Some of the largest banks have decided they don’t want to be left out of the action when it comes to small-business lending.

In recent months big banks have ramped up their efforts at making small-business loans, according to industry participants and new data on approval rates. This trend includes longtime leaders in Small Business Administration lending such as Wells Fargo and JPMorgan Chase, as well as new product offerings from the likes of American Express and Bank of America.

There are plenty of good reasons for banks to dive headfirst into originating small-business loans. For one, they do not want upstart online lenders to take over too much of the market, said Brock Blake, CEO of Lendio, which operates an online marketplace that lets small-business borrowers shop for loan products from 75 lenders.

“Banks realized there was an opportunity here — there are good loans here and money to be made,” Blake said.

Another factor is that banks’

“People’s risk appetites have changed,” Cuddy said. “Balance sheets for the most part in the banking sector are very, very clean now.”

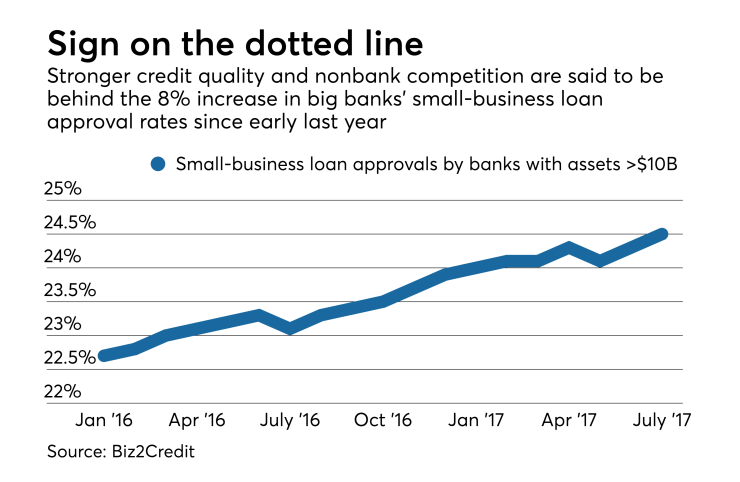

Approval rates for small-business loan applications at banks with at least $10 billion in assets rose to 24.5% in July, a post-recession high, according to Biz2Credit. Big banks’ approval rate had dropped to as low as 8.9% in June 2011.

However, big banks are stingier than other types of lenders. Small banks, defined as those with assets of less than $10 billion, approved 48.9% of small-business loan applications in July. Alternative lenders approved 57.2%, and credit unions approved 40.4%.

The approval rate is based on an analysis of more than 1,000 small-business loan applications filed through Biz2Credit’s loan-matchmaker service. They include application for both SBA and non-SBA loans.

During the financial crisis, the largest banks withdrew from the small-business lending market and only now have returned, Blake said. They spent years studying how the market had changed and developed their plans for attack.

“Banks vacated the space in 2008 and 2009,” Blake said. “That created a vacuum for small-business loans.”

Lenders like American Express have taken advantage. Amex has long made small-business loans, but it has recently expanded into merchant financing, working capital and term loans, Blake said.

“As you talk to customers … you realize that there was an unfulfilled need,” Stephen Squeri, vice chairman at American Express, said on June 14 at the William Blair & Co. Growth Stock Conference.

Banks were also kicked into action by the fact that online marketplace lenders like LendingClub were feasting on the market for small businesses, Blake said.

As banks have become more interested in the small-business market, many online lenders have sought partnerships with banks. Many banks

Those include B of A, which developed its own small-business lending products in house, Blake said. They include unsecured lines of credit and unsecured term loans, and a loan product for commercial vehicles, he said.

B of A has not necessarily been seen as a major player in small-business lending. During a recent investor conference, Morgan Stanley analyst Betsy Graseck quizzed Chief Operating Officer Tom Montag about the bank’s commercial lending growth.

“I’m not sure if you really do the small-business side,” Graseck said.

Indeed, its share of the SBA market is smaller than Wells Fargo and JPMorgan’s, but it is growing. Through June 30, B of A had approved about $111 million of SBA 7(a) loans, a 59% increase from the same period last year. By comparison Wells Fargo had approved $1.3 billion this year and JPMorgan had OK'd $534 million.

The increased commitment has paid off, company official say.

“We've … rolled out small-business capability to respond fast to the needs of the small businesses we serve across America,” Chairman and CEO Brian Moynihan said during a July 18 conference call. “We can't emphasize enough of the positive impacts of these investments.”

JPMorgan and Wells Fargo have historically been among the largest SBA lenders. But even they have tried to boost their small-business offerings.

JPMorgan in December 2015

“On the small-business side … you can go online and you can open up or apply for a loan and we’ll give you an answer in 45 seconds or 60 seconds or something like that,” CEO Tim Sloan said during a July 14 conference call.

Ultimately, the biggest banks questioned the wisdom of sitting on the sidelines on a permanent basis when it comes to small-business lending, said Rohit Arora, CEO of Biz2Credit. They concluded that they needed to address the market, both to drive profit growth and for expanding relationships with existing customers.

Upstarts’ ability to take loan applications online and through mobile apps is popular with small businesses, and banks realize they need to respond, Arora said.

“They are finally starting to feel that, if they don’t do that, they will lose their best customers,” he said.