-

Lending Club and Funding Circle are among the firms pledging to adhere to a range of self-imposed standards in small-business lending.

August 6 -

Many online small-business lenders worry that future regulations could stymie innovation in this fast-growing industry. But well-designed requirements would simply ensure that online lenders can offer adequate borrower protections without giving up market share.

August 4 -

So far, Washington has generally smiled on tech-driven lenders such as Lending Club and OnDeck. But many in the fast-growing industry are now bracing for closer scrutiny.

May 15

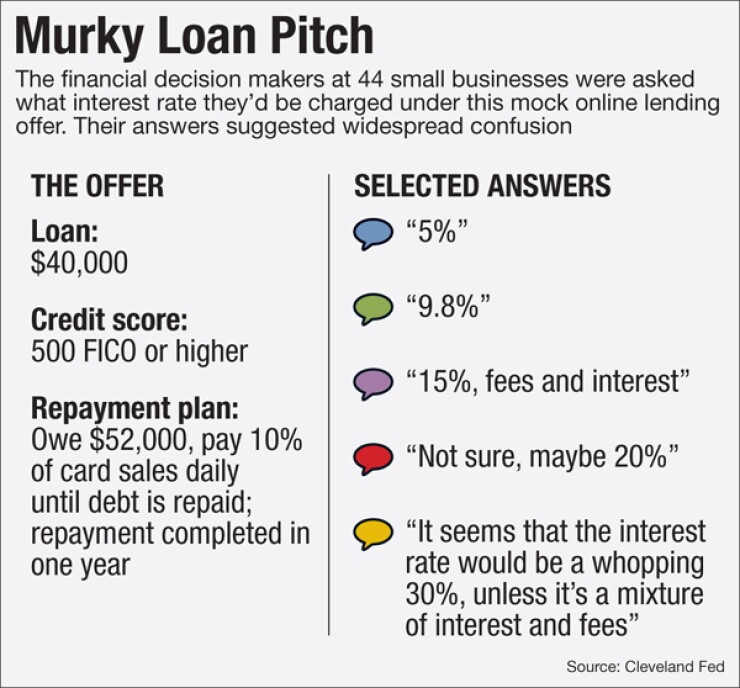

In recent online focus groups, Federal Reserve researchers presented 44 small-business owners with basic information about a loan and asked them to estimate the interest rate. The business owners' responses were telling.

The hypothetical loan, which was meant to mimic some of the products offered to small businesses online, is for $40,000. The borrower owes $52,000. The lender gets repaid by taking 10% of the borrower's daily debit card and credit card sales. The loan is paid off in one year.

So what is the interest rate? Answers from the self-described financial decision-makers varied widely.

"A little less than 10%," one said.

"I'm guessing it's about 23%," another offered.

"If you pay it back in 12 equal monthly payments, it's on the high side of 50%," a third responded.

The correct answer is that there's not enough information to calculate the interest rate. (The third respondent came closest if the small business makes equal daily payments, the effective interest rate on the loan is around 60%.) But the larger conclusion from the Fed study is that small-business owners are confused about the terms being offered by online lenders.

[Coming this November:

"Using information typically provided on online alternative lenders' websites, small businesses find it difficult to compare credit products," the researchers from the Federal Reserve Board and the Federal Reserve Bank of Cleveland wrote in a report published Tuesday. "Virtually all the focus group participants said they want clearly stated product features and costs and an easier way to compare product offerings."

The

This month, a group of nonbank small-business lenders unveiled

This niche, which is often described as marketplace lending or alternative lending, has grown at a torrid pace in recent years, although there is no comprehensive data about its size.

Online small-business lenders, which include OnDeck Capital, Kabbage and Funding Circle, among many others, generally use automated underwriting systems to make loans that are either too small or too risky for most banks.

On an annual basis, the loans can be quite pricey. OnDeck's average APR during the second quarter was 46.5%, according to the company's most recent earnings report.

The structure and terms of these loans vary widely. Some of the firms offer merchant cash advances, in which the borrower pledges to repay from a percentage of future revenues. Others offer term loans. Still other online companies compete against traditional factoring firms, which offer to small businesses early payment of invoices in exchange for a cut of the proceeds.

Small-business lenders are not subject to the federal Truth in Lending Act, which requires consumer lenders to disclose their annual percentage rates to borrowers. State usury laws generally don't apply to small-business loans, either.

In that landscape, the online lenders' rates and fees can be next to impossible to compare.

Kabbage borrowers pay from 1% to 12% of the amount financed during the first two months. For the next four months, they pay 1% a month.

PayPal, which offers credit to merchants that use its payment network, charges a flat fee that varies depending on to the percentage of PayPal sales the borrower decides to use for repayment. On an $8,000 loan, that fee is $294 for a borrower who turns over 30% of the sales to PayPal, but $949 for a business owner who forks over only 10% of the sales revenue.

In short, even the most financially savvy borrowers may have a hard time figuring out what the best deal is.

"Some lenders deliberately obfuscate a loan's total cost, refusing to disclose an APR, interest rate or tools like a loan calculator," Brayden McCarthy, head of policy and advocacy at Fundera, a website that aggregates small business loan offers, said in an email.

"There's no question that borrowers are getting into loan products they don't fully understand or can't reasonably repay," added McCarthy, who was one of the key architects of the self-regulatory pledge.

Nick Clements, co-founder of MagnifyMoney, a comparison-shopping site for consumer financial products, likened some of the online small business lenders to consumer payday lenders.

In both industries, he said, certain firms structure their loans in ways that make it unlikely the borrower will be able to repay, which leads to rollovers and additional fees.

"The structure of the product is such that it entraps individuals. And I see that happening to a certain extent in the small business space," Clements said.

The lack of uniformity in disclosures has resulted in an increasingly public fight within the industry. Some firms say they're losing business to competitors who are masking the true cost of their loans.

Such concerns helped give rise to so-called bill of rights for small business borrowers; signatories pledge to disclose an annualized interest rate and fees, among other steps. But the self-regulatory plan stops short of the kind of detailed disclosure rules that apply to consumer loans under federal law.

"If industry players refuse to participate in self-regulation, then of course governmental regulation is appropriate," said Mark Rockefeller, chief executive of StreetShares, a Reston, Va., lender that has signed onto the pledge.

The Cleveland Fed report stated that "it remains to be seen whether efforts on the part of the industry to gain consensus on and adopt best practices will be successful."

The Fed researchers, who conducted one online focus group with small-business owners in November and another one in March, made clear their view that small-business owners are being harmed by the lack of uniform disclosure by lenders.

The researchers found there was particularly high confusion regarding merchant cash advance products, such as the hypothetical $40,000 loan that elicited a wide variety of guesses from the focus group participants. The information that the Fed researchers provided to the participants was intended to replicate the terms and features as lenders present them on their websites.

"The wide variation in responses may reflect both differences in their interpretation of product features when those features are not clearly specified," the report stated, "as well as differences in participants' financial savvy."