Broadway Financial in Los Angeles has agreed to buy CFBanc Corp. in Washington.

The $491 million-asset Broadway will pay $38.1 million in stock to buy CFBanc, the parent of the $377 million-asset City First Bank of D.C., based on CFBanc's shares outstanding and Broadway's closing stock price on Aug. 24. The merger is expected to close in the first quarter.

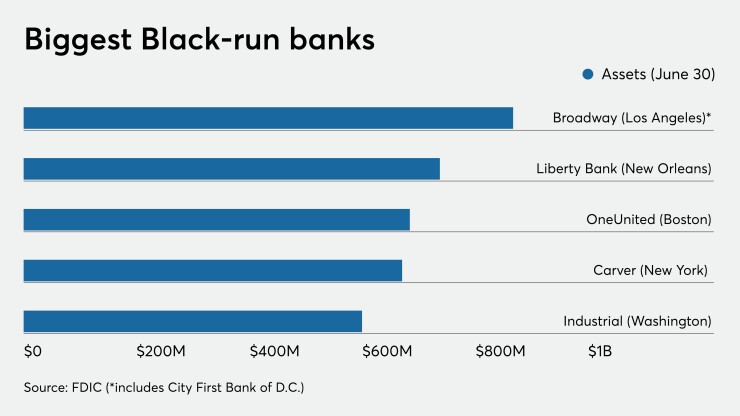

Broadway will retain its name and its shareholders will own 52.5% of the company. It will become the nation's biggest Black-run bank when the deal closes.

Broadway will maintain its status as a community development financial institution, requiring it to make at least 60% of its loans in low- and moderate-income communities. The companies said in a press release Wednesday that the merger will increase their lending capacity and create “a national platform for impact investors.”

“Given the compounding factors of a global pandemic, unprecedented unemployment and social unrest resulting from centuries of inequities, the work of CDFIs has never been more urgent and necessary,” Brian Argrett, City First’s president and CEO, said in the release.

“As part of this historic merger, we are demonstrating that thriving urban neighborhoods are viable markets that require a dedicated focus, long-term commitment and critical access to capital,” added Argrett, who will serve as vice chairman and CEO of the new company.

“The new combined institution will strengthen our position and will help drive both sustainable economic growth and societal returns,” said Wayne-Kent Bradshaw, Broadway’s president and CEO. “We envision building stronger profitability and creating a multiplier effect of capital availability for our customers and for the communities we serve.”

The company’s board will have five directors from City First and four from Broadway.

Bradshaw will serve as the company’s chairman, while Marie Johns, City First’s chairman, will become lead independent director.

The company will have headquarters operations in Los Angeles and Washington.

The deal comes two months after Broadway

Capital Corps, which obtained a nearly 10% stake from the Treasury Department in May 2019 as part of the unwinding of the Troubled Asset Relief Program, mounted a proxy challenge after

After facing stiff resistance from Broadway’s management and board, Capital Corps liquidated its holdings in late June at nearly double what it paid the Treasury. The sales coincided with the Buying Black movement, which encouraged community activists to buy shares in Black-run banks.

Raymond James & Associates and Covington & Burling advised City First. Keefe, Bruyette & Woods and Arnold & Porter Kaye Scholer advised Broadway.