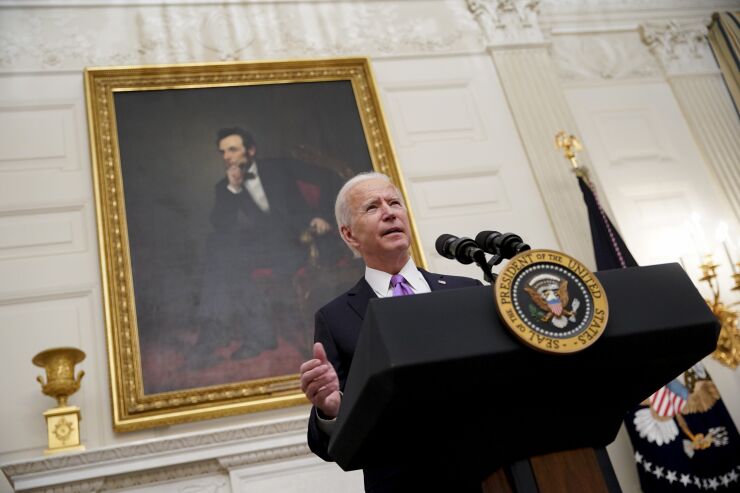

WASHINGTON — The Biden administration appears to be wasting no time attempting to unravel Trump-era financial policies.

The new president has not been in office for more than two days, and already the White House has selected regulatory nominees for key vacancies with progressive records, and urged executive-branch agencies to pause rulemakings yet to go into effect.

Observers say the speed and breadth of activity suggests President Biden's transition team prepared in advance to name agency appointees that could be installed quickly.

They see the early moves as a sign that the administration will try to unwind Trump-era polices ranging from the Office of the Comptroller's fair-access rule and Community Reinvestment Act reforms, to deregulatory actions carried out by the Consumer Financial Protection Bureau.

“It’s a feature, not a bug, that the Biden administration is acting quickly,” said Jeremy Kress, assistant professor of business law at the University of Michigan. “The transition is clearly very organized and efficient, and it shows — they knew what they wanted to achieve by Inauguration Day.”

Even before Biden was inaugurated, the administration's choice to lead the CFPB, Rohit Chopra, was reported. Late Wednesday, news outlets said the White House similarly was expected to nominate Michael Barr, a former Obama Treasury Department official, to run the OCC, and the administration

Meanwhile, on Wednesday, just hours after Biden was inaugurated, White House Chief of Staff Ron Klain issued a memo addressed to the heads of the government’s executive departments and agencies ordering a “freeze” of any pending regulation.

”With respect to rules that have been sent to the [Office of the Federal Register] but not published in the Federal Register, immediately withdraw them from the OFR for review and approval,” Klain wrote in the memo, dated Jan. 20.

Some legal experts believe the memo will not apply to federal bank regulators that largely operate without interference from the White House.

“How I read it is that the executive order applies only to executive agencies, and not to independent agencies,” said Meg Tahyar, co-head of the financial institutions group at Davis Polk & Wardwell. The OCC, the Federal Deposit Insurance Corp., the Federal Reserve Board and the CFPB "are all independent agencies,” she noted.

But other analysts said the memo could still have softer influence, compelling agencies led by Trump appointees to consider suspending rules that have not gone into effect.

“It certainly will indirectly apply to the agencies because they generally do their best to adhere to OMB standards, even though they are not covered by them,” said Karen Petrou, managing director at Federal Financial Analytics.

Experts note that a number of Trump-era policies have not yet appeared in the Federal Register. Those include OCC's

Likewise, the FDIC's

Some analysts said it was no surprise that the Biden administration would move rapidly upon taking office to try to reverse policies of the previous administration. The political chasm between Trump and Biden is “one of the most significant that we've had in a long time,” said Ian Katz, a director at Capital Alpha Partners.

“There's more for [the Biden administration] that they feel that they should reverse or stop, because a lot of the views and a lot of the differences in views between Trump and Biden, whether it's on environmental affairs or health or financial regulation, are pretty wide apart," Katz said.

Petrou noted that the Klain memo goes further than decrees by previous administrations for agencies to pause pending rules, by asking officials to consider whether any policies contribute to racial inequities in addition to resulting in unjust costs for specific industries.

“The goal is to reevaluate rules not just in terms of how many dollars they cost or pages of paperwork that have to be filed, but in terms of issues such as racial equity and even human dignity,” Petrou said. “These are unusual ways of thinking about rulemaking and I personally think they’ll be very constructive.”

The White House memo also made clear the administration would attempt to freeze and review rules published but not yet in effect. “With respect to rules that have been published in the Federal Register, or rules that have been issued in any manner, but have not taken effect, consider postponing the rules' effective dates for 60 days from the date of this memorandum,” Klain wrote.

At the same time, however, substantial questions remain about what policies may be nullified quickly and which will require more time-intensive regulatory action, like issuing new notices of proposed rulemaking, to altering or outright nullifying certain Trump-era rules.

Even without an obligation to do so, Tahyar said it is possible that the agencies follow the order anyway. “In their discretion as a policy matter, the leadership of those agencies might decide to apply" the memo, "but they would be doing so as a policy matter, not because it strictly applies to them,” she said.

The administration could also seek to halt or reverse Trump-era actions by installing new heads of agencies that may reopen previous rulemakings. Both Chopra at the CFPB and Barr at the OCC are seen as critics of previous policies that they could seek to overturn. The Democrats' slim majority in the Senate — with Vice President Kamala Harris holding the tiebreaking vote — could mean Biden's nominations move relatively quickly.

Two contentious CFPB rulemakings that have not yet gone into effect — on

Another example is the OCC’s attempt to reform the Community Reinvestment Act. That regulation was finalized in May but only partly, with regulators saying they would need more time and data to design the

In a

“A one-size-fits-all metric would not do a good job capturing the wide variety of bank business strategies in serving LMI communities and households, and the wide variety of local contexts in which they operate,” Barr wrote. “Such a metric would have difficulty, for example, capturing the changing nature of communities. Such a metric might reward lending to upper income borrowers in gentrifying neighborhoods, rather than focusing on lending to support affordable housing serving low-income residents.”

Katz said the Biden administration "could reverse, unwind, tweak pretty much whatever they want.”

“It's just a question of how long that takes, and how much bandwidth they have, and how high of a priority it is,” he said.

Kate Berry and Hannah Lang contributed to this article.