The Consumer Financial Protection Bureau plans to launch an inquiry into small-business lending, the first step toward crafting a rule for the collection and reporting of small-business lending data.

The agency said in a

The CFPB also released a 42-page

“Small businesses fuel America’s economic engine, create jobs, and nurture communities. Yet little is known about how well the lending market serves their financing needs,” CFPB Director Richard Cordray said in a press release. “This inquiry will help us learn how we can best fulfill our duty to collect and report information on small business lending.”

The CFPB's inquiry will focus on four main areas: defining what is a small business; determining what institutions and products are offered to them; identifying data collected during the application process; and exploring privacy issues.

The inquiry has been expected since it is a requirement of the Dodd-Frank Act.

Still,

As the enforcer of the Equal Credit Opportunity Act, the CFPB has only partial oversight of small-business lending. That law requires that lenders submit data on credit applications made by small and minority- and women-owned businesses. The data is meant to assess whether lending patterns reflect fair and equitable treatment or possible discriminatory practices.

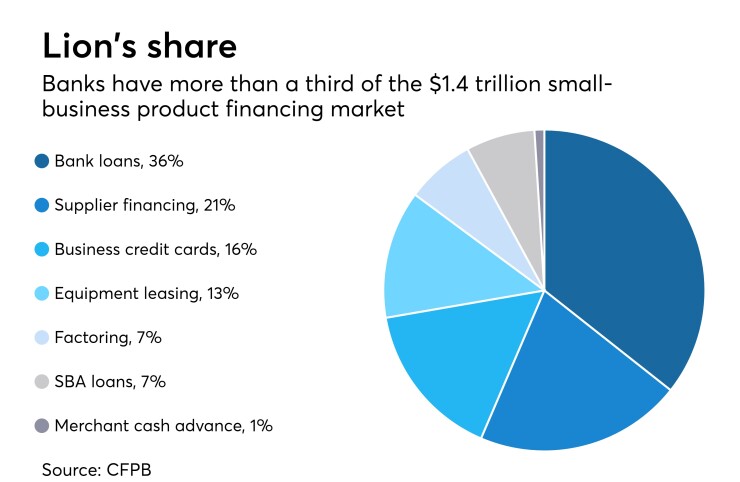

The agency's preliminary research suggests that public data is incomplete on how small businesses engage with lenders. The bureau is seeking input from a wide range of companies including banks, marketplace lenders, brokers, dealers and other third parties.

The white paper describes the need for more robust data, explores gaps in the data caused by the recession, and looks at definitions of women- and minority-owned small businesses.

One statistic that stood out: The 2012 Census Bureau identified 27.6 million small businesses, yet 83% have just one employee — the small-business owner.

"Conversations with a variety of financial institutions suggest there is little consensus on how they classify a business as small," the white paper stated.