Want unlimited access to top ideas and insights?

WASHINGTON — It took less than 24 hours after President Trump signed an order directing an expedited review of the Dakota Access Pipeline for Daily Action, a liberal activist group, to decide where its best hope of leverage was — calling on followers to divest themselves of the U.S. commercial banks involved in financing the project.

The group, an affiliate of the political action committee Creative Majority, sent a directive Jan. 25 to more than 100,000 subscribers asking them to terminate banking relationships with Wells Fargo, Citigroup and others involved in the pipeline.

“If you bank at Wells Fargo or Citi or SunTrust, it’s time to call and tell them that if they don’t reconsider their investment in DAPL as it currently stands, you’ll be moving your money elsewhere — and be prepared to actually do it,” the group said.

Shailene Woodley, an actress and environmental advocate, summarized the approach during a Feb. 13 appearance on "The Late Show with Stephen Colbert" in which she called on viewers to make their voices heard — not only with protests and at the voting booth, but with their money.

“The front lines can be wherever you are," Woodley said. "Protests are about creating awareness and about people coming together, and one of the biggest ways we’re going to defeat this pipeline ... is to divest from these big banks that are invested in the pipeline.”

The tactic is not confined to individuals, either. On Feb. 7 the Seattle City Council unanimously approved

The city council for Davis, Calif., followed suit later the same day, voting to divest its $124 million depository relationship with Wells Fargo by the end of the year.

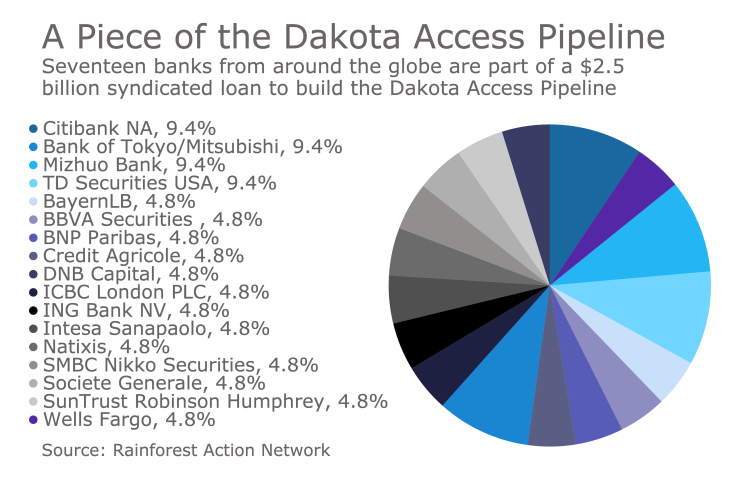

Ruth Breech, senior campaigner with Rainforest Action Network’s climate and energy team — one of the groups pressuring banks for their involvement in a $2.5 billion syndicated loan to Energy Transfer Partners, the company building the pipeline — said the move for individuals to divest themselves from banks whose activities they disagree with is gaining traction. That's in large part because many of those customers have already been disenchanted with their banks in the wake of the financial crisis and the more recent cross-selling scandal at Wells Fargo. Many simply don’t want to have banking relationships with institutions that are furthering projects they find abhorrent, Breech said.

“I think that’s what’s becoming really clear to the American public, is that these banks are complicit — when you put your money in these institutions, they’re taking that money and putting it into things like the Dakota Access Pipeline,” Breech said. “I think we’re about to see this really unprecedented strength and power from the grass roots.”

Their actions are a potent reminder of how the world has changed since the financial crisis. In an earlier era, banks might be targeted by consumer groups that wanted more lending to low-income and minority neighborhoods, for example. But in recent years financial institutions have found themselves unexpectedly having to take sides on bigger societal debates from which they would traditionally abstain.

