-

The acquisition of ISU Stetson-Beemer was Wells' fifth deal for an insurance firm since last fall.

September 28 -

HSBC Holdings PLC has approached a number of European and Japanese insurers regarding a possible sale of its global general insurance business, the South China Morning Post reported Thursday, citing unnamed people familiar with the situation.

September 29

BB&T Corp. is back in the insurance M&A game.

It bought two brokerages in the past week after a two-year hiatus from deals, and a top executive says it wants to take further advantage of the consolidation of the insurance industry.

"We will continue to look at some acquisition opportunities that have good geographic fit and size," says David Pruett, the vice chairman of BB&T's insurance arm, which has 100 agencies in 10 states.

Its primary targets are firms on the East Coast or in certain parts of California that have at least $5 million to $10 million of annual sales, he says.

The Winston-Salem, N.C., lender — one of the handful of banks with big insurance operations — was among the most aggressive buyers of small and large insurance firms until late 2009, purchasing 85 of them in about 15 years. Then it hit the brakes even as the biggest bank involved in insurance, Wells Fargo & Co., kept buying insurance firms. Wells on

BB&T had been pursuing its

"Would you sell your house today if you didn't have to? Business owners have been the same way," he says. "Our quiet time was not by design. We made no decision not to say we're not going to buy anything at this time. The timing wasn't right for the businesses we'd been most aggressively pursuing."

The

BB&T did not disclose how much it paid for Liberty and Atlantic.

Its last deal was its November 2009

Industry experts peg capital concerns as another reason for BB&T's deal restraint. Insurance businesses tend to be capital-killers because buying them almost always results in a goodwill charge since they have virtually no assets. Insurance is a service based on the talent and connections of salespeople. Construction-loan plagued Regions Financial Corp. of Birmingham, Ala., another big bank heavily involved in insurance, ended its buy-and-build streak in the sector before the economy collapsed.

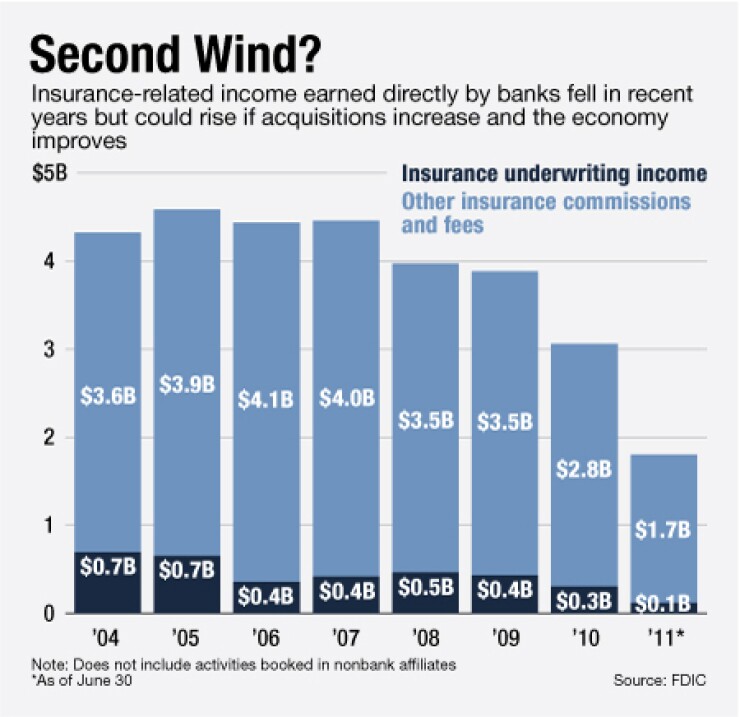

BB&T, having contained its homebuilding loan woes in Georgia and Florida, has the incentives and strength to go shopping again. It is flush with liquidity but struggling like other banks with anemic demand for loans. Insurance can be a lucrative - if unsteady - source of income.

"Insurance is our largest non-core banking business. We're No. 6 in the United States in insurance brokerage," BB&T Chairman and Chief Executive Kelly King says at a banking conference in New York on Sept. 13. "It represents about 13% of our revenue" and one of a handful of business lines it wants to build on a "national scale."

There are ample opportunities: The insurance industry is dominated by thousands of small, independent operators. It has been steadily consolidating for the last fifteen years. Its executives are aging, and businesses that need insurance products and services increasingly prefer dealing with big providers.

Wells Fargo has demonstrated that many opportunities exist for capable buyers. It bought four insurance firms in 2010 in addition to the four it has purchased this year.

Marty Mosby, an analyst with Guggenheim Securities LLC, says Wells and other banks involved in insurance have found that the business hinges on expert salespeople. Getting branch tellers or relationship bankers to peddle insurance does not really work. Banks in general want to offset falling loan interest and deposit revenue by generating higher fees elsewhere, he says. Wells has been making acquisitions in its trust unit, too.

The businesses BB&T bought this week sold for different reasons, Pruett says. Atlantic, with 45 employees, is a broker that needed a bigger partner to keep growing at the same pace, he says. The 25-employee Liberty's specialty is consulting. It expects health care reform to hurt its ability to help its biggest clients manage insurance costs and does not have the capital to grow on its own, he says.