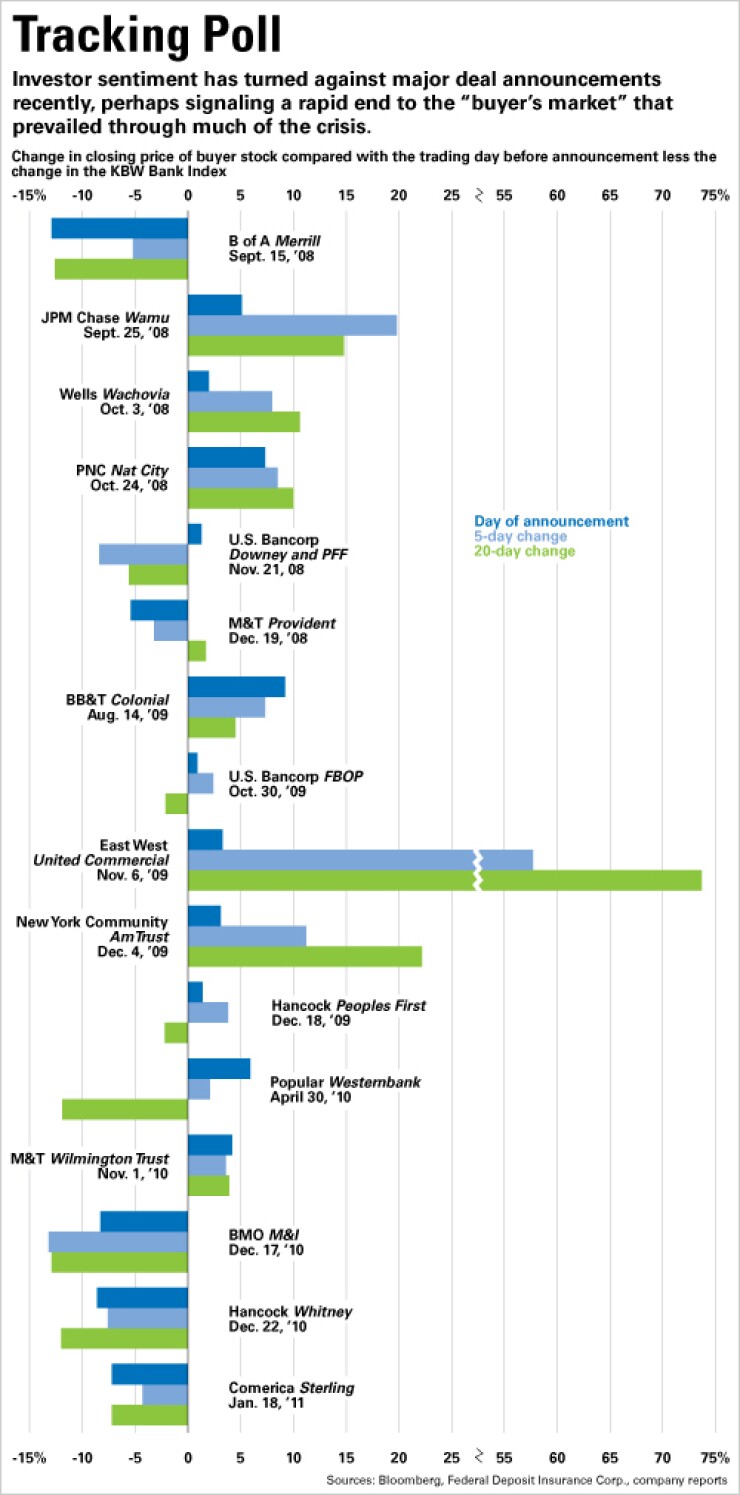

Trading in acquirers' stock shortly after deal announcements forms a kind of tracking poll of investor sentiment on merger valuations.

Through much of the crisis and its aftermath, buyer shares jumped on news of acquisitions (see chart, at right or below), reflecting fire-sale prices as a chain of wounded institutions encountered tepid interest at auction. As recently as November, Richard Davis, U.S. Bancorp's chief executive, said, "It's a buyer's market

But in three of the largest deals recently, investors have hammered buyer shares, perhaps indicating a rapid shift in favor of sellers at the bargaining table.

To be sure, mergers alone do not drive trading, and relatively small acquisitions are less likely to cause significant moves in stock prices. (The fair value of assets acquired in each of the U.S. Bancorp deals shown here represented about 7% of its total assets at the time.)

Still, the shares of JPMorgan Chase & Co., Wells Fargo & Co. and PNC Financial Services Group Inc. significantly outperformed the KBW Bank Index after the major deals they struck during the height of the financial crisis in late 2008. (For charts further detailing investor reaction to each deal,

Reaction to East West Bancorp Inc.'s deal with the Federal Deposit Insurance Corp.

In December of last year, however, markets jeered Bank of Montreal's

In a note in February, analysts with KBW Inc.'s Keefe, Bruyette & Woods Inc. wrote that "the economics have recently been shifting from the buyers to the sellers" more quickly than they had expected, with an improving economy and buyers' "need to deploy excess capital" acting to support valuations.

They concluded that stock trading could be "signaling that the buyers are being overly generous … this early in the cycle."

[IMGCAP(1)]