Expect bankers to cut more expenses next year.

Several banks have already announced cost-cutting efforts this quarter, attributing their decisions to the

Those initiatives, which have included layoffs, branch closures and office reductions, should increase in 2021 as banks continue to navigate through uncertainty, industry observers said.

“The earnings environment is still tepid, at best,” said Stephen Scouten, an analyst at Piper Sandler. “The next step to offset that is to bring down the expenses.”

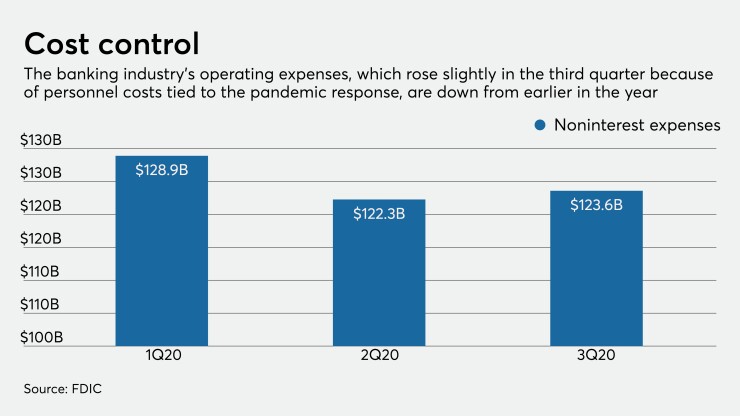

Though operating expenses rose slightly in the third quarter from the prior three-month period, largely reflecting personnel costs tied to the Paycheck Protection Program and the overall pandemic response, they fell by 4.1% from the first quarter.

Banks of all sizes have announced plans to sell or close branches in coming months. Increased reliance on telecommuting has allowed banks to lower utility and maintenance expenses. The industry reduced its number of full-time staff by 0.3% during the third quarter, to less than 2.1 million employees.

First Midwest Bancorp in Chicago said in October that it would permanently shutter 15% of its branches next year, attributing the decision to accelerated customer adoption of digital channels.

The shift “has been amplified and accelerated” by the pandemic, said Mark Sander, the $20 billion-asset First Midwest's president and chief operating officer.

Several companies, including TCF Financial in Detroit; Webster Financial in Waterbury, Conn.; Bankwell Financial Group in New Canaan, Conn.; and First Horizon in Memphis, Tenn., are looking to cut more costs, with executives promising to provide details as early as January.

The $83 billion-asset First Horizon said it will go beyond the projected $170 million in annual cost cuts tied to its recent

The company plans to discuss its findings early next year, which should include a specific savings goal, said B.J. Losch, its chief financial officer.

“Traditional loan demand broadly across consumer and commercial portfolios is pretty muted at this point,” Losch said in an interview. It is “just the nature of the environment right now.”

Webster Financial also plans to

Webster began assessing its expense structure earlier this year but accelerated its efforts when the pandemic hit, said John Ciulla, the company’s chairman, president and CEO. The effort will focus on simplifying Webster’s organizational structure, improving back-office operations and automating “critical processes” to reduce costs.

TCF, under the leadership of newly appointed CEO David Provost, is

Banks could face more pressure to control expenses if the pandemic forces a new series of economic shutdowns that, in turn, leads to

Many vulnerable borrowers have been able to avoid defaulting on loans because of federal stimulus programs and payment deferrals. But those programs — the focus of debate among lawmakers in Washington — are winding down as the pandemic surges.

“Further fiscal support is needed but has been difficult to achieve,” said Scott Brown, the chief economist at Raymond James. “Growth is likely to slow into early 2021.”