Flexible work weeks. Telecommuting. Casual attire. Those used to be fighting words in the banking industry.

"We were at each other's throats at the notion of wearing blue jeans," says Karen J. Hartnett, a human resources consultant who came out of the Texas banking industry. But as companies in other sectors loosened their policies-and their ties-banks began to follow, says Hartnett, owner of Houston-based KJH Consulting.

Banks may not be installing foosball tables behind the teller lines or encouraging staff to bring their dogs to work. But, Hartnett says, they've at least come far enough to generally trust that employees working from home are actually working. And some banks are showing up on multi-sector lists of the best places to work in their state or region, reflecting the attention paid to workplace culture.

Now, banks have a list of their own. The best of them, as determined in these rankings compiled for American Banker Magazine, offer competitive pay and benefits, but also strive to engage and motivate employees in less tangible ways. "It's not that you do everything employees are asking for," Hartnett says. "But you make a conscious decision that I'm going to make my bank friendly to the work-life balance that my employees require."

As the economic recovery continues, banks will have to work harder to attract and retain talent, especially if they are competing for IT experts, accountants or other professionals who can pick the industries in which they want to work. Banks also will have to work smarter, as budgets likely will remain tight. "Those organizations that do have money, they're going to be a little more surgical in deciding who they invest in," says Lee Weisiger, a partner in The Titan Group, a Richmond, Va.-based HR consulting firm that serves banks. Money for training and career development likely will flow to high performers or people identified as high potential. Banks also could begin taking a closer look at performance incentives. During the downturn, when profit margins were tight, some banks shelved so-called variable compensation plans. Or to sustain morale, they gave everyone an equal share of the profits, regardless of individual performance.

The best banks are beginning to steer rewards again toward high performers, but they are more careful about not encouraging risky behavior, says J. Timothy O'Rourke, president and CEO of Matthews Young Management Consulting in Hillsborough, N.C. "It's become a little more scientific than it used to be," O'Rourke says, noting that a bank might tie compensation to the quality of a loan portfolio, not just its growth.

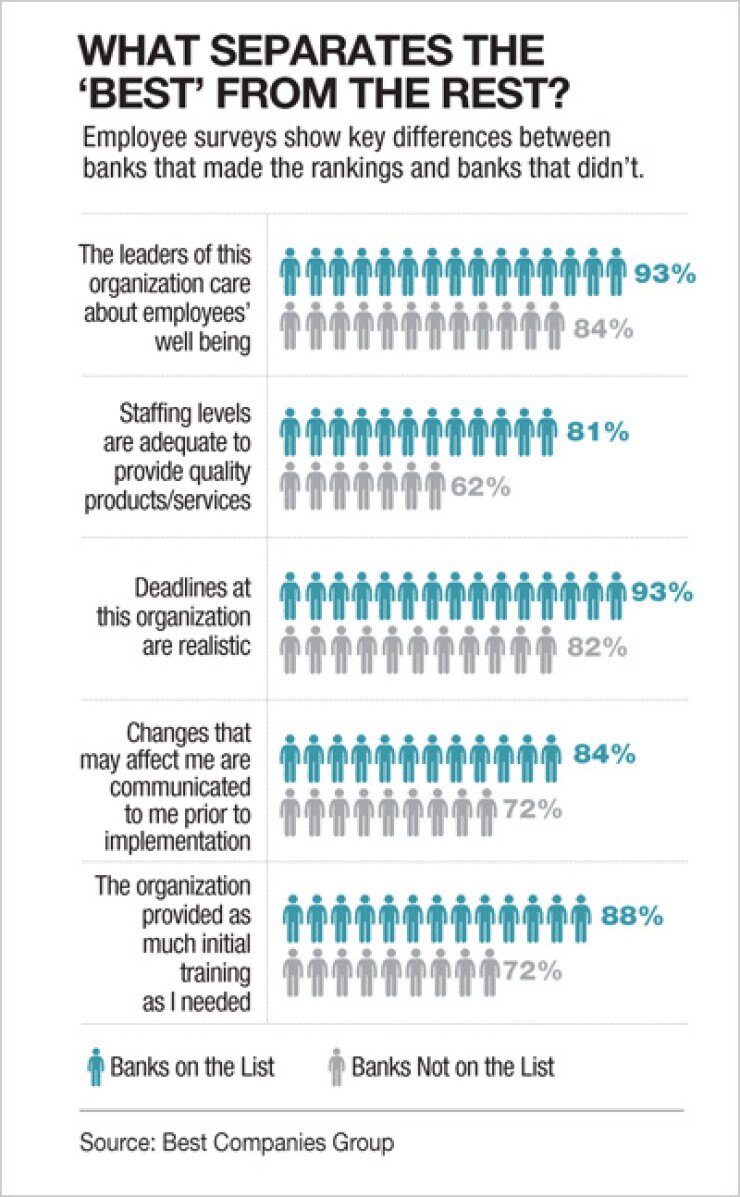

Open communication is another vital element in creating a great place to work, evenor maybe especiallyif difficult decisions still loom, says Mike Hamilton, a senior consultant at Matthews Young. He cites the example of a banking client where management explained in detail the need for layoffs, ensuring employees understood the financial pressure the institution was under and the cost of alternatives.

"The survivors, even though it had been a tough downsizing, were pretty positive about the future of the organization, because they were confident in the plan," Hamilton says.

The resiliency spoke to the strength of the culture. But even an experience like that is no excuse to get comfortable. As CCG Catalyst Consulting Group's Tami Maupin Buttrey says, building a great workplace is similar to preserving a marriage. It takes commitment, and it demands continuous effort.

Under $3 Billion in Assets

First Federal Savings and Loan Association of Pascagoula-Moss Point Somerset Trust Company 1st National Bank (Wis.) Centier Bank Bell State Bank & Trust First Citizens National Bank (Tenn.) Live Oak Bank Chesapeake Bank Capital City Bank Security Bank The Muncy Bank and Trust Company Mascoma Savings Bank NORTHSTAR Bank of Texas Old Point National Bank SharePlus Federal Bank Boiling Springs Savings Bank City Bank Independence Bank Elmira Savings Bank Bank of Ann Arbor North Shore Bank First Internet Bank Metropolitan National Bank Central Bank BankPlus Citizens Bank (Ohio) Norway Savings Bank First Green Bank

Between $3 Billion And $10 Billion in Assets

Over $10 Billion in Assets