WASHINGTON - Bankers are sending the Federal Deposit Insurance Corp. a clear sign about its proposed logo for all banks and thrifts: It clashes.

Industry representatives are raising several issues with the plan, including the time line for attaching the logo to teller windows and advertisements, and potentially confusing wording about insurance limits.

But several companies, including Bank of America Corp. and Wachovia Corp., take issue with the sign's aesthetics. They say the proposal - which requires institutions to use the logo with a gold background and black letters - will interfere with their individual branding patterns.

"Wachovia has a corporate color standard of silver background and black lettering for all branch signage," Eugene M. Katz, an assistant general counsel with Wachovia, wrote in a Sept. 15 letter. "Thus, having a specific color requirement would be problematic for us, as it would impact signage at, among other locations, approximately 10,000 teller stations."

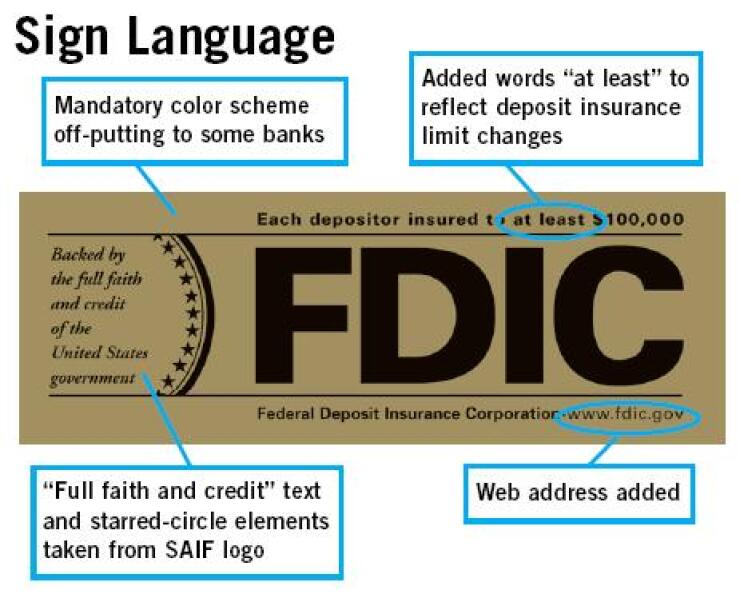

The deposit insurance reform law enacted in February required the FDIC to create a sign to reflect the merger of the Bank Insurance Fund and the Savings Association Insurance Fund. The agency unveiled a logo July 11 that would replace the two signs currently in use at banks and thrifts.

Though the new logo's color scheme is similar to the current gold-and-black one for banks, the agency previously demonstrated flexibility on the issue. According to an advisory opinion issued in 1992, banks can choose their own color scheme, as long as the sign is otherwise the same and the institution uses the same color for the logo's lettering and the FDIC symbol.

However, the July proposal unveiling the new logo allows banks to use only black lettering and a gold background.

That requirement has angered bankers and industry officials. The required color scheme and other issues prompted 12 comment letters to the agency before the Sept. 15 deadline.

"Why is it important that the FDIC change this long-standing policy?" Paul Smith, a senior counsel with the American Bankers Association, asked in an interview. "We don't see the point of the change."

In a Sept. 15 letter to the FDIC, Mr. Smith wrote, "Some banks have developed specific branding programs, including specific logos and color combinations, they have now for over a decade used in their institutions." The proposal "would force them to have … differently colored signs on lobby doors, windows and advertising brochures, which could be confusing to their customers."

Paul Kramer, an assistant general counsel with Bank of America, wrote in a Sept. 15 letter, "We propose that the proposed rule be amended to permit a bank that is procuring its own official signs from a commercial supplier to vary the color scheme for signs used even in locations where deposits are received."

Marketing experts said that the issue is not trivial, and that consistency in a company's branding imagery can make a difference.

"Thematic continuity is very important. We preach it hard all the time," said Haden Edwards, a partner with the Manchester, N.H., branding firm Tracey Edwards O'Neil.

Robert K. Passikoff, the founder and president of Brand Keys Inc., said the homogeneity of banking products makes branding crucial. Disturbing a company's branding system creates "communication noise" that can interfere with the message to customers.

"In psychology, colors evoke different feelings," Mr. Passikoff said.

The bankers' argument is "valid in so far as the fact that, largely speaking, most of the banks can't differentiate themselves through the products and services they offer," he said. "So they look to be able to create image differentiation with color schemes and branch layout. It's all they have left."

A FDIC spokesman said that the proposal is still under review, and that the agency will examine the comments carefully before issuing a final rule.

Bankers also raised objections to the proposed time line for using the new logo. The FDIC said banks and thrifts would have six months after a final rule is published to switch signs.

But representatives said banks with a lot of branches would not have enough time, and that the proposal would force them to waste paper materials that use the old logo. Some banks include the logo in advertisements, and the proposal would require thrifts to start using the "Member FDIC" tag line in ads. (Banks already are required to do so.)

"All institutions, especially community banks, will face a large expense related to replacing all these materials and should be given more time to exhaust their existing stock," Patricia A Milon, the chief legal officer for America's Community Bankers, wrote in a Sept. 8 letter.

Randall C. Neidenthal, an assistant general counsel with JPMorgan Chase & Co., wrote in a Sept. 15 letter that it would need a year to switch the signs at its 2,660 branches in 17 states.

"The changing of all of the official signs will be a significant effort that could be efficiently managed over the course of one year," he wrote.

One banker even took issue with how the new logo would explain changes in insurance limits. The current logos say that depositors are "insured to $100,000." But the deposit insurance reform law raised the limit for certain retirement accounts to $250,000, and starting in 2010 regulators will be allowed to raise the general limit to keep pace with inflation. The proposed logo says depositors are "insured to at least $100,000."

Cheryl Nakashige, a compliance officer with the $857 million-asset Citrus and Chemical Bank in Bartow, Fla., said the change makes little sense if the general limit starts changing regularly and the logo needs future adjustments.

"If the rate of inflation changes every five years from now, will all insured banks and savings associations need to again replace all the FDIC official signs if the language is revised?" she wrote in a July 25 comment letter. "This would be a continuous cycle every five years if the limits change. That is burdensome to financial institutions and unnecessary if the official sign language is ... not considered permanent."