Banks and other credit card issuers may start scaling back supplemental benefits they offer customers, a J.D. Power official predicted Thursday. His comments came after the company published survey data that showed persistent confusion among cardholders about perks beyond their core rewards.

Card issuers have piled on richer core rewards, like free miles or points, in a fight for market share as consumer spending soared in recent years. But a complicated array of supplemental benefits that some issuers also added to gain an edge — like airline passes for travel companions, travel insurance or free late checkouts — may have backfired. They are often difficult to understand or may not work when a cardholder tries to use them.

Those customers who reported completely understanding their supplemental benefits in the survey cited having "significantly fewer" offered to them.

"The pendulum may swing back as issuers try to work through this," said John Cabell, director of wealth and lending intelligence at J.D. Power.

The company said cardholders had on average 16 different benefits available to sort through, but only one-third of those surveyed said they “completely understand” them.

Some of the add-ons revolving around travel benefits were among the most difficult to understand, the survey found.

To be sure, issuers saw their score on “benefits and services,” which is tied to supplemental rewards, increase slightly to 758 in the 2019 survey from 753 last year. But J.D. Power said this was hardly enough of a jump to argue that the problem is not a drag. The category was tied with “credit card terms” for the lowest score among the 10 the company tracks.

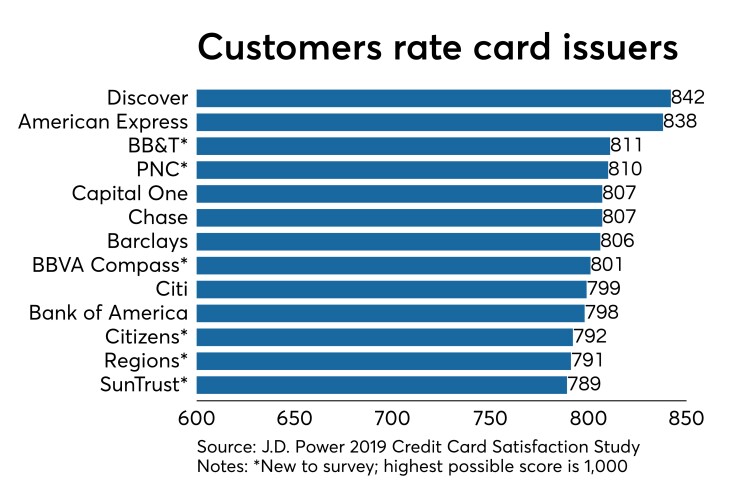

The average customer satisfaction score was 806, only slightly above 801 in 2018.

Efforts at innovation, especially by upstarts, will be watched closely. Apple Card is an example of a rewards system that may be more straightforward and easier to use.

J.D. Power conducted a “pulse survey” earlier this year that showed a high level of awareness of the offer and estimated that one-third of those surveyed would apply even though it lags behind competitors in overall rewards. Cabell said the company will begin surveying customers about the Apple Card for a broader credit card study next year.

Meanwhile, existing card issuers have “room for improvement” in brand image, J.D. Power said. Fewer than half of the survey’s respondents said they “strongly agree” that their credit card issuer acts in their best interest.

For the first time in the 12 years since the company has been conducting its annual credit card study, it included grades for regional banks. Cabell said more of its clients asked to see how firms of this size were faring among cardholders.

Six of the 13 highest-ranked companies were regionals. Those six included BB&T in Winston-Salem, N.C., and SunTrust Banks in Atlanta, which are waiting for final regulatory approval of their merger agreement to create a nearly $450 billion-asset bank called Truist Financial.

BB&T’s rating of 811 on a 1,000-point scale came in ahead of the $373.6 billion-asset Capital One in McLean, Va., and the $2.7 trillion-asset JPMorgan Chase.

“We see regional banks can perform quite well in customer satisfaction and advocacy because they aren’t as tainted with some of the issues that the big banks had over the last decade,” Cabell said.