Consumer Financial Protection Bureau Director Rohit Chopra is laying the groundwork for regulatory oversight of the largest technology companies as the agency crafts rules around consumer choice and control over financial data, observers said.

Chopra made waves just days after being sworn in by publicly demanding that Amazon, Apple, Alphabet’s Google, Facebook, PayPal and Square

The information request was seen as a sign by many that the bureau is gearing up to be tougher on tech giants that expand their financial services offerings, despite complaints by big-tech advocates that the agency is veering outside of its lane.

“A tech company that decides to start engaging in basic financial services like payment processing is right inside of the wheelhouse of the CFPB,” said Chris Peterson, a law professor at the University of Utah's S.J. Quinney College of Law and a former special advisor at the CFPB.

Consumer advocates hailed the fact-finding mission as a necessary use of the CFPB's power and banks welcomed it too as a sign that regulators will level the playing field between the financial and tech sectors. But others suggested that the Chopra was moving too aggressively and should defer to Congress in overseeing big tech.

Chopra’s order builds on his work as a former member of the Federal Trade Commission, where he routinely criticized the business practices of Facebook, Amazon and others.

Still, some viewed the public release of the

“This is a bold and interesting move by the CFPB, essentially announcing itself as a player in the regulation of Big Tech in a way we haven’t seen before,” said Michael Gordon, a partner and co-chair of the fintech practice at Bradley Arant.

The CFPB issued the information request under rarely used authority granted by the Dodd-Frank Act to take significant steps to monitor consumer risk.

The orders demanding the payments-related information from the largest tech companies come as the tech firms are already under massive scrutiny and public pressure in Congress, including the release of the so-called Facebook Papers divulging internal policies of the social media giant that are the subject of investigative stories by The Wall Street Journal and others.

The level of scrutiny means lawmakers from both parties who

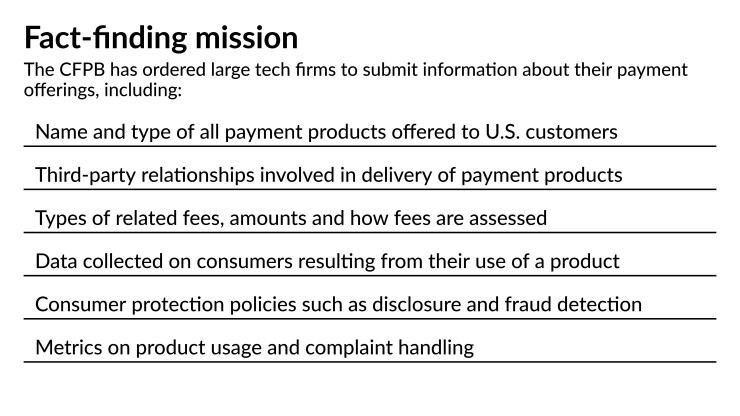

The information request requires the tech firms to submit details on their payments offerings, sale and handling of consumer data, fees, how they respond to consumers' complaints, and more. Chopra is set to testify this week before the House and Senate banking committees.

But the technology industry has been lobbying heavily for Congress alone to take action on data privacy issues.

“While the CFPB has an oversight role to ensure that consumers are protected, Congress also has a role to play,” said Jason Oxman, president and CEO of the Information Technology Industry Council, which represents the technology industry. ”The CFPB's inquiry into tech payment platforms underscores the need for Congress to protect consumers by passing comprehensive federal privacy legislation.”

Meanwhile, Chopra made clear that the order requiring information from the tech companies will help inform the CFPB on one of its most consequential upcoming policies: a rulemaking expected by April 2022 on how financial services providers share consumer data across banking and tech platforms.

“Little is known publicly about how Big Tech companies will exploit their payments platforms,” he wrote.

In July, President Biden issued a broad executive order meant to promote competition across the U.S. economy. That

Banks, tech giants and fintechs are trying to figure out how Chopra will use the information from the order to promote consumer data access. That consumer data rulemaking, required by Dodd-Frank, aims to clarify standards for how fintechs access bank account data.

The data access rule deals with complex issues of data security, disclosures and liability for third parties as well as competition in the financial services industry.

Some observers predict Chopra's general views on consumer choice and competition will factor into the rulemaking process and how he sets policy on monitoring the tech sector's involvement in the financial services sphere. As the CFPB's student loan ombudsman in the Obama administration, he raised concerns about borrowers being unable to pick their own servicer.

At the FTC, Chopra wrote extensively on the issue of market dominance. Some suggest he may be looking at whether there is a fact pattern in which tech giants are similarly taking unreasonable advantage of consumers in using or selling consumer financial data.

“It’s not that the CFPB is going outside it’s core area, it’s that the tech companies are outside their core area,” Peterson said.

The CFPB already has the authority to regulate, supervise and oversee payment processors through the Electronic Funds Transfer Act.

Meanwhile, the Consumer Bankers Association and other financial sector advocates applauded Chopra’s move.

Bankers allege that fintech companies increasingly are offering products and services that traditionally were handled by banks but they are

“All consumers deserve the highest level of protections, regardless of where they go to meet their financial needs,” said Dan Smith, an executive vice president and head of regulatory affairs at the CBA and a former CFPB assistant director of the office of financial institutions and business liaison. “When growing segments of the market are not subject to the same federal oversight requirements as banks, including examination of their day-to-day activities and ensuring a ‘robust compliance management system,’ policymakers have no idea whether those institutions are protecting consumers adequately — or at all.”

Still, the large tech companies are not engaged in lending. Oxman said the share of the financial services market of the six large tech companies is “a fraction of 1% of the overall market,” while the three top banks control 30% of market share.

But Smith noted that fintechs now account for nearly 50% of all unsecured consumer loans, typically ranging from $2,000 to $30,000, and primarily have oversight by state regulators.

He described four different types of fintech firms that are engaging in financial services: installment lenders, data aggregators, fintech deposit companies that partner with banks and payment processors that include the largest tech companies.

Of the large tech providers, he said: “They started out [saying] all they do is process payments and now they’re just trying to morph into large financial institutions, but without the same regulatory oversight that banks have."