President Trump's recent executive order on immigration is another case where large banks were suddenly faced with potential protests depending on their views, much to bankers' dismay. But the Dakota Access Pipeline may arguably be bigger, since the protests have caught the attention of everyone from movie stars to the pope, who this week appeared to side with the Native American activists. Ultimately, the banks involved may even face reputational damage depending on the outcome of the protests — especially if they turn violent.

At the very least, it raises this daunting question for institutions: Can a call for bank divestment change how banks approach lending — and what does it mean for banking if they can?

The pipeline

The Dakota Access Pipeline was first proposed in 2014 and is designed to stretch some 1,200 miles, from the oil fields of western North Dakota to an oil storage hub in Patoka, Ill.

The completed pipeline would have capacity to carry 470,000 to 510,000 barrels of oil a day, oil that to date has largely reached market by more costly — and arguably

Unlike the similarly controversial Keystone XL pipeline, which stretched from Alberta, Canada to the Gulf of Mexico, the Dakota Access Pipeline does not cross international borders, so it simply requires an easement from the U.S. Army Corps of Engineers. The Corps indicated that it intended to approve that easement Feb. 7, clearing the way for construction.

The project was opposed by many of the landowners whose property the pipeline and its permanent 50-foot easement would pass through — most notably a number of Native American tribes, several of which have said that there is no need for the pipelines and that they fear real and potential impacts it poses to their water resources, livelihoods and cultural heritage. Those conflicts erupted late last year into massive protests in North Dakota and sporadic violence between the demonstrators and law enforcement.

On Aug. 2, 17 banks signed a syndicated loan organized by Citigroup to provide Energy Transfer Partners with roughly $2.5 billion to complete the project. In response to the growing backlash against the pipeline, Citigroup issued

Citi also said it was enlisting the services of Foley Hoag LLC, an independent human rights consulting firm, to examine the permitting process for the pipeline and determine whether the native tribes were adequately consulted in its construction.

The

Other banks have gone further. The Dutch bank ING said

E.J. Bernacki, vice president of corporate responsibility communications at Wells Fargo, said the bank is reviewing and enhancing its due diligence procedures for loans that are subject to the Wells’ environmental and social risk management policy to include “more focused research into whether or not indigenous communities are impacted or have been consulted.”

“In this case, we did become aware of these issues after we were involved in the credit facility but before the campaign to get the banks [involved] began in earnest,” Bernacki said. “We have met with … our customer at Energy Transfer Partners and the members of Standing Rock Sioux to hear their concerns. We take these things very seriously, and we encourage all parties to work toward a more positive and peaceful outcome.”

Jason Disterhoft, climate and energy senior campaigner for the Rainforest Action Network, said that the post facto efforts by the banks are welcome and that activists are interested in what recommendations surface from the third-party report. But he said that he is skeptical of claims that the banks were not already aware of the resistance before arranging the loan and that he believes they should have applied more scrutiny to the ethics of the deal.

“By August 2016, it was evident there were problems with the project, and banks … have to acknowledge that and they have to own that,” Disterhoft said.

Can a divestment campaign work?

Aside from questions of timing, the broader question is whether a campaign like this might actually change the way those institutions do business. And if so, what factors make such campaigns effective, and what might the secondary effects be?

Arthur Wilmarth, a law professor at George Washington University, said those types of economic pressures certainly can achieve their desired goals. Divestment campaigns were waged in the 1970s and 1980s against companies that conducted business in South Africa during apartheid, and more recently pressures have been applied to chemical companies that manufacture drugs used to carry out capital punishment. Campaigns to pressure companies and universities divest themselves of fossil-fuel-related assets, however, have had “mixed success,” he said.

“Where you would expect to see these kinds of campaigns succeed is where there is a broad ... coalition against what is at issue, whether it’s the death-penalty drug or apartheid, and where the companies being targeted don’t have to go out of business to comply with the threatened boycott,” Wilmarth said. “For banks that are big in the energy business, I can see where they might think, Where is this going to stop?”

