The largest banks are outpacing regionals in the quality of advice they offer to consumers.

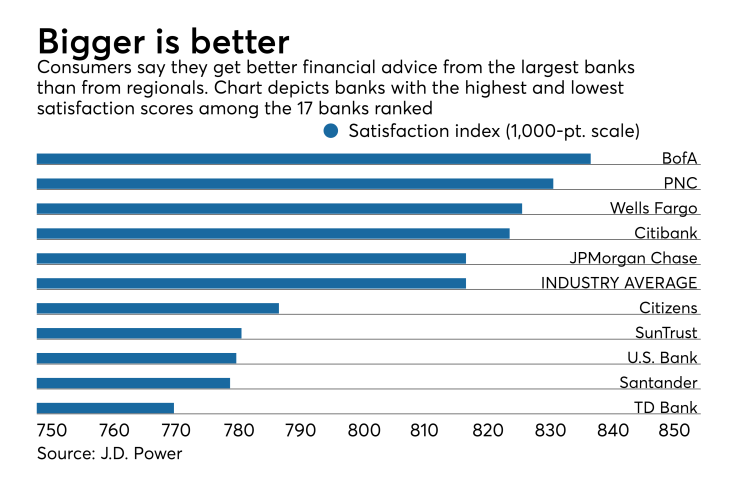

A new study released Thursday by J.D. Power found that, for financial advice, consumers gave the highest marks to five of the nation’s largest retail banks — Bank of America, PNC Financial Services Group, Wells Fargo, Citigroup and JPMorgan Chase.

As the industry shifts from a sales-based business model to one centered around providing consumers with useful advice, the largest banks are leveraging their bulk in two ways, according to J.D. Power.

First, they have huge branch networks, so consumers find them to be more convenient when looking to speak to a financial expert.

Additionally, they are designing and managing their own digital applications, whereas regional and smaller banks tend to rely on third parties for mobile technologies. When a bank controls its own software for these applications, it can adjust to market conditions quicker, say the authors of the J.D. Power study.

“The convenience and broad presence they offer through large branch networks is a key factor,” said Bob Neuhaus, vice president of financial services at J.D. Power. “Their levels of investments in digital have also been higher.”

In J.D. Power’s U.S. Retail Banking Advice study, Bank of America and PNC scored the highest for the quality of advice they dispensed both in retail branches and through digital channels.

Bank of America ranked No. 1, with a score of 839 on a 1,000-point customer satisfaction scale, while PNC had a score of 833. Wells Fargo, Citigroup and JPMorgan Chase were the only other banks to score above or at the industry average of 819.

More than three-fourths of the 3,719 retail bank customers surveyed said they are interested in receiving financial guidance from their bank.

The largest portion of consumers surveyed said they wanted advice on investments, followed by tips on how to improve their financial situation, advice on retirement, and household budgeting.

While many want to speak to a banker at some point, 58% of consumers said that they prefer to receive advice through digital channels.

The largest banks have made significant improvements to the advice they provide through mobile apps and on their websites. That’s

Banks in this asset class have the resources to build their own online and mobile-banking platforms, Neuhaus said.

“They’re not using outside vendors to support your digital strategy,” he said. “They have more control over their digital products. That gives them more room to innovate and be responsive to consumer needs.”

Seventeen large and regional banking companies were included in the J.D. Power Study. BB&T, Capital One, Fifth Third Bancorp, KeyCorp and Huntington Bancshares landed in the middle of the pack, with scores ranging from 805 to 815.

Six companies — M&T Bank, Citizens Financial Group, SunTrust Banks, U.S. Bancorp, Santander Bank and TD Bank — had scores below 800.

The reasons for their low scores? Consumers said these banks contacted them less often, did not handle in-person meetings as well as the larger banks and that the advice they provided did not meet their needs, according to the survey.