The Consumer Financial Protection Bureau is poised to deliver a big victory for payday lenders, following through on a three-year effort to gut underwriting requirements for high-cost loans.

Yet the CFPB's final payday rule, which was expected as early as this week, has already spurred critics of the agency to prepare legal challenges to the plan even before Director Kathy Kraninger releases it.

Analysts widely expect consumer groups to sue the CFPB claiming it did not follow correct procedures in reversing underwriting standards established by former Director Richard Cordray. Kraninger also faces a likely backlash from House Democratic leaders, who could try to repeal the rule under the Congressional Review Act.

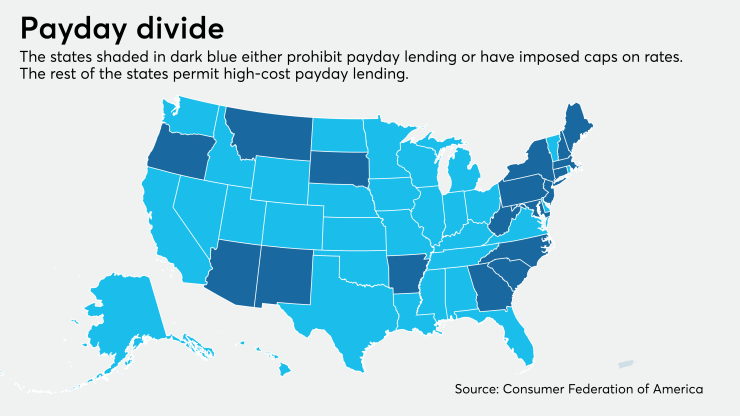

“The effect of the rule is essentially, at the federal level, no regulation of payday lending,” said Alan Kaplinsky, a partner and co-practice leader at Ballard Spahr. “I do think there will be a battle under the Congressional Review Act because there are always a few Republicans in states that don’t allow payday lending and for them it may be politically important to not come out looking like they’re supporting payday lenders.”

Cordray, an Obama appointee, finalized tough standards in 2017 requiring small-dollar lenders to evaluate borrowers' repayment ability. But that rule never went into effect as the Trump administration later appointed acting Director Mick Mulvaney and then Kraninger, who have set a deregulatory agenda for the agency.

Rescinding the underwriting requirements would save the payday industry between $7.3 billion and $7.7 billion a year, consumer advocates and lawmakers have estimated and Kraninger confirmed in congressional testimony last year.

The payday industry has been successful for years at delaying any federal regulations of the industry — largely with the help of Republicans. In 2018, two payday trade groups

Congressional and legal challenges expected

Yet it will likely be supporters of Cordray's 2017 rule exploring every avenue to stop Kraninger's overhaul from going into effect. That could mean a brighter spotlight on the Congressional Review Act.

Early in the Trump administration, GOP leaders — then controlling both chambers of Congress — used the law to repeal Cordray-era rules on arbitration clauses and auto lending. But with Democrats controlling the House, they are likely to mount a similar effort to challenge Kraninger's payday rule.

However, even though such a challenge could mean a showdown in the Senate, where Republicans hold a narrow four-vote majority, President Trump would be sure to veto it. And Democrats are also limited by the law's deadline of 60 legislative days from the issuance of a rule to enact a repeal.

But the bureau is also expected to be sued by a consortium of consumer groups including Public Citizen and the National Consumer Law Center. Some groups took steps to challenge the agency on the issue well before any final rule. Last year, the Lawyers' Committee for Civil Rights Under Law sued the CFPB to force the agency to produce documents on its rationale behind repealing the ability-to-repay underwriting standards.

"I do think there will be a battle under the Congressional Review Act, but I’m anticipating there will be another lawsuit filed challenging the validity of the elimination of the ability to repay," said Kaplinsky.

State attorneys general also could be involved in a lawsuit. Currently,

Consumer advocates are likely to claim that Kraninger’s final payday rule is “arbitrary, capricious, and unsupported by substantial evidence,” and therefore, in violation of the Administrative Procedure Act. That 1946 law gives agencies latitude to write regulations but requires rigorous research and analysis to change existing rules.

Kraninger's CFPB has sided with the industry in arguing that tough underwriting requirements would cut off access to credit, leaving low-income borrowers with nobody to turn to for fast cash.

