-

A reporter spent a day trying to cash checks, send money and complete other financial transactions without the use of a bank account. He was surprised by what he saw.

June 5 -

T-Mobile's flexible pricing strategy is forcing its major telecommunications competitors to change. Bankers should take note, given the carriers recent foray into financial services.

March 20 -

Mobile banking can alleviate friction and save time for underserved, low-income consumers, but face-to-face interaction is critical to serving their financial needs.

October 29

In low-income neighborhoods across the country, shops that sell prepaid mobile phones often sit in close proximity to check cashers and money-transfer stores.

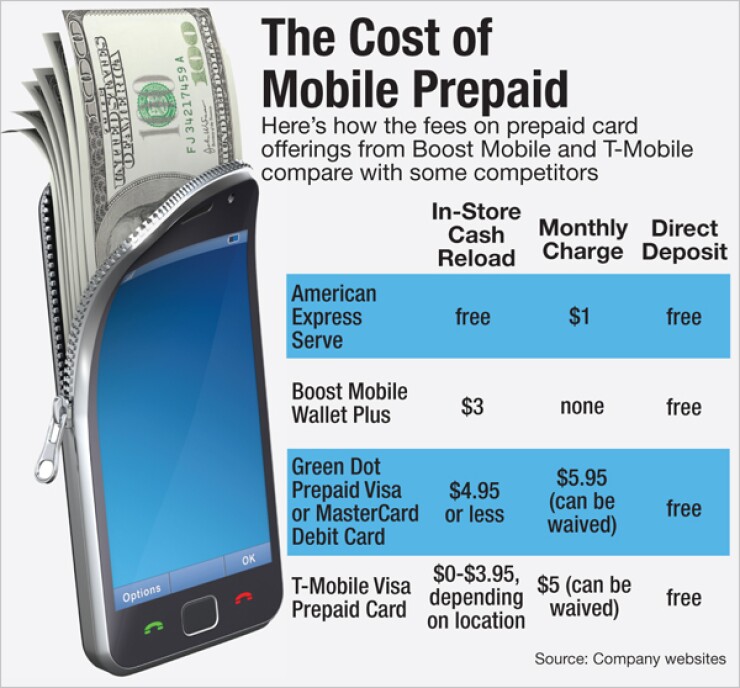

That overlap consumers who don't have bank accounts often lack expensive cellphone contracts, too smells like an opportunity to Boost Mobile. The prepaid mobile phone carrier, which is owned by Sprint, is currently trying to muscle its way into a market led by Green Dot (GDOT), NetSpend, American Express (AXP) and numerous banks that sell prepaid cards.

Boost Mobile's foray into financial services comes at a time when banks are paring back their bricks-and-mortar footprints and focusing more on their mobile apps. So there's a certain irony in the fact that a mobile phone company is counting on its on-the-ground presence as the key to signing up customers.

Nationwide, there are approximately 20,000 independently owned and operated prepaid wireless stores, estimates Richard Kang, the chief executive of Wipit, a Pasadena, Calif.-based startup that has partnered with Boost Mobile to offer a co-branded mobile wallet aimed at unbanked consumers. "They're located in the right neighborhoods," Kang says.

In a recent interview, Kang pointed to a map showing more than 100 prepaid phone stores located within a five-mile radius in one predominantly Hispanic neighborhood in Los Angeles.

There is

"I think Green Dot and NetSpend and Walmart have done an incredible job of seeding the market and creating familiarity," he says. "But to go to the next step of adoption for the unbanked and underbanked, it's going to require people, not just self-service."

Boost Mobile's basic financial product, which is currently being rolled out nationwide, includes international money transfers, bill pay and the ability to add minutes to the customer's mobile phone plan.

The basic version of the Boost Mobile product is seen as an on-ramp for a more extensive version, which includes a reloadable prepaid card that enables direct deposit, free person-to-person mobile payments and mobile check deposit at $4 per check.

