-

U.S. Bancorp and Comerica produced strong loan growth in the first quarter, but sustaining it partly will depend on converting commercial loan commitments into loans — something, they say, that is easier said than done.

April 17 -

Capital One Financial Corp. gave Mike Slocum and Jon Witter their official move-up orders this month. Slocum was named president of commercial banking. Witter was named president of retail and small business banking.

September 15

Forget credit cards or mortgages. Mike Slocum wants to offer you a loan against your new jail cell door.

As head of Capital One's (COF) commercial banking unit, Slocum is in charge of a wide array of lending operations - including financing the bank offers local governments collateralized against specific municipal equipment, such as garbage trucks, ambulances and, yes, prison doors.

Such equipment-based lending to municipalities is merely one sliver of Capital One's specialty finance and commercial banking operations, which also specialize in commercial real estate, health-care finance, and energy banking. It is a business that can offer banks big returns - as long as they have the staff and experience to devote to such niches.

From the perspective of Capital One's corporate clients, "it's obviously much more comfortable and value-added to deal with people who have an intricate knowledge of your business and what your needs are for capital and borrowing," Slocum told American Banker in an interview last month.

"It doesn't really matter whether you're manufacturing a widget or a basketball, you need someone who knows that industry better" than any other bankers, he added.

Commercial loans rose 15% in the first quarter, to $34.9 billion, compared with a year earlier, the McLean, Va., company reported last month. Commercial banking revenues for the quarter also grew 15% from a year earlier, to $516 million, and Slocum says that Capital One expects the segment to provide some 20% of its net income generally.

"We provide probably less volatility" than other Capital One businesses, Slocum says.

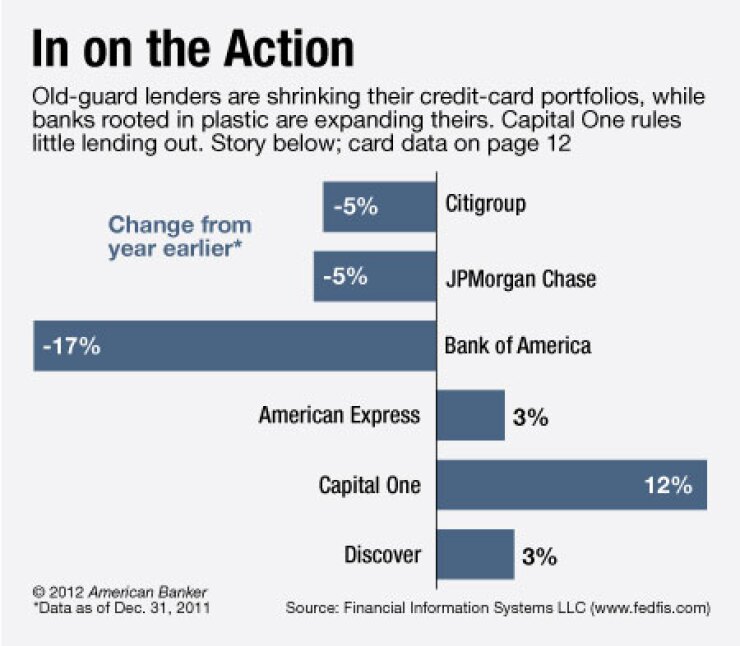

"Commercial tends to make our company look a little more bank-like and a little less credit [card]-focused. We have been transforming the company from a credit card lender into a more full-service commercial bank."

Capital One is hardly alone in flexing its commercial lending muscles while consumer lending growth remains sluggish. National and regional competitors from JPMorgan Chase (JPM) and Wells Fargo (WFC) to PNC (PNC) and Comerica (CMA) reported growth in commercial lending in the most recent round of quarterly reports.

But the business stands out especially at Capital One, long known for its credit card lending, which has just reinforced that consumer-centric reputation by

"We continue to be perceived by the general public as the credit card guys, and we've worked hard to build a more balanced business across a number of segments," Slocum says, adding somewhat ruefully, "I meet with a lot of people and talk about the different businesses we're in . and they look at me, like, 'What?'"

Slocum, 55,

"We see less competition in some of these specialty segments because some of the historical competitors have backed away," Slocum says.

He adds that while some domestic banks "are redoubling their efforts" in commercial lending, some "are continuing to lick their wounds from the last few years. . We see more competition in the more general industry middle market space, and there seems to be more increased competition for more generic real estate loans. In the specialty space, we've seen not that much increased competition."

Some of Capital One's previous acquisitions have helped it gain a toehold in the specialty finance market. For example, it gained a robust energy banking business with its 2005 acquisition of Hibernia Corp. of New Orleans. Now Capital One has a Houston unit that

"We have petroleum engineers on staff, we have an investment banking group that focuses on writing research .We've been able to marry together the capabilities that Southcoast has, with the lending that our bankers have," he said, referring to the investment bank and analyst research unit that Capital One acquired along with Hibernia.

"We've been able to grow not only the lending book but also fee income from the business," he adds.