Almost all the bankers contacted for this article declined to speak about the issue on the record because the Dakota Access Pipeline has become too politically sensitive. But several said it makes sense to be as open as possible to different kinds of business loans, within legal, ethical and regulatory boundaries. Part of that is in fairness to the businesses themselves, and also because it’s hard to accommodate all complaints.

“It’s a tough position," said an industry source, who spoke on condition of anonymity. "In this climate, there are a lot of passionate opinions on all sides, and it is something to be sensitive to, but if you give in to a pressure on one particular client or walk away from them, what signal does that send to your other clients in the energy space? And where does it go from there?”

A second industry source said that the efficacy of bank divestment from the banks’ perspective depends on the issue at hand. It’s harder to pressure banks on loans that have already been made, this source said, simply because the banks themselves have less leverage. If a project is still in early phases, customer divestment might gain more attention, but even then it’s more likely to be part of broader doubts about a project and its viability.

In any case, individual customer accounts in themselves simply don’t move the needle the way a large investor institution, such as the city of Seattle, might.

“It's unclear as to whether there’s a direct cause-effect in terms of the business impacts. I view it as more of an ecosystem of impacts," the second industry source said. "If you are looking for where the pressure could be greatest on banks, I would look to investors.”

This source added that one wrinkle lost in this debate is the number and kinds of projects that never even get considered for financing because of the internal controls that banks have put in place as well as the implicit external pressures from regulators and the public. That shift is relatively recent and is noticeable, the second source said.

“Because of the shift in how banks look at environmental and social risk and address it as part of due diligence, people don’t even bring projects to us that won’t fit our policies," the second source said. "There’s a shift in what is even deemed bankable — banks don’t want to compete on who’s a good bank and who’s a bad bank. We want a level playing field.”

Is there a different tack activists could take?

One issue is whether it might be more productive for activists to apply pressure on the bank regulators rather than the banks themselves, pushing for more stringent standards for consultations with indigenous peoples or incorporating the effects of climate change into loan prospectuses.

Having a single standard to which all banks must adhere would reduce the variability between banks on the one hand and would bake these types of social considerations into the banks’ loan review process on the other.

Karen Shaw Petrou, managing partner at Federal Financial Analytics, said that approach has been attempted at the international level but had middling success, not least because social and environmental benefits can frequently conflict. Biomedical research, for example, can cure disease and save lives, but neither banks nor any other financial institution is required to fund those types of projects.

“There’s no mandate for any financial institutions to do that. Is that any more or less important than climate change?” Petrou said. “These are really tricky questions when you start saying to private institutions, ‘You must act for the public good,’ but my good is different than yours.”

Divestment is here to stay

Whatever the impacts, one thing is virtually certain: The divestment movement is unlikely to go away, and may intensify. The first banking source said the lingering resentment against banks leftover from the financial crisis will likely make them a target for divestment regardless of whether it works, and that sentiment isn’t likely to change anytime soon.

“Rightly or wrongly, the financial crisis I think empowered the divestment tactic," the first source said. "It feels like there’s a lot of that residual anger in this debate.”

Breech at the Rainforest Action Network said that if banks want to avoid that outcome, all they would have to do is think more holistically about the types of businesses they want to be in. Banks have increasingly

“We can deal with this project by project and play this game for years,” Breech said. “Or they can start to think bigger and start to look at what the systematic issues are and start to address it on that level.”

If that pressure endures, another question is whether banks will be compelled to take stances on social issues in a way that has been the norm in other industries for some time.

But unlike in fast food, clothing or retail, however, the implications of a politicized financial system could be vast, even if banks themselves would prefer not to be forced to take sides, said Wilmarth, the Georgetown law professor.

“There’s a feeling that banks can play either side of the street as they have found most advantageous, but maybe that’s going to be less true — that political activists will force them to take sides on these issues,” Wilmarth said. “Then you get blue finance and red finance. Maybe it’s the opening gun in a war that we haven’t seen yet.”