Though State Street Corp. is the natural bidder as Barclays PLC looks to sell its exchange-traded fund business, most observers say the trust bank cannot afford it.

"The obvious candidate is State Street. They have a lot of issues to sort out, but still they are an obvious bidder," said Burton Greenwald, an analyst at BJ Greenwald Associates in Philadelphia.

Gerard Cassidy, an analyst at Royal Bank of Canada's RBC Capital Markets Corp., agreed that State Street is the "ideal acquirer" but said any deal by the Boston financial services company would be difficult "because they are low in capital due to problems in their investment portfolio."

Barclays confirmed Monday that its iShares business is up for sale, and analysts figured that it could fetch $4 billion to $7 billion. The London company is trying to raise money through asset sales in order to avoid selling a stake to the British government.

Rus Prince, an analyst at Prince & Associates in Shelton, Conn., said the deal presages a trend. "It is going to be an interesting year for banks with big capital issues," he said. "Clearly, the solution is to sell businesses, and that includes businesses that are strong performers.

"We are going to see a major dismantling of global financial players."

Cassidy said selling in a crisis hands leverage to the buyer.

"If this business was put up for sale in 2007, it would've been a seller's market, and Barclays would be watching a bidding war drive up the price," he said. "But now, whoever buys this will get a great price versus what they would've paid in 2006 or 2007."

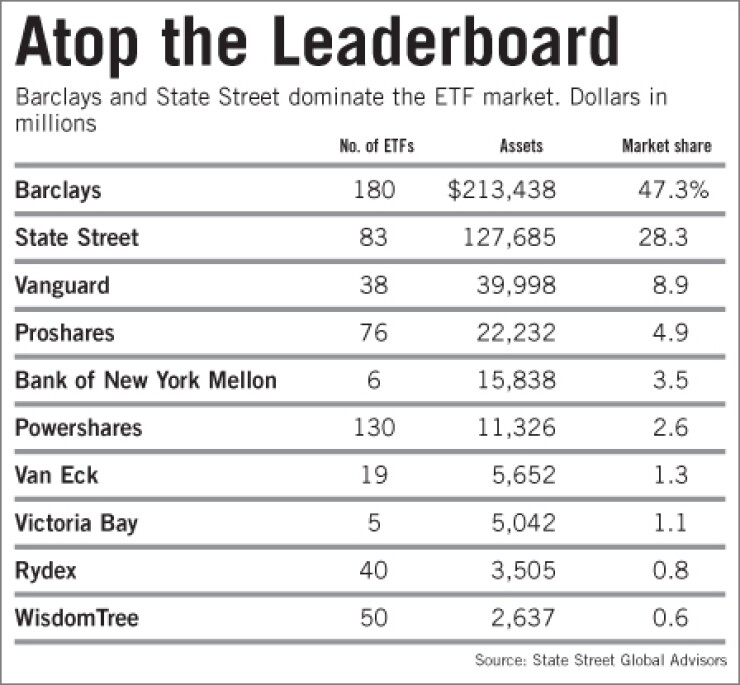

Barclays is the dominant player in the U.S. exchange-traded fund market, with $213.4 billion of assets under management at Feb. 2 — a 47.3% market share. State Street ranked second, with $127.69 billion and a 28.3% share.

The two other big trust banks — Bank of New York Mellon Corp. and Northern Trust Corp. — face similar hurdles, including the fact that they accepted money from the government's Troubled Asset Relief Program and use of these funds is being scrutinized.

Bank of New York Mellon does a lot of work as a custodian for other ETF providers and is always competing with State Street, but Geoffrey Bobroff, an analyst at Bobroff Consulting in East Greenwich, R.I., said: "Like State Street they received Tarp funding So they both will be hard-pressed to make an acquisition until they have paid back the Tarp."

Northern may be an even less likely bidder. It closed its family of exchange-traded funds last month. Spokesmen for State Street, Bank of New York Mellon and Northern declined to comment.

Barclays' iShares exchange-traded funds dominate a corner of the investment industry that continues to draw assets. The Investment Company Institute reported investors poured $177 billion into exchange-traded funds last year while withdrawing about $225 billion from conventional funds.

So if the big U.S. trust banks are out, who would be likely to bid? Private-equity firms, foreign banks, or fund companies, analysts say. "This is the perfect opportunity for private-equity money," Prince said. "Two years ago if something like this popped up, the leading contenders would be the fee-based banks, but today they just don't have the necessary capital to make this kind of deal."

Greenwald speculated that executives at iShares may be trying to put together funding to buy a majority stake in the business, and Bobroff said he thinks a major fund company like Fidelity Investments, Vanguard or Schwab could be interested. "Fidelity has a toe in the ETF water already," he said. "They could decide to get into this in a big way."

Vanguard, which is the third-largest player in the ETF industry, has $40 billion of ETF assets under management and an 8.9% share; Fidelity has one fund, with $65 million of assets. Analysts said Vanguard typically expands its ETF business organically but Fidelity is a logical possibility.

Alexi Maravel, a spokesman for Fidelity, said he would not comment on rumors about Barclays specifically, but that, "speaking in general, we are always evaluating our product line and we'd add to our capabilities as shareholder needs dictate."