-

Mobile banking services hold serious sway over small business owners, according to a new study.

January 7 -

As more community banks look at working with alternative lenders, they must be mindful of the regulatory and reputational risk that can occur if they make a bad referral.

January 8 -

Executives at Lead Bank in Garden City, Mo., are hopeful that offering small businesses more high-touch services, such as consulting, will provide an advantage in an area that has become fiercely competitive.

January 22 -

A recent survey found that a significant number of customer problems take multiple interactions to resolve or are left unaddressed. Improvement in this area is critical as banks try to keep customers.

December 13

Smaller banks have long touted their ability to outperform bigger competitors when it comes to serving small businesses.

That sentiment may no longer be true, some industry observers say. Technology, such as mobile banking and credit scoring, is slowly eroding any advantage smaller banks once held in reaching those who own businesses.

To be sure, community banks still count a large number of small business owners as clients. But they face fierce competition as larger banks court smaller customers as a way to boost revenue. If smaller banks want to keep competing in this segment, they must provide great customer service and new technology.

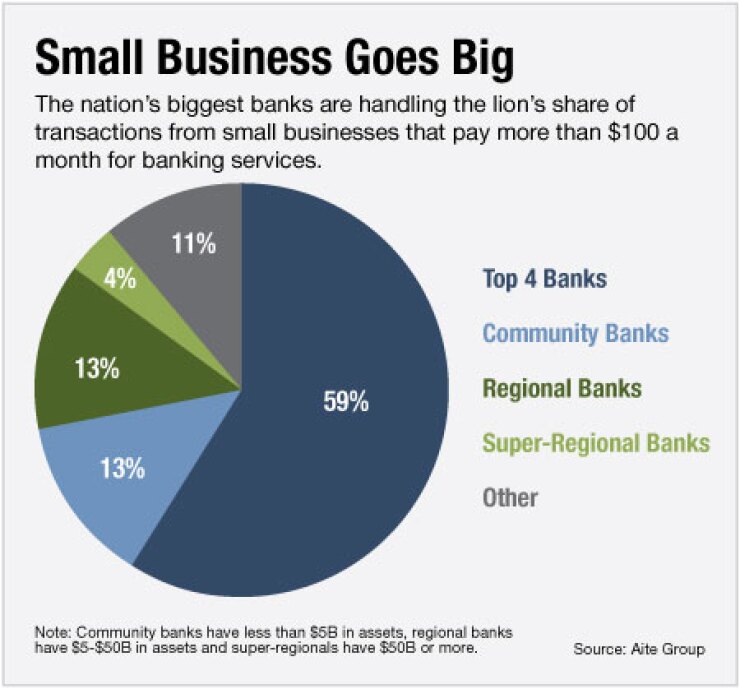

"You often hear that small business owners love the community bank feel and that these banks understand their needs," says Christine Barry, research director in Aite Group's wholesale banking practice. "But when you look at who these business owners are banking with, the largest banks have a large market share."

A recent

"I think the trend is clear that more people prefer mobile and like the technology that the larger banks offer," says Nick Miller, president of Clarity Advantage. "It makes those banks more accessible."

Services such as mobile banking, remote deposit capture and online bill pay are becoming necessary offerings for community banks, industry experts say.

CoBiz Bank tries to stay ahead of the technological curve, says Amy Wright, the bank's product manager. It launched remote deposit capture for business customers in 2006, when the product was still relatively new, especially for smaller banks.

The unit of the $2.8 billion-asset CoBiz Financial (COBZ), mostly serves midsize companies, an area that expects that type of technology, says Rod Young, the bank's manager of product solutions.

Technology is "a 'must have' for customer retention," Young says. "A community bank just won't bring in these clients if you don't have the technology. Once you have the tech, it's even more important to keep up with the latest in order to retain those customers."

Smaller banks must fight the perception that larger institutions have better technology. Executives can also beef up technology offerings by working with core processors and other firms, says Tim Holt, president of Profit Resources. Many of these vendors offer technology to smaller banks that is similar to products used by the bigger players, he says.

"There's a threat out there," Holt says. "There's great pressure to start offering the kind of things that are value adds that a community bank may or may not currently think to offer."

For example, RDM, a technology company that provides payment processing products to financial institutions, works with some of the largest U.S. institutions. But it also works with smaller companies, like CoBiz, says Harry Rose, RDM's vice president of sales.

"This means some community banks can go to market with the same applications that the largest banks use," Rose says. "All banks want additional services to capture corporates. These businesses are more demanding."

Community banks should rethink their traditional strategy of treating small business owners as consumer clients, Barry says. Small business owners need services to solve common business problems, such as tracking cash flow or providing accurate forecasts. So banks need to find ways to offer solutions, Barry says.

Doing so would allow banks to earn more revenue from these relationships. A recent Aite study found that many small businesses don't pay for products because their bank wasn't charging them.

"Small businesses are more willing to pay for products than banks give them credit for," Barry says.

Besides customer-facing technology, offering things like credit scoring have improved big banks' ability to serve small business owners, says Allen Berger, a finance professor at the University of South Carolina. There is a long-held belief that smaller banks have an advantage processing soft information, like an owner's reputation, and big banks excelled at handling hard data, he says.

After the first small business credit scoring became available in 1995, larger banks were able to better reach this segment, Berger says. His research found that larger banks are just as good, compared to smaller banks, at being the main banking relationship for small businesses. He also found that the strength of the relationship between a business owner and a big bank is just as strong as one with a community bank.

"The hard information used to make lending decisions appears to be just as good as the soft information," Berger says.

Still,

Additionally, about half of small business owners involved in the study were asked to open an account during their visit to the bank. About 90% of the business owners who reported that the banker built a rapport with them said they would become a customer of that bank, the study found.

"You have to accurately demonstrate your value proposition and then you have to ask them to become a customer, even if you falter a bit during the process," Aloi says. "That eagerness is important."

Better customer service may also mean shifting the focus of branches away from completing transactions to being more sales and consulting oriented, Miller says. Even though branch activity is down, banks are still wary of closing locations because many clients select a financial institution based on its brick-and-mortar presence. There is a lot of

"There is a steady stream of bankers that leave larger institutions and migrate their way down to community banks because they have the time to work with their clients," Miller says. "But still a little community bank may not have the products to do certain things effectively."