Blend is aiming to expand its customer base of banks and credit unions with a digital account opening product that it says takes some customers as little as two minutes to complete.

The account comes in addition to the mortgage products the digital loan origination fintech already offers and can stand on its own or be integrated as a package, the company said Tuesday.

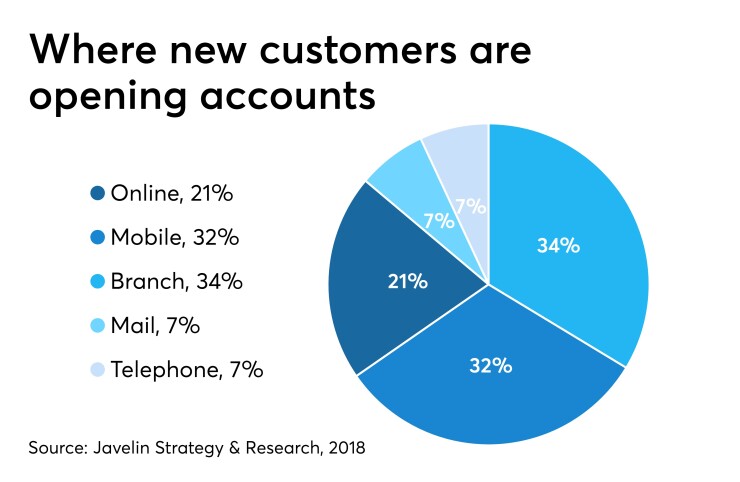

Around half of customers who begin a mobile account opening process don’t finish, according to a 2018 report from

The Blend product prefills any information that customers have already provided a financial institution through Blend's other products. If a bank offers customers a discount on their mortgage by opening an account, such as TIAA Bank, they can now also open an account using the same Blend interface.

“We have an account opening process currently, but we don’t have it integrated within the mortgage flow,” said David Andrews, vice president of TIAA Bank’s home lending strategy. “Currently, we have a bifurcated process where we have to do a manual follow-up with the banking group.”

TIAA has around $1.5 billion in mortgages, roughly 70% of which are purchase loans. Since adopting Blend’s mortgage product, TIAA has seen 30% of applicants come through the app. It plans to integrate the digital account opening product within the mortgage product it already offers from Blend, Andrews said.

Mountain America Credit Union in Sandy, Utah, one of Blend’s pilot institutions for the product, saw account opening times decrease by 46% to around five minutes after offering the product. “The faster the process is, the fewer applicants abandon it,” said Blake Terry, the credit union’s assistant vice president of deposit products.

When the credit union launched Blend’s product, they found that 50% of the applications came through mobile account opening — an option the credit union had not previously offered.

If customers start with something as complex as a mortgage, that data will be reused for them to start an account, said Olivia Teich, head of product at Blend. “Anything after that is easy,” Teich said.

Blend isn’t the only contender that’s paid attention to the difficulty in opening bank accounts online. Two years ago, Fiserv began to explore what a new online account opening process would look like by giving a group of customers $100 each to open an account at the institution of their choice. The study eventually led to the company launching a new account opening product last September.

“Whether it was a large or small institution, we noticed customers stumbled over the same things,” said Jeff Sonderman, director of product management at Fiserv. “One of the things we found across the board was a suspicion issue. So we made sure with this product that customers understood why we were asking them each question.”

Digitizing the account opening and loan origination processes are related issues that banks are weighing equally, said Lane Martin, a partner in the banking practice at the consulting firm Capco. Even though clients will onboard faster, there’s risk if banks update only one part of their system.

“What a banks looks to do at account origination sets the tone for that relationships with the institutions,” Martin said. “If you offer them a slick digital experience upfront, then you better have an ongoing digital experience after you get them through the door.”