Call it survival of the biggest.

Banks with more than $1 billion of assets increased total deposits by 6.7% over the last year, according to new data from the Federal Deposit Insurance Corp.

Meanwhile, depositories with less than $100 million of assets saw their total deposits shrink by 8.7% between mid-2015 and mid-2016. Institutions with between $100 million and $1 billion of assets fared somewhat better than the smallest firms, but they still experienced a 2.6% decline in deposits.

Consolidation is driving the decline in deposits at small banks. The number of institutions with less than $1 billion of assets fell by 9% during the the 12-month period, as many smaller banks sought to merge with similar-sized rivals or sell to larger players. Throw in the lack of new community bank charters, and it is easy to see why the smallest institutions are losing deposit share.

Overall, though, total deposits at U.S. banks increased 5.7% between June 30, 2015 and June 30, 2016, to $11.3 trillion, according the FDIC's annual summary of deposits data released last week.

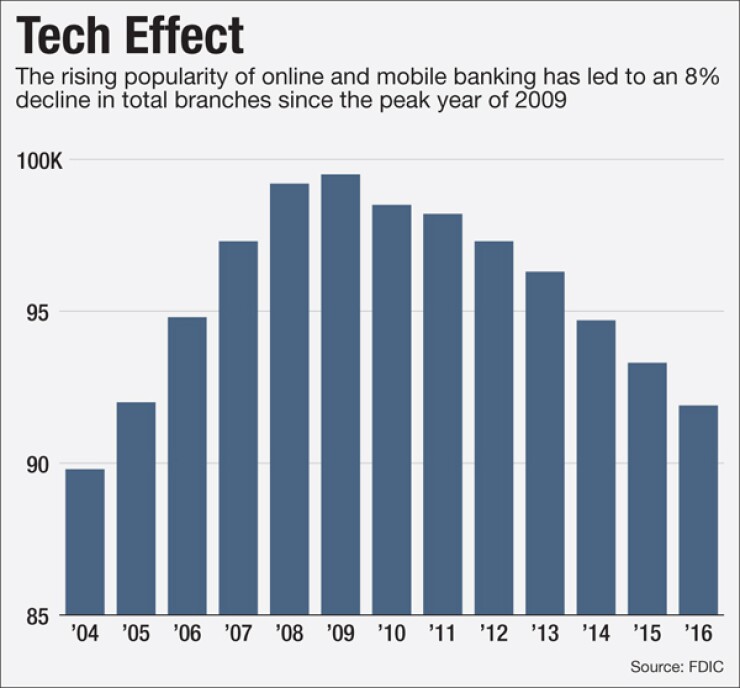

The growth occurred even as the number of banks and branches continued to decline. Overall, the total number of U.S. banks fell by 4.6% to 6,067 as of the middle of this year. The decline was also 4.6% between 2014 and 2015.

Nationwide, the number of banking offices dropped to 91,860, a 1.5% decline from last year and down nearly 8% from 2009, when the total number of branches peaked at 99,544. The decline in total branches is expected to accelerate as digital banking continues to become more popular.

Still, if the nation's four biggest banks are excluded — Bank of America, Citigroup, JPMorgan Chase and Wells Fargo all cut their office count over the last year — banks with more than $1 billion in assets actually added branches year over. Again, that's largely due to consolidation.

On June 30, 2015, banks with less than $1 billion in assets were operating more than 24,500 offices across the country. A year later, that number had dropped by more than 1,200.

Meanwhile, banks over the $1 billion mark had more than 68,500 offices in 2015, and a year later they reported a drop of less than 200 offices.

One thing that is clear from the latest data is that scale matters. Below a certain asset size, banks are struggling to survive on their own, and while it is not clear where exactly to draw that dividing line, the $1 billion-asset mark appears to be a key inflection point.

As of June 30 of this year, 739 banks held at least $1 billion of assets. Those institutions accounted for 12% of the total number of banks, but they held 91% of all deposits across the industry.

The gains were spread relatively evenly across large community banks. regional banks and megabanks. Among banks with between $1 billion and $3 billion in assets, deposits grew by 6.9%. And at institutions between the $3 billion and $10 billion marks, the growth rate was 7.5%.

Big banks continued to rake in deposits, even without the benefit of acquisitions. Chase recorded year-over-year deposit growth of 7.6%, which was the strongest among the megabanks. Wells grew its deposits by 5.9%. At Citi, the growth rate was 5.3%. And Bank of America recorded 3.1% growth.

Several large regional banks also fared well in terms of deposit gathering. Minneapolis-based U.S. Bancorp grew its deposits by 6.7%. McLean, Va.-based Capital One recorded 7.2% growth. And Toronto-Dominion Bank enlarged its deposit base by 10.6%.