Unlike numerous other versions of mobile check deposit, Boost Mobile customers get instant access to their funds, which is a big selling point to consumers who live paycheck to paycheck.

Boost Mobile and Wipit have not disclosed how many customers have signed up for their product since its nationwide rollout began last May. The mobile wallet is now in thousands of Boost Mobile stores, according to Kang, but he declined to provide the exact number.

If the product is going to succeed, it will largely be because of the efforts of dealers who operate Boost Mobile stores. Those dealers have been receiving training on how to sell the product, and they will receive an undisclosed cut from each sale. "You've got to share the pot," says Kaan Kilik, manager of mobile commerce product development at Boost Mobile.

Kate Lee, who manages Boost Mobile stores in Los Angeles and Pasadena, Calif., said she is in the process of finalizing the paperwork necessary to sell the Mobile Wallet in her stores.

She expressed uncertainty about the size of the potential opportunity, but added: "I believe that there are people who might be interested in getting prepaid debit cards."

Lee has spoken to other Boost Mobile dealers who are already offering the mobile wallet and have yet to see large sales volume. That may be in part because Boost Mobile is not currently advertising the product on television, she said.

"Right now, it's more like advertising through word of mouth," Lee said. "So I think it's going to take some time."

Jennifer Marble, an analyst at Mercator Advisory Group, calculates that if 3.8% of Boost Mobile's existing customer base sign up for the mobile wallet, the company would have the same number of accounts that American Express Bluebird had within its first year.

"This level of acquisition would still require increased acquisition rates from the current values but could be achievable within the next 5-10 years," Mercator wrote in a recent report. "Reaching this level would put them in the top 10 prepaid providers and make them serious prepaid card competitors."

But she also cautions that far more consumers visit Walmart than Boost Mobile stores, which means that Boost Mobile's prepaid card has a relatively small target audience, compared with other sellers of prepaid cards.

Wipit does not have an exclusive partnership with Boost Mobile or its parent company, and Kang hopes to mimic the growth strategy used in Kenya by the mobile payments venture M-Pesa.

M-Pesa, which has expanded to other countries, including South Africa and India, built a financial services powerhouse by relying on stores that sold cellphones and airtime to people who lacked bank accounts.

"It seems to be working in many part of the world," Kang says. He quickly acknowledges: "The U.S. is a different beast."

One reason that M-Pesa worked so well in remote Kenyan villages is that there was so little financial infrastructure to replace. That's not true in the United States.

Still, there's a bigger opportunity to build a disruptive system for unbanked Americans than there is for people who are part of the U.S. financial mainstream, says Mary Monahan, research director for mobile at Javelin Strategy & Research.

"You're not breaking a habit," Monahan says, referring to Americans who currently rely exclusively on cash. "They don't have a card. So if you provide them something that works well, that's great."

It is unclear if other mobile phone carriers will mimic the strategy employed by Boost Mobile and Wipit of targeting unbanked households. It appears that some carriers see an opportunity to reach customers who are closer to the financial mainstream.

Sprint recently began offering its own version of the mobile wallet from Boost Mobile and Wipit. Although the two products are basically the same today, they will likely be differentiated over time, in order to appeal to Sprint's more mainstream customers, Kang said.

T-Mobile also offers a prepaid card that it's marketing to consumers who have bank accounts. "Checking account fees keep going up," the product's website reads. "We're knocking them down."

T-Mobile did not make an executive available for an interview.

Looking at the bigger picture, banks should be concerned about the threat posed by the big nationwide mobile phone carriers, says Sasha Orloff, a former executive at Citigroup (NYSE: C).

Orloff, who is now the chief executive officer of LendUp, an online lending startup, notes that the telecom companies have huge revenue streams, which should allow them to undercut banks' prices, and they also have extensive payment and billing information on their customers.

He recalls being asked during his time at Citi to research the major threats to banks.

"Everyone wanted to think about Google or Facebook being the biggest threats, or Amazon because they had the payment information," Orloff says. "I thought that the phone carriers were the biggest threat."