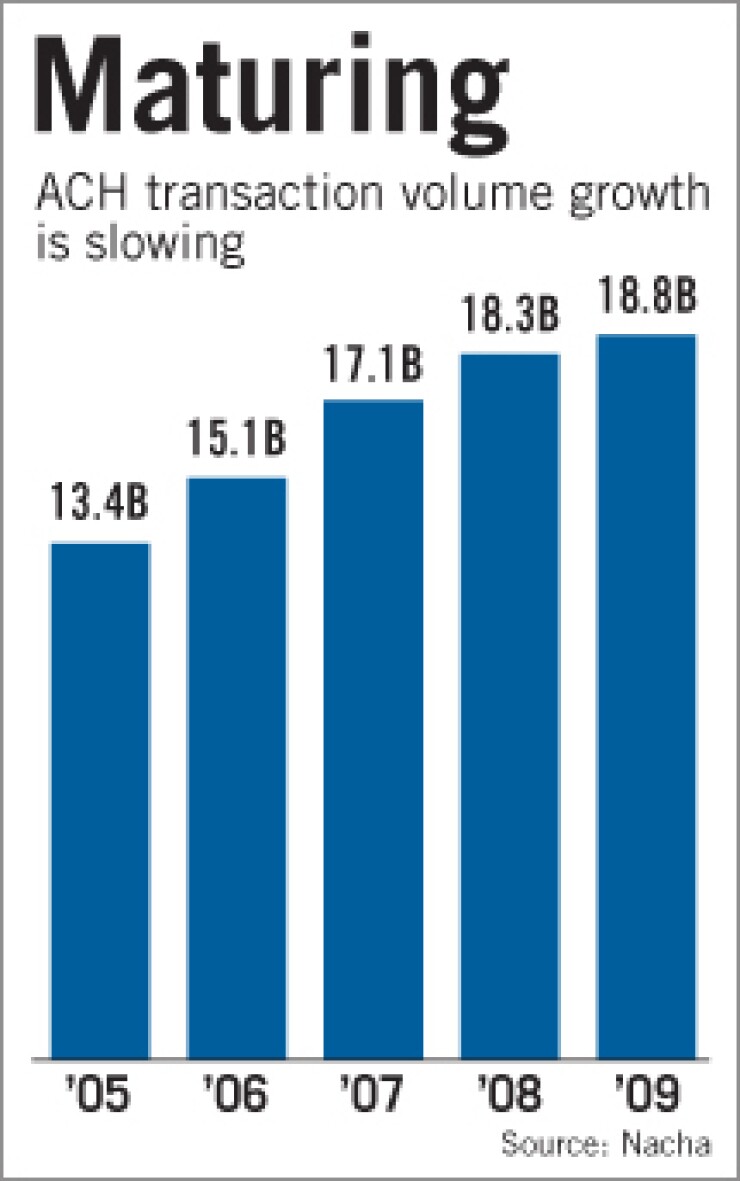

The automated clearing house network is maturing, bringing slower growth rates and probably slowing fee revenue.

Payments executives say businesses are trying to reduce their costs by shifting more payments to the ACH system, but these gains have been offset by a sharp decline in check conversion, long a major driver of transaction volume.

While the total number of ACH payments increased slightly last year, according to data released Wednesday by Nacha, the dollar value sent across the network actually fell.

Observers said this dichotomy is a sign that ACH payments have reached most of the easy targets and are now expanding slowly into the more isolated corners of the payments market.

The falling transaction growth rate will hinder revenue growth for banks that originate ACH payments, observers said.

"We're seeing the kind of peak of all the check conversion activity," said Laura Lee Orcutt, a senior vice president and group product manager in the treasury management group at Wells Fargo & Co. "Check conversion itself is going to trail off because there is less check writing by consumers."

Nacha, the electronic payments association, has "successfully gotten a transition from checks toward ACH," said Nancy Atkinson, a senior analyst who focuses on business-to-business payments for the Boston research firm Aite Group LLC.

