Woodforest National Bank in The Woodlands, Tex., is out to prove that it can change its spots.

The $5.7 billion-asset institution, best known for operating hundreds of branches in Walmart stores, has relied heavily on consumer-related fees to boost revenue. As recently as 2016, service charges on deposits made up almost half of its revenue.

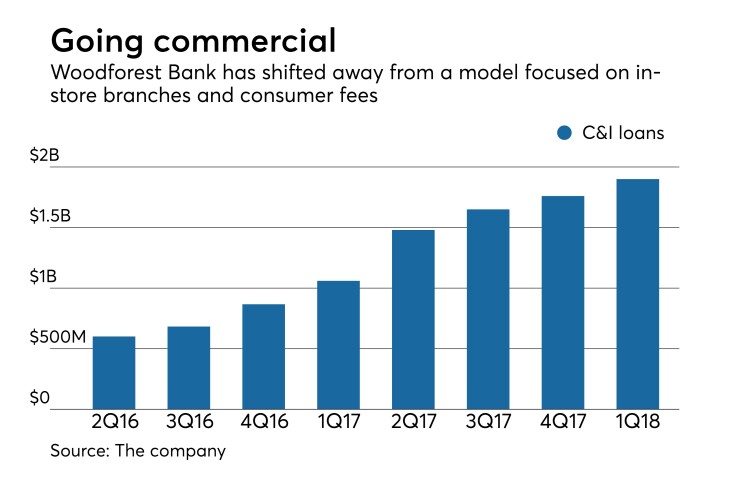

That business model has been slowly changing under the leadership of Cathy Nash, who became Woodforest's CEO in April 2015. In recent years, the bank has made a push into big-ticket and middle-market commercial lending, hiring dozens of bankers and opening loan-production offices in Los Angeles; Charlotte, N.C.; and Fort Lauderdale, Fla.

The move followed a period where Woodforest ran afoul of regulators and advocacy groups over its reliance on overdraft fees. At the same time, the bank faces a cap on interchange fees when it surpasses $10 billion in assets.

Executives for Woodforest declined to discuss the reasons for the strategic shift.

A major commercial push represents a "radical move" for the bank, said L.T. Hall, president and CEO of consulting firm Resurgent Performance. "You don't see many of these stories," he added.

The effort officially kicked off in August 2015 when Nash hired Derek Ragland, a former HSBC executive, as president for commercial banking.

It didn't take long for the bank to gain traction.

Commercial loans have more than tripled since mid-2016, totaling nearly $2 billion at March 31. Momentum seems to be building even more, as the bank has made several notable loans in recent months.

Woodforest in December closed on a $19 million loan to a firm led by Houston Astros owner Jim Crane that is using the cash to build a 191-room luxury hotel in West Palm Beach, Fla., where the baseball team holds spring training. The bank is also the administrative agent for a $70 million participation loan to Solaris Oilfield Infrastructure in Houston that closed in January.

More recently, Woodforest made a $30 million loan in May to Renegade Holding, an energy-related firm in Granbury, Tex. The borrower used the funds to refinance existing debt.

“Woodforest invests in their clients' success, and this new partnership … significantly lowers [Renegade's] cost of capital, leaving it well-positioned to execute its future growth initiatives,” Brian Lobo, an investment banker who helped broker the deal, said in a press release announcing the loan.

As a result of the commercial loan growth, net interest income for 2017 rose 31% from a year earlier, to $163 million, according to the bank's call report with the Federal Deposit Insurance Corp.

Woodforest, to be sure, remains dedicated to its retail operations, staffed by “small teams of universal bankers busting their tails,” said banking consultant Dave Martin. The branches provide a harvest of deposits that help fuel the scaled-up lending operations.

Service charges remain a factor, though they are playing a smaller role in profitability. Such charges totaled $60 million in the first quarter, or 38% of total revenue, according to FDIC data.

It is highly unlikely that Woodforest would completely abandon the in-store model it spent years developing, Martin said.

“In-store is in their DNA,” Martin said. “It gives them a presence in a bunch of markets. Say what you want about Walmart, it’s one of the biggest, most progressive retailers in the world."

One risk to revving up commercial lending is a potential spike in credit issues. After all, it hasn't been that long since loans to energy-related firms tripped up a number of banks in Louisiana and Texas.

Woodforest's credit metrics remain solid. Net charge-offs totaled $2.6 million, or 0.22% of total loans, in the first quarter.

Still, many of its high-profile energy loans have only been on the books for a few months, untested by fluctuating oil prices or a shift in the economic cycle. The bank should do fine if it makes smart hires and identifies the right niches and markets, industry experts said.

“This is a major transition, but it can be done,” Hall said.

Jackie Stewart contributed to this story.