Two North Carolina banks are getting creative with efforts to reach more millennial customers.

NewDominion Bank in Charlotte is nearly two years into an effort to reinvent its look, values, marketing and business model. The $335 million-asset institution’s tagline — Banking Handcrafted — emphasizes local roots and its status as the last community bank based in Charlotte.

M&F Bank, roughly 150 miles northeast in Durham, recently formed a millennial advisory board to help improve its technology and marketing efforts. The $268 million-asset black-owned bank will soon debut a checking account designed for younger customers.

Both banks are hosting creative events to build awareness.

NewDominion and M&F are among a growing number of community banks investing more money and manpower to appeal to millennials. Bigger banks have gained traction by boosting their digital banking capabilities, forcing many smaller institutions to play catch-up.

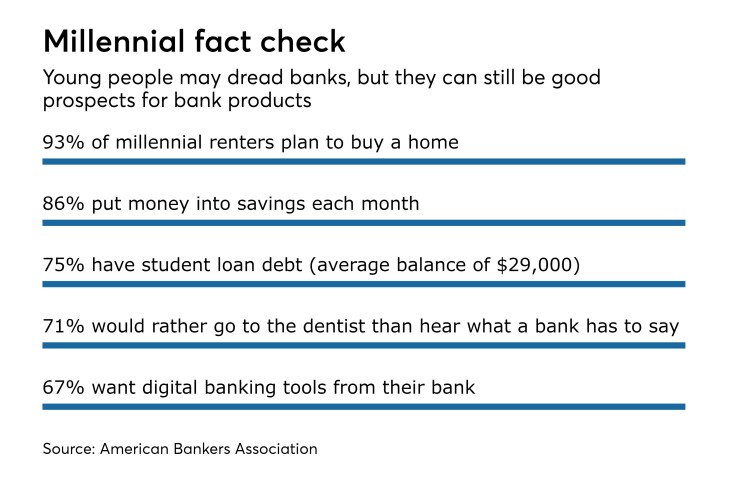

“You have to bring some new thinking, take some risks and try some new things to tap into a new customer base,” said Jim Edrington, the American Bankers Association’s chief member engagement officer.

NewDominion began to reposition itself in late 2016. Before the makeover, only a tenth of its customers were considered millennials. Now, the demographic makes up roughly a quarter of the bank’s customers.

“We’re having fun,” said Blaine Jackson, NewDominion’s CEO.

It wasn’t always that way.

NewDominion, which struggled during the financial crisis, initially focused on cleaning up its balance sheet. Nonaccrual loans, which hit $30 million at the end of 2010, totaled just $294,000 on Sept. 30.

The bank is back on offense, hiring about 20 new people in the last year, including a number of millennials. Jackson said employee engagement is also on the rise.

NewDominion also hosts events where it believes it can reach its targeted demographic.

On three occasions, the bank has provided drink tickets and food at a local brewery at events for potential first-time homebuyers. Jackson said the sessions drew young couples who wanted to learn how to improve their credit scores, establish credit and what to expect from a down payment.

“We’re interested in educating local people on mortgages and educating them on NewDominion Bank,” Jackson said. “If they choose to use us for that mortgage, that’s fantastic. But if it’s better for them to go somewhere else, and they’re better equipped, that’s fine as well.”

M&F is also planning activities once considered out of the norm for a bank. It is set to host parties in two cities to celebrate its new checking account. The events will feature food trucks and a DJ.

“I’ve never had a DJ at an account opening,” said James Sills, the bank’s president and CEO. “We’re thinking differently. This is the kind of stuff [millennials] are looking for.”

M&F had some help. The idea of forming a volunteer millennial advisory board came about after two young men had an unpleasant experience in an M&F branch.

Marcus Howard and Charles Hands wanted to keep supporting the bank despite the negative experience, so they wrote a two-page letter to CEO James Sills expressing their concerns.

“We said, ‘We had an unpleasant experience at a branch. We’re not going to leave, but we want to sit down and talk … about the experience and about how we can improve the experience for other millennials who come across your bank,’ ” Howard said.

Following meetings with Howard and Hands, M&F conducted market research and formed the board, naming Howard its chairman. The group helped the bank organize the kickoff parties.

Other community banks, including Centric Financial in Harrisburg, Pa., and Lake Shore Savings Bank in Dunkirk, N.Y., have formed board to help connect with millennials.

Centric partnered with the Harrisburg Young Professionals to form a millennial advisory board in 2016. The board, which includes Centric employees, has had an influence on a variety of decisions at the bank.

"If we aren't looking right now to see how they work differently and see what resonates with them, we will miss the boat," Patricia Husic, Centric’s president and CEO,

At M&F, about 45% of its customers are at least 60 years old; just 13% are between 20 and 39, Sills said. Less than 6% of the bank’s customers are in their 20s.

“We have a very loyal, older customer base, but it’s really important for us to change those demographics a bit to get people in the 25- to 45-year-old range to sustain the bank long term,” Sills said. “We have to do something different to attract that demographic.”

While M&F’s efforts are still in the early stages, Sills said he is monitoring millennial account openings and social media engagement.

Howard and Hands are looking to offer their services to other financial institutions, forming a Charlotte firm called Engage Millennials.

“Not only do you have to create Facebook and Instagram [accounts], but you have to get into the spaces where [millennials] are engaging and mobilize them to come support their business,” Howard said. “That’s what we’re the best at.”

NewDominion has also stepped up its game, agreeing last fall to become the preferred community bank of professional basketball’s Charlotte Hornets.

“Brand awareness is something we’re really focusing on,” Jackson said. “Obviously the Hornets have [considerable] brand awareness, so aligning with their brand and their demographic is a perfect fit.”

The rebrand is providing a lift to NewDominion’s balance sheet, Jackson said. Total loans increased by 13% last year, after a 1% decline in 2016. Deposits rose by 9% in 2017 after falling a year earlier.

“You can’t point to any one thing, but I’m very confident the rebrand has had a significant positive impact on the overall growth of our balance sheet,” Jackson said. “It has absolutely had a positive impact.”