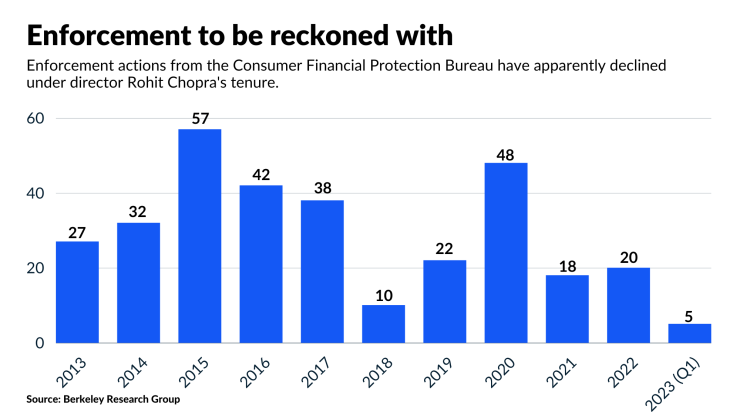

The Consumer Financial Protection Bureau's enforcement actions have plummeted under the leadership of director Rohit Chopra, while employee morale at the agency is lagging compared with the Obama administration.

Chopra appears to be pursuing a far different strategy compared with his Democratic predecessor Richard Cordray, the CFPB's first director. The consumer watchdog has filed just five enforcement actions so far this year compared with 20 last year, which marked the second-lowest number on record; just 10 enforcement actions were brought in 2018 during the Trump administration. By comparison, Cordray filed 27 enforcement actions in 2013, 32 in 2014 and 57 in 2015, a record high.

The drop in enforcement actions is attributable to the lack of major financial crises that the CFPB could leverage into settlements. Remote work during the pandemic may have limited the bureau's oversight as well. Yet the numbers do not compare favorably even to former CFPB Director Kathy Kraninger, a Trump appointee, who took a more collaborative approach to policing financial firms and sought to refocus the bureau on education. Kraninger filed 48 enforcement actions in 2020, more than twice the number that Chopra brought during each of his first two years helming the agency.

"That the CFPB is not even at the level of Kraninger seems eye-opening at first blush," said Ed Groshans, senior policy and research analyst at Compass Point Research & Trading.

Chopra has focused primarily on getting banks and financial institutions to adjust their policies and practices through supervision, making notable progress in getting major banks to slash billions in overdraft fees in the past two years. The additional focus on supervision reflects the reality that investigations and enforcement are time-consuming and increasingly being challenged in court.

"There's a lot of uncertainty around enforcement actions, and they are expensive," said Todd Zywicki, a law professor at George Mason University who headed

Still, lawyers representing banks and financial firms say the bureau is busy ramping up enforcement with more actions expected in the second half of this year.

"No one should think that Director Chopra is lax on enforcement because that's simply not the case," said Lucy Morris, a partner at Hudson Cook and a former deputy enforcement director at the CFPB. "Although there have been fewer [enforcement] announcements, this does not mean that enforcement is asleep at the wheel. In fact, they are extremely active."

Vince Urbancic, managing director at Berkeley Research Group, said the numbers under the Trump administration "might be inflated a little bit," due to multiple enforcement actions filed for the same issue against several companies.

"The Biden administration's actions are still much lower than the Trump era," said Urbancic. "A lot of things are being handled that aren't being publicly disclosed or that don't get to the level of a consent order or enforcement action. I do think there's going to be more [actions] coming in the area of fair lending and fair servicing."

The CFPB opened 25 new enforcement investigations in fiscal year 2022, compared with 64 in fiscal year 2021, said Robert Maddox, a partner at the law firm Bradley Arant Boult Cummings. He said Chopra is using a wide range of tools, from issuing advisory opinions to using the bully pulpit, to encourage financial institutions to adopt pro-consumer policies.

"Chopra is a pragmatist who realizes his directorship is tied to a Democrat in the White House," said Maddox. "If you only have a possible shelf life of four years, then the best way to make change is not through litigation and enforcement."

Last year, an appeals court

Chopra has prioritized enforcement of repeat corporate offenders and has used the CFPB's bully pulpit to try to force banks to eliminate so-called junk fees. While he has focused on fair lending and other efforts to address discrimination, the vast majority of the CFPB's actions during his leadership have been brought against firms for "unfair, deceptive or abusive acts or practices," known as UDAAP violations.

A spokesperson for the CFPB noted that the agency under Chopra continues to reap billions of dollars in relief for consumers.

"Last year, the CFPB initiated 20 public enforcement actions and resolved seven previously-filed lawsuits, recovering nearly $2.5 billion in relief for consumers — more than three times more for consumers than the nearly 50 actions in 2020," the spokesperson said. "In the same year, the CFPB also imposed nearly $2 billion in civil money penalties — a record number — that will be used for victim relief going forward. Requiring meaningful injunctive relief in orders is critical to effective enforcement and preventing illegal practices from causing additional harm to consumers in the future."

Some CFPB employees have become more critical of Chopra's leadership claiming he has surrounded himself with a small group of advisors and takes little input from staff. Though morale at the bureau remains high compared with the Trump administration, it has fallen dramatically compared to the Obama administration, in what appears to be a departure from Cordray's era.

The CFPB's annual employee

Asked in the

In response, the CFPB said that the survey reflected employees' commitment to protecting consumers.

"The CFPB is proud to employ talented and dedicated public servants," the CFPB spokesperson said. "We are pleased that the broader Annual Employee Survey data reflect how committed CFPB staff are to the agency's mission, and how hard staff work for the American people. As always, CFPB leadership intends to continue working to make sure that the CFPB remains a place that can attract and keep top public servants."

Chopra is scheduled to testify on June 13 before the Senate Banking Committee, where he is expected to field questions on the bureau's enforcement actions and other matters. Some experts note that Chopra has taken a more aggressive approach in negotiations with financial institutions, which could also be tamping down settlements.

"Chopra is seeking far more aggressive remedies than in the past and the focus is largely, but not entirely, on larger entities," said Morris. "Seeking larger penalties and structural remedies against large companies can make it harder to settle a case, meaning that more cases land in litigation."