"The fact is that the 2017 rule prepared under former Director Cordray blatantly ignored the opinions and experiences of real-world small-dollar loan borrowers in order to pursue a predetermined rule designed to deprive millions of Americans their ability to access cost-effective, transparent, and regulated credit," said Jamie Fulmer, a senior vice president at Advance America, a payday and installment lender based in Spartenburg, S.C.

"The original process was dictated by personal biases against our services, politics, and political ambitions, in close collaboration behind closed doors with activist organizations hell-bent on eliminating regulated small-dollar lending," Fulmer said.

But consumer groups insist the agency is sidestepping research conducted under Cordray.

“It is truly shocking that the CFPB is bending over backwards to side with the most scurrilous lenders over the consumers it is supposed to protect," said Lauren Saunders, associate director of the National Consumer Law Center. "The evidence to support the debt trap of payday loans is overwhelming and the CFPB’s flimsy excuses for repealing protections do not stand up."

In a potential lawsuit, consumer groups may claim that the agency actually has not even tried to challenge much of the bureau's previous research.

In the proposal last year rescinding underwriting requirements, the CFPB only disputed or reinterpreted three of the 153 studies that the 2017 rule relied on, said Alex Horowitz, a senior officer at the Pew Charitable Trusts.

“They simply haven’t made the case that the evidence underlying the 2017 rule was flawed,” Horowitz said in an email. “Eliminating consumer protections for payday loans isn’t justified by the evidence the CFPB cited. Their rationale for the rescission is assumed rather than proven. Credit would have been widely available under the 2017 rule, and many of the new small-loan products developed since then comply with the 2017 rule anyway.”

Kaplinsky pointed out that in addition to a potential lawsuit and repeal effort by House Democrats, Kraninger's rule could also be threatened by presidential politics if presumptive Democratic nominee Joe Biden wins in November.

"There will be a challenge, and litigation will begin, and then the election will happen, and it could end up that there's a new director of the CFPB in January who is more liberal, and my guess is that new director could try to do things to stop this rule and go back to the original rule," Kaplinsky said.

Leaked memo

Last May, Thomas Pahl, the CFPB’s policy associate director for research, markets and regulations, told a House subcommittee that the research under Cordray did not justify such an aggressive rule.

“We have decided to reconsider the rule, in part, because the research that was done — [there was] nothing wrong with it in and of itself — is not a very strong basis for addressing all vehicle title lenders nationwide and all payday lenders nationwide and for that reason we have questions about it, and that’s why we put it out for public comment to see if there are other sources of information on this point before the bureau makes a final determination,” Pahl said.

But a 14-page memo written by a former CFPB economist, Jonathan Lanning, claims that Mulvaney pressured the bureau’s research staff to water down its findings and downplay the harm to consumers if the tough underwriting requirements in the 2017 rule were dropped, according to

The CFPB did not return a request seeking comment.

But Fulmer said the leaked report suggests that CFPB officials disregarded the opinions and assessments of "some staff." He claims that Cordray failed to conduct a rigorous cost-benefit analysis in the 2017 rule, but consumer groups counter that neither has Kraninger conducted such an analysis for the rewrite of the rule.

Mulvaney

Effects of coronavirus pandemic

In addition to the final rule rolling back the underwriting standards, the CFPB is also expected to issue a separate proposal to reconsider payment restrictions in the 2017 rule that limited how often a lender can debit a borrower’s bank account.

The 2017 rule limited lenders to two consecutive debit attempts. The industry has pushed to extend it to three attempts.

Payday lenders have claimed that the 2017 rule would have eliminated 55% of revenue for small-dollar lenders that offer loans of 45 days or less. But since the 2017 rule was first proposed, lenders have been changing their products to longer-term installment loans.

The coronavirus pandemic has already forced many lenders to shut retail storefronts and move businesses online. Moreover, to get a payday loan, a borrower must be employed and have a bank account. With so many low- and moderate-income consumers laid off and collecting unemployment, it is unclear yet what the impact has been on the industry.

"Estimates suggested revenue losses could be even more substantial, leading to significant reduction in the number of lenders," said Fulmer. "This all adds up to regulations designed not to preserve consumers’ access to regulated credit but to effectively ban it and eviscerate a [state] regulated industry."

But Cordray said the coronavirus pandemic should lead to stronger consumer protections, not the reverse.

"Opening up consumers to high-cost payday loans with no restrictions is adding insult to injury during this crisis," Cordray said in an interview.