At this point, it is widely perceived that blockchain technology has the ability to help banks cut costs, but the next frontier could be in figuring out how — or perhaps if — the technology will make banks money.

The revenue potential is not a priority right now, but observers say that given the amount of time and effort some banks have put into exploring the technology, it ought to be. That's because technology that makes money is often more appealing than things that trim costs.

"There is a lack of forcing mechanism behind" the blockchain race, Jeff Penny, a senior adviser at McKinsey, said at a recent industry gathering hosted by Broadridge Financial. "This discussion is largely motivated by interests in improving efficiencies and understanding new technologies … but there's no one telling us we have to be here. The closest thing we have to an imperative is the need to cut costs in bank income statements today."

Although the potential to cut costs is appealing, innovation is often driven by the desire to gain an edge, Penny said.

"There is a battle amongst technology providers to create a winning solution, but we're essentially taking processes that don't give rise to competitive advantage and we're trying to find ways to reduce costs associated with the way of doing them, and then doing them the same way as everyone else, which completely eliminates the source of differentiation," he said. "One of the great motivators we usually have for innovation in this business is differentiation."

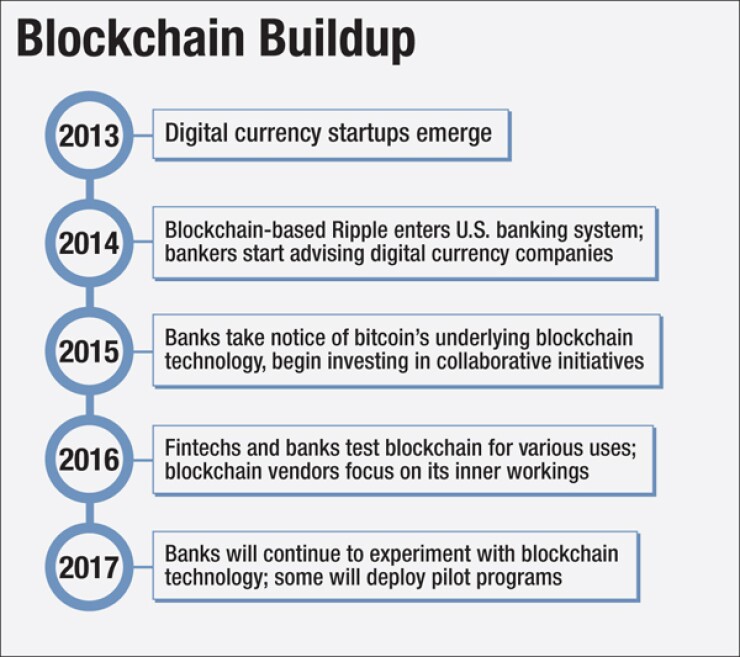

Such an edge could fix some of the fatigue currently plaguing blockchain implementation. Despite banks' excitement about blockchain, which began in 2013 and grew louder this year with unending cycles of proof-of-concept announcements, or PoCs, bitcoin remains the only blockchain platform that is in widespread production, said Ajit Tripathi, a director at PwC's blockchain practice. Financial institutions are asking whether investments in innovation will ever bring cost reduction or business growth to the institutions investing in these experiments.

"More and more of our clients are pushing their partners as well as innovation and technology organizations to come up with a clear path to production," Tripathi said. "The question isn't whether the technology can deliver the benefits. The PoCs have shown which use cases make sense over what time frame and which ones are vaporware. Now the race is on to realize those benefits."

Eventually, banks will be able to make money on their blockchain implementations by creating products and services that benefit customers. Such solutions could range from digitizing illiquid assets to building micropayment systems. But if they weren't experimenting with proofs of concept this year, they'll have a lot to catch up on later, said Julio Faura, head of research and development for Santander's blockchain practice. In other words, those who are already exploring blockchain are closer to making money on it, even if that isn't their focus.

"There will be a lot of use cases enabled by this technology. It's just that we try to push all the hard work that we do today on the basis of future business models that don't exist today," Faura said. "That's just more difficult than if we capitalize our investments on top of efficiency. Initially, we will see benefits from efficiency. Later on we will see benefits from new products, new revenue sources and new services" on top of blockchain technology.

Not everyone agrees that blockchain needs to present revenue opportunities to accelerate its development. For instance, State Street sees the technology as more of a near-term solution and an opportunity to upgrade the bank's efficiency, and it can "worry about entire industry transformation down the road," said Hu Liang, senior managing director of the Boston bank's emerging technology center.

"If people come up to us and say, 'You aren't forward thinkers,' or 'You think this is just a tool as opposed to an industry change,' we're comfortable with that statement. We proofed it out and are going to be ready to drive through these technology developments," Liang said. "We couldn't come to that conclusion as comfortably as we have and stand behind it if we were just waiting for the high-level news."

Liang predicts that after internal applications and blockchain components, banks will be able to offer applications to clients — services that could create revenue.

If the first post-blockchain awakening phase was about efficiency and saving money, the next will be "more about creating new customer solutions and experiences that don't easily exist today," said Ian Lee, head of the Global Lab Network and Acceleration Fund at Citi Ventures. The boundaries of one phase versus the other don't have to be so strictly defined, however.

"I don't think it's sequential, that it's these opportunities and process efficiencies versus new experiences and new solutions," Lee said. "Many of the exciting things in the next year and ahead in this space," he said, "are actually in that second category," like digital identity, the internet of things and unique applications of smart contracts.

Still, others say it is too early to talk about next phases of blockchain implementation. They say the exportation of blockchain from its narrow use as the protocol for bitcoin to a revolutionary system for the financial system is going to take time and the industry is still trying to grasp the basics.

For starters, no one actually knows what blockchain technology will do for legacy financial institutions or what business benefits it can provide at scale, said Steve Wilson, a principal analyst at Constellation Research, where he focuses on digital identity and privacy. Also, the digital-only aspect of first-generation blockchains is a very large and overlooked limitation, he said. The original bitcoin white paper published in 2008 was about a completely digital chain process. Companies might be naive in believing they'll be able to easily track physical assets on it.

"People say you can do anything on a blockchain — land titles, stock trading, all sorts of things — and get security benefits of blockchain technology, but I'm afraid they're wrong because you need all these off-chain processes to do nondigital assets," Wilson said. "It's almost certain what we'll see will be distributed-ledger technologies that are really unlike the first-generation blockchain, which is all about cryptocurrency, removing friction, moving a lot of the blockages in payments."

Perhaps it could be 2020 when a solid financial system distributed ledger will emerge.

"Things will slow down; I don't think anything great will happen in 2017," Wilson said. "There will continue to be PoCs and people will learn that blockchain in its original form is digital-only, and it's very niche."