Want unlimited access to top ideas and insights?

This year's compilation of the most important technology news in the banking industry includes a widespread data breach that impacted Bank of America, the downfall of banking-as-a-service, the rise of artificial intelligence and more.

Data breach affects 57,000 Bank of America accounts

Article by

A data breach at Infosys McCamish, a financial software provider, compromised the name, address, date of birth, Social Security number, and other account information of 57,028 deferred compensation customers whose accounts were serviced by

An unauthorized party — apparently a ransomware group known as

The breach occurred on Nov. 3, 2023, according to the letter, and Infosys McCamish notified

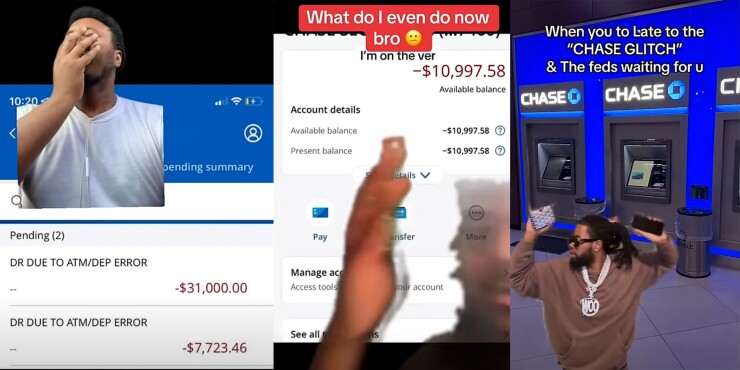

Check fraud against Chase goes viral on TikTok

Article by

A form of

The scheme was portrayed as a glitch rather than

"Let's go to the ATM, let's go to the ATM, let's go to the ATM," one person said to his friend in a TikTok video reacting to the trend.

What bankers need to know about Trump's World Liberty Financial

Article by

In a

"We're embracing the future with crypto and leaving the slow and outdated big banks behind," Trump said in the short video about the company, World Liberty Financial.

Trump has pledged during his presidential campaign to turn the U.S. into the "crypto capital of the planet," as he put it in

FDIC rebukes Sutton Bank, Piermont Bank over fintech partners

Article by

Banks that offer banking-as-a-service to fintechs be warned: Regulators continue to critique these programs. In the most recent example, the FDIC announced consent orders against Sutton Bank in Attica, Ohio, and Piermont Bank in New York City.

Other banks that have been slapped with similar consent orders include

In these orders, regulators tell the banks they need to step up their oversight and monitoring of their fintech partners, and insist their boards must be involved. When the fintechs take on new customers, it's the bank's responsibility to make sure they aren't criminals, terrorists or money launderers. As the fintechs process transactions, the banks have to monitor them to make sure they meet all Bank Secrecy Act, anti-money-laundering and countering financial terrorism rules.

Fintechs contend with banking-as-a-service fallout

Article by

When one child misbehaves, even innocent siblings can expect extra scrutiny when their parents come home.

"It doesn't matter if you're the problem child," said Jason Henrichs, founder and CEO of community bank consortium

The same could be said of players in the banking-as-a-service space. Financial institutions including

A recent analysis by S&P Global Market Intelligence found that banks that provide BaaS to fintech partners accounted for 13.5% of severe enforcement actions issued by federal bank regulators in 2023, a disproportionately large number considering how few banks in the U.S. engage in BaaS, the analysis said.

The AI bringing zen to First Horizon's call centers

Article by

Call-center agents who have to deal with angry or perplexed customers all day tend to have through-the-roof stress levels and a high turnover rate as a result. About 53% of U.S. contact center agents who describe their stress level at work as high say they will probably leave their organization within the next six months, according to CMP Research's 2023-2024 Customer Contact Executive Benchmarking Report.

Some think this is a problem artificial intelligence can fix. A well-designed algorithm could detect the signs that a call-center rep is under pressure and do something about it, such as send the rep a relaxing video montage of photos of their family set to music.

First Horizon is using artificial intelligence and such video "resets" to bring a state of calm and well-being to the people who talk to customers on the phone all day. Down the road, it also plans to use a large language model to

Banking-as-a-service banks: 'There is a reckoning'

Article by

The quickening waves of consent orders slamming into financial institutions engaged in banking-as-a-service spurred change among banks who want to get it right.

"The number one takeaway for banks has to be that banking-as-a-service is not the silver bullet many of them thought it would be for deposit gathering," said Jason Henrichs, founder and CEO of community bank consortium

Banks are

JPMorgan Chase accuses TransUnion, others of stealing 'trade secrets'

Article by

In the lawsuit the New York bank filed against TransUnion in Delaware Federal District Court, it said Argus Information & Advisory Services collected the bank's credit card data while under contract as a data aggregator for the

"While Argus did not have access to any of our customers' personally identifiable information, this data is valuable and competitively sensitive," said Seth Wheeler, Chase's chief data and analytics officer. "Argus used Chase's data for its own commercial gain, and it's time this pattern of behavior stops once and for all."

U.S. Bank announces partnership with Greenlight to provide family app

Article by

U.S. Bank in Minneapolis has partnered with the Atlanta-based family finance fintech Greenlight Financial Technology to help customers teach their children healthy spending habits.

Consumers with the $684 billion-asset bank that have eligible U.S. Bank checking accounts can gain free access to Greenlight's platform and linked debit cards for children and teenagers up to 17 years old. The collaboration is the latest product tied to the launch of the institution's

"Families were looking for a better way to raise financially smart kids [and] we found that age-appropriate financial literacy, paired with a debit card to put the skills into practice, is a powerful way to meet that need," said Jennifer Miller, head of strategic alliances and campus banking at U.S. Bank. "Greenlight has revolutionized how parents teach their kids and teens about money, and we wanted to bring that to our customers in a simple and seamless experience."

Why Citi is rolling out generative AI to all its developers

Article by

Like most large banks, Citi is evaluating hundreds of use cases for generative AI, assessing the business impact and risks of each. But it is moving forward quickly on a few.

The bank will have a roadmap for rolling out GitHub Copilot to all developers – about 40,000 employees – by mid-April, according to Shadman Zafar, CIO of personal banking and wealth management at Citi and lead for its generative AI work. This should save a lot of time, especially where reusable code can be found within the bank's own repository. Citi is also using generative AI to modernize legacy systems and do first drafts of compliance assessments, among other things.

"I do believe it's a technology that will, in a sustainable way, have a long-term impact on how we do work for a couple of decades to come," Zafar said in an interview.