But as checks go away, "there's less opportunity for this volume to grow," Atkinson said. "It's a natural progression in that sense. In the past, ACH basically still had a huge check volume out there that they could keep focusing on."

Nacha said that 3.06 billion checks were converted into ACH payments last year, down 5.8% from 2008. The dollar value of check conversions fell 13.3%, to $694 billion.

Total ACH volume rose 2.6%, to 18.76 billion transactions, in 2009. That was considerably slower than the 6.9% growth rate in 2008 and 13.2% in 2007.

The dollar value of ACH transactions fell 1.1% in 2009, to $29.64 trillion.

The dollar value covers only payments sent through the ACH network, not "on-us" payments. Nacha does include on-us payments in its overall transaction volume figures using self-reported data from originating banks, which typically do not report the dollar value of these transactions. (On-us payments are those that are originated and received by the same bank.)

Excluding on-us payments, total ACH transaction volume grew 2% last year, to 15.26 billion.

"The fact the network is still increasing is a very positive trend in the down economy," said Janet Estep, Nacha's president and chief executive.

She said that electronic payments are more cost-effective than writing checks, and businesses and government agencies are making efforts to rein in their treasury management expenses by shifting more transactions to the ACH network.

Business-to-business ACH payments increased 3.5%, to 2.06 billion. The value of these transactions slipped 2.2%, to $19.37 trillion, a sign that companies are sending more low-value payments electronically.

ACH payments sent by the federal government increased 5.2%, to 1.21 billion, and the value increased 7%, to $4.29 trillion.

Estep said that there is still headroom in check conversion, especially the back-office conversion format, which enables businesses to convert checks into ACH payments in their item processing centers. BOC volume increased 104.6% in 2009, to 160.5 million transactions.

Orcutt said that Internet-initiated ACH payments are another growth area as more consumers turn to ACH out of convenience and greater familiarity and trust.

The ACH system has also has improved the way it presents billing information, making it easier for consumers to identify specific payments. "Two months later they can look at their checking account statement and say, 'Oh yes, that $200 was to pay the ABC Company,' " Orcutt said.

In 2008, Nacha put into effect the Company Name Rule requiring originators to clearly identify themselves to make it easier to determine the purpose of each payment.

Consumer Internet ACH transactions grew 8.6%, to 2.4 billion, according to Nacha, making it one of the fastest-growing ACH categories last year. The dollar value rose 3%, to $950 billion.

Wells Fargo was the No. 2 ACH originating bank in 2008; Orcutt said it sent 2.9 billion ACH payments across the network in 2009, up 8.2% from the 2008 figure provided by Nacha. (Nacha has not yet released its 2009 list of top ACH banks.)

Peter Hohenstein, a senior vice president with Bank of America Corp., said that Internet ACH payments will continue to grow as businesses roll out more features that enable customers to enroll in online bill pay.

He also said that continued interest in the B-to-B category, driven by businesses' ability to transmit payments with remittance data, will cushion declines in the check conversion field.

Like consumers, "more and more businesses are saying they too don't want to write the original check," Hohenstein said.

Bank of America sent 1.96 billion ACH payments across the network in 2009, Hohenstein said.

According to Nacha data, Bank of America was the No. 3 originator in 2008, with 1.55 billion ACH transactions.

JPMorgan Chase & Co., the top ACH originator in 2008, did not make an executive available.

Aite Group's Atkinson said the ACH network "still has a lot of capacity" for volume but transaction growth will continue to slow, resulting in flat revenue for ACH payments.

Pariter Solutions LLC, a joint venture that Bank of America and Wells Fargo formed in 2008 to develop a private ACH system that would handle their shared volume as on-us payments, could also throw off Nacha's growth rates, Atkinson said.

The system, if it ever gets off the ground, would eat into the overall payment volume sent across the ACH network, she said.

Bank of America and Wells Fargo have said Pariter could go live at the end of this year, but declined this week to discuss its progress. Observers have speculated that in time the two companies could offer Pariter's services to other banks.

"To the extent they eventually open up the network to other banks, it's possible they can develop a revenue-generating competitor to the" ACH network, Atkinson said.