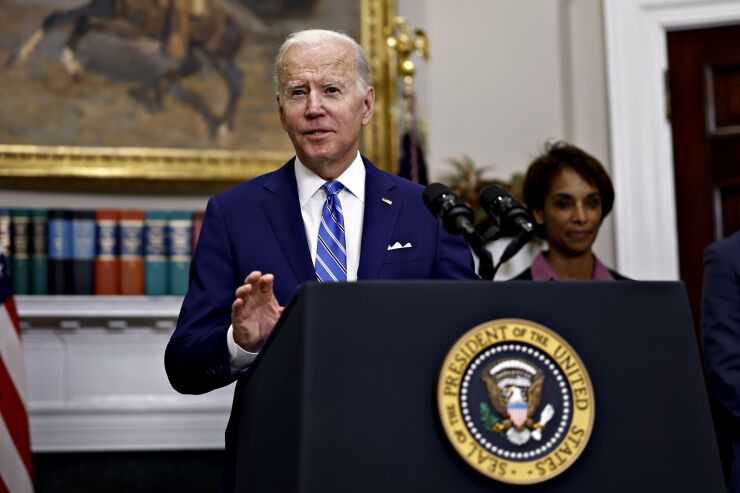

WASHINGTON — President Biden signed the Inflation Reduction Act into law Tuesday afternoon, capping a legislative achievement that will direct billions towards climate change finance and make notable tax reforms directed at large corporations.

A

"The law takes the most aggressive action ever in confronting the climate crisis and strengthening our energy security," Biden said in a statement on Tuesday. "It will offer working families thousands of dollars in savings by providing them rebates to buy new and efficient appliances and weatherize their homes, and tax credits for heat pumps and rooftop solar."

Much of the package's spending is dedicated to climate preparedness — a total of $369 billion in the form of tax incentives and subsidies that could boost the nation's transition towards cleaner forms of energy and lower carbon emissions. While environmental groups say more federal funding will be required to reach the Biden administration's loftiest climate goals, the initial investment inside the Inflation Reduction Act will go a long way towards beginning the transition away from fossil fuels in earnest.

"Our communities that are being ravaged by floods, wildfires, droughts, and other climate-fueled disasters have waited too long for real action to address the interlocking crises of climate change, systemic racism, and public health," said Leslie Fields, national director of policy advocacy at the Sierra Club, in a statement Aug. 6. "The $369 billion of climate and clean energy investments in the reconciliation bill will go far toward meeting our climate goals, helping families deal with rising prices, and advancing environmental justice."

Proponents of the law have said the Inflation Reduction Act will also raise tax revenues by roughly $700 billion over the next ten years by closing certain corporate tax loopholes, greatly expanding the budget of the Internal Revenue Service for additional technology resources and personnel, among other provisions. The law would also require companies with annual revenue greater than $1 billion to pay a 15% minimum tax.

Under the new law, corporations' stock buybacks will also be taxed for the first time, starting at 1% — a provision that could impact banks in particular. The reform has long been favored by progressive lawmakers including Senate Banking Chair Sherrod Brown of Ohio, though some analysts have warned that the change could

Republicans have pilloried the law since it passed the Senate earlier in August. Sen. Pat Toomey of Pennsylvania, who serves as ranking member of the Senate Banking Committee, described the package as a "reckless tax-and-spending spree" that would "only further exacerbate a recession we're already likely in," according to an Aug. 7 statement.

Economists have