Bank of America has been aggressively expanding its digital channels, and its digital banking leader has a plan to sustain that momentum as social-distancing practices ease and consumers resume at least some face-to-face transactions.

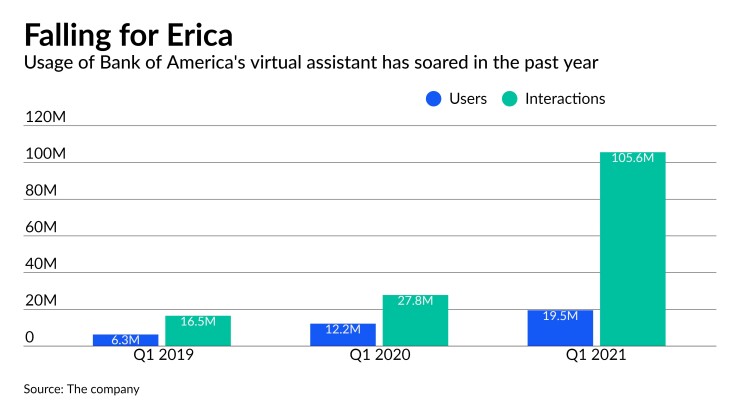

More than 52 million of BofA's 66 million customers have signed up for mobile or online banking; 40 million use it frequently. About half the company's consumer sales are made through a digital channel. Moreover, its digital assistant Erica had 19.5 million users at March 31, up 60% from a year earlier. Interactions with Erica grew nearly four times in that same time period to 105.6 million.

Some of this traffic was surely driven by the pandemic, which led many branches to temporarily close or shorten hours. But some of it is the result of a drive toward continuous improvement of BofA's digital channels. The company has been making more than 2,000 feature enhancements to its digital channels per year, and the pace of digital feature releases has quickened from quarterly to every 28 to 32 days. It’s been upgrading Erica from a bot that would tell customers their current balance and other basic account information, to a virtual assistant that can execute on commands (e.g. “Erica, Zelle Mark $20,” to providing “insights,” for instance alerting consumers if they’re spending more this month than they usually do, or if they’re about to overdraw).

In an interview, David Tyrie, the company's head of digital, shared which digital features are most and least popular, the differences in behavior he’s seeing among different generations, and some of the work Bank of America is doing to advance Erica, its digital tools for wealthy BofA and Merrill Lynch clients, and its new financial planning feature, Life Plan.

Big players like Bank of America and JPMorgan Chase are still the ones to watch in digital banking. They don’t always have the innovative features challenger banks have, but they have the resources to provide a wide range of services. In Bank of America’s case, the scope ranges from digital mortgages to personalized advice to online investing.

For wealth management clients, the company recently built e-signature technology and document sharing into its online banking portal.

Last year, Bank of America introduced My Financial Picture for Merrill Lynch and private bank customers. This is where it uses data aggregation to allow clients to see their assets at other institutions alongside their BofA accounts, get a better financial picture of themselves and develop a plan of action to improve their standing.

In October, the company launched a tool in its mobile app called Life Plan. Here, customers tell Bank of America what is most important to them, choosing among seven life priorities, and the company assembles content for them, considers their financial picture and suggests next best steps. For instance, if a customer says improving credit is a priority, Life Plan will recommend 10 things to do to improve credit.

What features of your mobile app, online banking and Erica have been most and least popular during the past year?

DAVID TYRIE: Erica has been on a 60% increase year over year [comparing March 2020 to March 2021]. With Zelle, we're now at about 30% year-over-year increase. We're seeing growth in mobile check deposit. We also saw a pretty significant increase to the tune of about 30% in digital wallet activity amongst our clients.

Which features have not been as popular?

In use of biometric ID [facial recognition to log into the bank's app], we’ve only seen a 10% increase. That's the smallest increase of anything that we have as far as feature adoption, and it's still double-digit.

Last weekend we updated SafePass two-factor authentication, and we expanded it out to other areas. In the past you would have used it for things like adding a first-time Zelle payee. We've just expanded that capability across the spectrum.

I think banks have been pressured to use two-factor authentication for years. And they've been for the most part reluctant because they don't want to make it more difficult for people to access their accounts and get legitimate users kicked out. But I think gradually we're seeing more acceptance.

That's the essence of what's happening in banking. You can't go too fast because then you get rejected by your customer base. But you also can't be too slow. So the challenge is, it's an art of how fast can you move.

Have you noticed some differences in digital adoption among different generations?

It's all about speed of adoption. Pre-pandemic, two areas that you and I had talked about was, how do you make the boomers and the seniors out there aware of your capabilities? I've given the example a million times of my mom, who owns a kindergarten and she likes to go down on Fridays to deposit the receipts for that week's tuition. And she likes seeing the people in the financial center. And she doesn't want to change that. The pandemic did change it. Now she's a mobile check deposit user. So the pandemic forced people who had already built habits to break those habits, like the seniors and boomers.

What percent of customers are using mobile check deposit today?

About 40% of our deposits now come through mobile.

Are there any tools or features you’re seeing younger people use a lot?

Our younger populations tend to be the most digitally active, and they really are using Life Plan more than all the other age groups. Out of the 4 million Life Plan users, 64% are millennials and Gen Z, and they're using it for budgeting, savings and improving credit. We're now seeing a surge in those looking to buy a home.

How does it help people improve credit? Does it actually give advice like, you should be paying your bills on time?

It does. In Life Plan, you choose what your life priority is. And if improving credit was on the list, what we do is we assemble the content about improving credit from across all of our digital properties. We might provide 10 rules to think about, three things you should do right away, and here's what it's going to look like in 10 years. It will give a choice of next step. It might be something like paying down your credit twice a month.

How far would you say you've come overall with this? A lot of banks are trying to get to real personalization, which is hard because your data has to be really accurate and organized and you have to make sure the advice is relevant, otherwise people are going to be upset. How far would you say you've come down that road of being able to offer a really personalized, tailored experience?

I believe that we're the leader out there, but I also believe that we're only in the first inning. We've done a really nice job of using Erica for that. And Life Plan is collecting transaction data alongside people’s priorities. So we've got 4 million people now who are telling us what their aspirations are. They're rewarded with a better experience.